Member of Russell Bedford International, a global network of independent professional service firms.

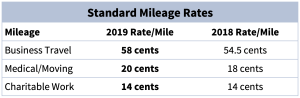

The updated mileage rates for travel for 2019 have been confirmed by the IRS. The standard business mileage rate is increasing by 3.5 cents to 58 cents per mile. The medical and moving mileage rates are also increasing by 2 cents to 20 cents per mile. Charitable mileage rates remain unchanged at 14 cents per mile. Please see the chart below for quick reference:

It is important to properly document your mileage in order to receive full credit for your miles driven. As always, should you have any questions or concerns please contact Cray Kaiser at 630-953-4900.