Member of Russell Bedford International, a global network of independent professional service firms.

John’s skills and talent have resulted in a great deal of success for the company. His sales job involves quite a bit of driving throughout the Midwest. You’ve decided you want to reward his efforts and success with a company car. Before you tell John, you have a decision to make. Will his car be leased? Or will the company buy it outright? What kind of impact does leasing versus owning have on the company’s tax situation? Several factors impact this decision, including how long the car will be kept and how consistently the car will be driven.

How long will the company keep the car?

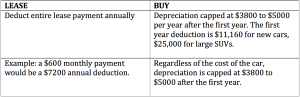

If the company plans for John to keep the car longer than a leasing period, it likely makes sense to buy the car outright. If the company plans to reward John with new cars fairly frequently, a lease may make more sense. Weigh the annual lease payments against the annual deductions.

Will the use of the car be consistent year-to-year?

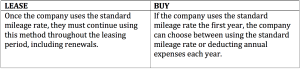

Regardless of whether you lease or buy John’s car, the company has a choice to make. They can either deduct all expenses, including gas, service, repairs, depreciation/lease expenses and insurance, or use the standard mileage rate (54¢ per mile in 2016). Tolls and parking can be expensed in addition to the standard mileage rate.

Only mileage associated with business use can be deducted, and a log must be kept to separate business mileage from personal use. In order for the expenses/mileage to be fully deductible to the company, the employee using the car must have the personal portion of the auto use recorded on their W2 as a fringe benefit. The pretax benefit to the employee far outweighs the small amount of additional income associated with the fringe benefit.

Different rules apply to switching between deduction methods for leasing versus buying.

If John’s use of the company car will vary from year to year, buying the car will offer more flexibility. In addition, inconsistent use can also create costly leasing expenses. Leases include an annual mileage allowance with per mile surcharges for overages.

Choosing the best option between leasing and buying John’s new car means considering tax implications and predicting the use of the car. Careful planning including consideration of when John’s car will be replaced and how consistent his travel will be will help you reach the best decision for your company.

If you are facing a similar decision and want to talk through the tax implications, we would be happy to help. Contact us today.