Member of Russell Bedford International, a global network of independent professional service firms.

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on Jacob Suchecki.

GETTING TO KNOW JACOB

No day at CK is ever the same for Jacob in his role as Staff Accountant. His day is centered around conducting financial audits and providing assurance to clients. Whether he is audit planning, conducting data analysis or testing to ensure compliance with accounting standards, Jacob’s expertise of attention to detail shines through.

Jacob started his journey at CK as an intern in February and joined the team full-time in May. He was immediately drawn to the dynamic and collaborative work environment. The CK team’s commitment to professional development, team-oriented culture, and the opportunity to gain valuable experience were all key factors that fueled his excitement to join the company.

WHY CK?

When asked which core value means the most, Jacob answered, “Integrity. While all the values are important, integrity aligns with the ethical standards and professional conduct which is important to the accounting and assurance field and remains a fundamental part of my role.” Jacob continued, “In order to keep client connections and guarantee the accuracy and dependability of financial information, it is crucial to value integrity which includes honesty, ethics, and transparency.”

Jacob enjoys his role at CK and remains at the company because of the support he receives for his professional growth and the strong ethical standards CK upholds. He also appreciates the opportunities to work with diverse clients from various industries, which keeps his job interesting.

Before CK, Jacob received his bachelor’s degree in accounting from Saint Xavier University. While pursuing his degree, he interned for a small accounting firm that allowed him to experience the accounting field. He plans to continue his education and pursue his CPA.

When asked about a piece of advice he would give to someone just getting started in the accounting industry, Jacob answered, “As someone who is just starting in the industry, I would advise focusing on education, staying up to date on industry changes, and honing the skill of paying attention to detail. Developing strong communication skills to build professional connections by networking and applying to internships is how I was able to land an internship at CK.” He continued, “Finally, setting clear career goals and committing to lifelong learning will help you succeed and thrive in the accounting field.”

Jacob’s favorite CK group outing was when they participated in a golf outing in August. The outing was the perfect opportunity for team building, relaxing, and stress relief. It also provided a great space for networking with colleagues. The outing contributed to a more cohesive and enjoyable work environment, making it a memorable experience.

MORE ABOUT JACOB

Tell us about your family.

My parents both came from Poland when they were teenagers. I have two younger brothers who are 19 and 17. My family is a big fan of soccer and golf.

Do you have a special/hidden talent or hobby?

The hobby I love doing is golf. Being outdoors for 4-5 hours with family and friends is what I love most about golf.

What is your favorite vacation? Or what is the #1 place on your vacation list?

The #1 place on my vacation list is to travel to anywhere in Europe. My plan would be to backpack throughout Europe and get to experience every country. Since I am big soccer fan, I would also love to go experience a game in Europe.

What’s the last book you read?

The last book I read was ‘Rich Dad Poor Dad’ by Robert Kiyosaki. The book provided valuable insights on financial literacy and investments, emphasizing the importance of financial education.

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on Daniel Jacobson.

Daniel is a Senior Accountant in the assurance department. His role includes serving as lead on audits, reviews and compilations. A typical day for Daniel consists of performing audit tests or analytical procedures for engagements.

Daniel joined CK in October of 2022. He was immediately drawn to the amazing group of people who work at the firm, the values of CK, and the great work environment. The mentors he has had the opportunity to work with and learn from and the friendly atmosphere of the firm are two major things that excite him about CK.

When asked which of CK’s core values mean the most, Daniel answered, “Integrity is the most important core value to me because it is important to provide our clients accurate and honest assessments through our work and actions.”

Before CK, Daniel graduated from Northwestern University as a history major. During his time as an undergraduate, he started taking accounting courses which he found enjoyable. After graduation, Daniel began working in a variety of positions in the accounting field. He attended night classes to earn his CPA and passed the final CPA exam in May 2015. He has been working with public accounting firms since January of 2016, including Baker Tilly, Jesser, Ravid, Jason, Basso & Farber, and Picker & Associates.

When asked about an impactful moment in his career, Daniel answered, “I have an unusual path for a public accountant. I did not major in accounting or have an internship with a CPA firm. Studying towards my CPA and spending my own money on classes, review courses, and tests is the greatest accomplishment in my career.”

What motto do you live by?

Be open to new experiences and perspectives.

How do you like to spend your weekends/time off? Bonus question: what do you want to do most when tax season is over?

I enjoy spending my free time with friends and family. You can usually find me dining out or at the movies. After tax season is over, I like to take a long vacation, usually somewhere overseas.

Do you have a special/hidden talent or hobby?

I’m great at trivia; particularly sports, movies, tv, and music.

What’s the last book you read?

Killers of the Flower Moon.

In-Charge Tax Accountant

When I was beginning my journey to become an accountant, I had the opportunity to intern at Cray Kaiser and KPMG. These internship experiences allowed me multiple opportunities when deciding on my post-graduation employment. In the first semester of my senior year, I signed and accepted an offer to join the CK team where I currently work full-time. It is essential to take the initiative to take as many internships as possible. Taking a proactive approach allows you ample time to secure a spot, as many firms tend to fill up a year in advance.

Working full-time at Cray Kaiser was a smooth transition. I was getting exposed to so much as an intern that I felt prepared to advance into the next step. What was an adjustment for me was not going to school while working. Now with my extra time, I use it to focus on my career goals. One career goal for me is studying for the CPA exam.

If you plan to pursue the CPA exam, I recommend the Becker program. The software is easy to use, provides printed material, and is always on sale (there is usually a better sale around the holidays). They also have a fantastic planning system. You enter when you want to take the exam, and it will tell you how many hours you need to study, or you can tell Becker how many hours you can study, and it will give you a custom plan for what days to study, what to study, etc. The program makes you feel less overwhelmed when you are deciding when, what, and how long you should study.

In any career, I think it’s important to make sure you enjoy what you are doing. In the accounting profession, everyone always asks if you are interested in audit or tax. Without experience in both fields, how does one know? Two solutions I found to this are to have internships in both areas or work at a smaller firm where you can assist in both areas.

I love working on complex tax returns and was thrilled to join the tax department. However, I still am allotted the opportunity to work with the assurance team and build on those skills too.

One skill I have built is being a self-advocate and letting management know what areas interest me and where I would like to see my skills grow. Remember that no one can read your mind. You will need to speak up to management to tell them the areas you find most interesting to work in. My goal is to enjoy what I do and make a difference to the organization I work for and the clients we serve. I have found at Cray Kaiser, we aren’t just tax preparers and auditors we are trusted business advisors who are going to help all the family-owned businesses we serve.

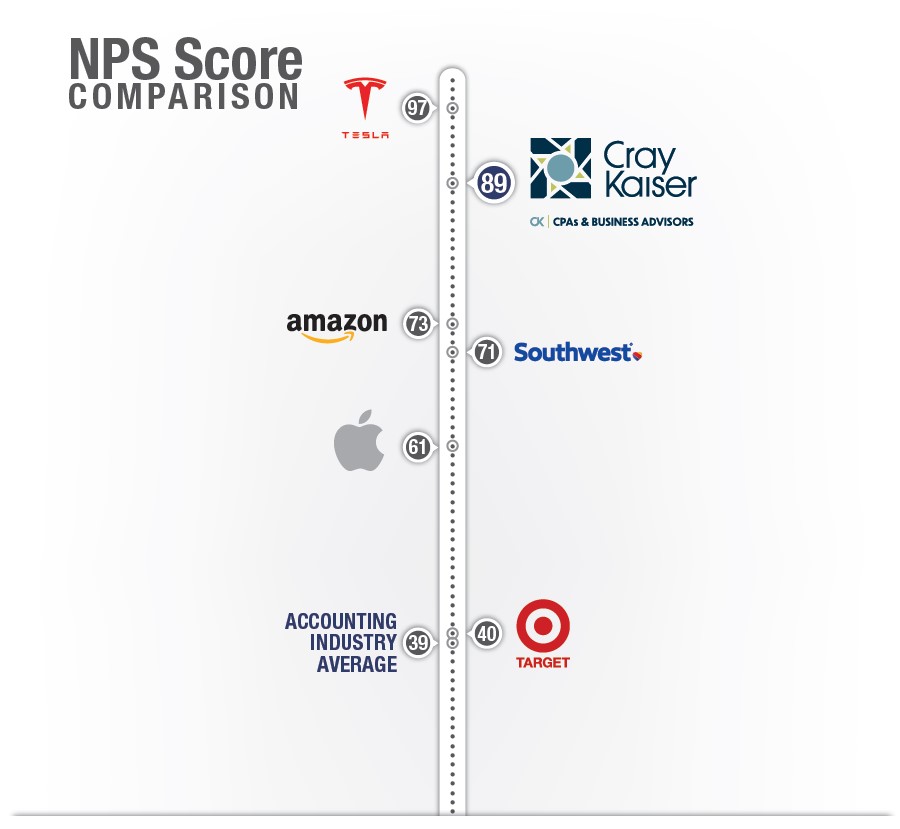

At Cray Kaiser, we believe in a simple yet powerful philosophy: that behind every number is a person. Our dedication to melding numbers with our clients’ narratives has been a central pillar of our ethos. And guess what? This commitment has once again been validated by our latest NPS score for 2023.

For anyone unfamiliar with it, Net Promoter Score, or NPS, is a standardized metric used across industries to gauge customer loyalty and satisfaction. How does it work? Customers are asked one straightforward question: “On a scale from 1 to 10, how likely are you to recommend our business to a friend or colleague?”

From the responses, customers fall into one of three groups:

The formula to derive the NPS is as straightforward as the question itself—subtract the percentage of detractors from the percentage of promoters.

To give some context: A score above zero is already good, surpassing 50 is deemed excellent, and anything beyond 80 is simply incredible.

Comparing against industry standards and rivals provides a clear view of where a business stands. With an astounding NPS of 89 this year, Cray Kaiser has once more surged past the accounting industry’s average.

But that’s not the end of our story. Cray Kaiser’s NPS still shines when juxtaposed against market leaders across different sectors. We’re talking scores higher than industry titans like Target, Amazon, and Apple.

It’s more than just a number for us. It’s an affirmation that our clientele trusts and values the service we provide.

Your success stories are ours, too. In 2023 and the years ahead, our focus remains unwavering: to be impeccable with our numbers and unparalleled in our people skills. Cheers to another year of achieving together!

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on Raychel Korn.

Raychel is a staff accountant at Cray Kaiser. Her day is mostly filled with corporate and not-for profit audits, reviews, compilations, and employee benefit plan (401k) audits. When tax season begins, she works on preparing individual tax returns.

During her time at Aurora University, Raychel interned for the winter tax season at CK. Once she graduated, she joined the team as a full-time staff accountant in May 2022.

Raychel was drawn to CK because of the learning environment. She appreciates how all members of the staff, managers, and partners value continuing education and take the time to educate others when needed. It’s no surprise that the two core values that mean the most to her are Education and Care. “At CK, we all care for each other and the clients,” says Raychel. “We are always there for each other even if it is personal or work related.

“To those who are just getting started in the accounting industry, your light bulb moment will come,” says Raychel. She says every project will have its own nuances. But each engagement or project will help you gain more and more knowledge until everything just clicks.

When asked about some of her favorite times with the CK group, Raychel says Saturday games during tax season are always a blast. “We all laugh, have fun, and have team bonding! My favorite games are when it’s Team Tax vs. Team Assurance. Go, Team Assurance!”

I would want to be an expert scuba diver. I think it would be cool to travel and see the different marine life around the world.

I enjoy going to concerts and music festivals with my friends. I enjoy dancing and singing to my favorite artists.

I try to always be positive. My motto is, “Don’t worry, be happy.”

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on Tatyana Jackson.

Tatyana is one of CK’s Accounting Service Specialist/Staff Accountants. Her days are spent calculating monthly transactions on clients’ books. She also performs year-end accounting and tax compilations. During tax season, Tatyana has a hand in preparing business and individual tax returns.

Prior to joining CK, Tatyana was part of a very small accounting company located in Little Rock, Arkansas where her role was similar to the role she holds now at CK. A unique fact about Tatyana is that she immigrated to the United States from Russia in 2016. She spent nearly 7 years living in Arkansas where she received a bachelor’s degree in accounting from the University of Arkansas at Little Rock. Tatyana also holds a master’s degree in education.

Tatyana joined the CK team in July of 2022 and was immediately drawn to the rich culture CK provides. She was also impressed by the strong female presence within CK. When asked which of CK’s core values mean the most and why, Tatyana answered, “Education means the most. I believe in lifetime learning and appreciate that CK provides that to its employees.” Tatyana enjoys working in the accounting department because she has the opportunity to learn from the best– her team everyday. “All CK team members are helpful and always willing to jump in and teach when needed,” says Tatyana.

When asked about her favorite CK group outing, Tatyana answered, “Our bowling event right before tax season was a lot of fun! I enjoy bowling and it was great to have outing prior to the busy season to give us all a boost in energy.”

“The Golden Mean in everything.”

Right now, the #1 place I would love to visit is the Grand Teton National Park in Wyoming. As for an overseas destination, I would love to visit London, UK.

“Ozark” on Netflix!

Master and Margarita by Mikhail Bulgakov.

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on Sarah Gutierrez.

No day is the same for Sarah as one of CK’s Accounting and Tax Specialists. Her duties range from assisting with individual and business tax returns to helping the accounting department with monthly and quarterly compilations.

Prior to CK, Sarah graduated from Aurora University, located in the same area where she grew up. During her college career, Sarah interned at CK and found her love for public accounting.

When asked what piece of advice she would pass along to someone just getting started in the industry, Sarah answered, “Be patient, be kind, and be open to suggestions and feedback. The first two years are a learning experience but it will pay off in the end. Just trust the process!”

After interning at CK and gaining some experience in the industry, Sarah decided to return and join CK full time in August of 2022. The CK team and culture were a deciding factor in Sarah’s return. She feels most at home in the environment and surrounded by the CK team.

CK’s core values were also important in Sarah’s decision. “CK’s core value of ‘Education’ means the most to me because I believe in empowering myself, my team, and clients with the knowledge that I have and can pass along,” said Sarah.

I love to spend time with my family. Life is too short; I like to enjoy it with my loved ones. After tax season, I am looking forward to taking a vacation and being outside most afternoons.

You only live once.

I have a wonderful husband, Dominick. I have a 9-year-old daughter, Ellaina and a 3-year-old son, Emmett. I have two dogs, Petra and Petunia, and 2 guinea pigs, Mocha and Camila. Our life is chaotic, but I wouldn’t have it any other way.

St. Lucia and Spain are on my bucket list. My favorite vacation spot is Cancun, as it is where I got married and we try to go every year!

My favorite show is Schitt’s Creek. I identify with Mora. I have rewatched it 4 times!

Bad Bunny, Shakira, Taylor Swift, Adele… my music taste depends on how I am vibing that day, to be honest.

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on Matt Richardson.

Matt is one of CK’s In-Charge Accountants, with much of his day revolving around the many steps of tax preparation with both business and personal taxes. For businesses, Matt is often involved in reviewing clients’ accounting records and closing books in addition to executing the return itself. He also will occasionally jump in to assist with the review and audit teams to help with tax-related issues. Matt is currently a generalist but over time plans to grow into a more specialized role.

Prior to joining CK, Matt’s career looked a bit different. He studied trombone and music history at Cleveland’s Oberlin Conservatory and went on to complete a PhD in music history at Northwestern. After teaching for a few years at Northwestern and at Wisconsin, he decided to change career paths and use his social and critical thinking skills in accounting.

Matt joined the CK team in November of 2022 and was immediately drawn to the firm’s focus on people. When asked what about CK made him excited to work at the firm, he said, “Whether it’s co-workers or clients, I’ve always personally believed it’s important to remember that it all comes down to how you treat people, so the values at CK really resonated with me.” He enjoys the environment at CK and feels it’s one conducive to growth and learning.

When asked which of CK’s core values mean the most to him and why, Matt answered, “I think people and integrity resonate with me the most. To me, integrity means we take pride in the accuracy and quality of our work as trusted advisors to our clients. And ultimately, it all comes down to People. Nothing else we do can happen without strong relationships with the people we work with.”

I love trying new restaurants whenever I have a chance. Some of my favorites are Italian and Japanese. After tax season (besides catching up on sleep), I’m looking forward to a vacation. This year I’m hoping to make it out to L.A. for a weekend to catch an Angels game and a Dodgers game.

My favorite place I’ve been to is Tokyo. There are so many fantastic restaurants and cafés, and I always manage to meet so many people and discover interesting new things when I’m there. The #1 place I’d like to visit is Vienna. I love opera and symphonic music so I’d love to hear the Vienna Philharmonic and the Vienna State Opera.

I think my favorite movie has to be The Empire Strikes Back. I loved watching the Star Wars movies with my dad growing up, and I never get tired of re-watching them.

I’ve been working my way through some funk and soul – a lot of things like James Brown, Stevie Wonder, Billy Ocean, and Lionel Richie. And I’m always cycling in some classic 80’s Japanese pop, like Akina Nakamori, Seiko Matsuda, and Yu Hayami.

Today is International Women’s Day and we are so proud to recognize and celebrate the strong women of Cray Kaiser. These women continue to advocate for others and blaze a bold path forward for women’s equality in the world. We are especially proud to share that 50% of the Cray Kaiser team is made up of women, with the firm being 66% women-owned.

We recognize the unique value that women bring to the workplace and we will continue to take action to drive out gender disparity until we can all embrace equity.From all of us at Cray Kaiser, Happy International Women’s Day!

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on Natalie McHugh.

As Cray Kaiser’s newest Principal, Natalie helps manage the workflow and people in the tax department. Her days typically consist of reviewing returns and spending time consulting, whether projecting tax costs for clients, researching complex tax situations or assisting clients through a sale transaction. Her niche is estates, gifts and trusts, high-net wealth individuals and partnerships.

Natalie is a DePaul University graduate and interned at KPMG in their personal financial planning department during her college career. After graduation, she joined the firm full-time and it was there that she found her passion for taxes, specifically personal, trust, estate and gift tax returns.

Natalie joined CK in December of 2013. She was instantly drawn to the CK culture, the variety of clients and having female partners at the firm. Knowing this, Natalie could see herself progressing at CK. When asked why she has stayed at CK, Natalie says, “Our clients. I enjoy helping our clients navigate through their tax situations and helping educate them along the way. I also love the variety of client work we have here. Every day there is something new and I’m constantly learning.”

To Natalie, CK’s core values of Care and People are her two favorites. She is passionate about the amount of care that takes place at CK. She says, “We value a solid work product and want to make sure our clients are taken care of.” When it comes to People, Natalie says, “Each person on the CK team has unique talents that contribute to our solid work product.”

Soak it up! Learn from those around you and learn what you enjoy the most. There are many different lanes in accounting, from audit to tax to industry. Also, ask lots of questions! Your colleagues are there to help.

I spend a lot of time with family – I love to plan activities like bowling, dinners, and game nights. My daughter plays travel softball and a lot of time is spent over the summer at tournaments watching games and socializing with the families of the team. I work out regularly to balance my sitting at the office. I also love to read and listen to books during my commute.

I live with my husband, Matt and 13-year-old daughter, Eleanor and 2 dogs, Pepper and Stitch. My 26-year-old daughter has her masters in School Counseling and works at a magnet school. She just moved to Wrigleyville, and we enjoy visiting her and going to Cubs games, taking walks with her 2 dogs and visiting different restaurants and bars.

I’ve become the unofficial Mexico all-inclusive travel agent for friends and colleagues. I will find them good prices and give them resort suggestions and then send them over to my travel agent who will deal with the hard work.

Mexico all-inclusives are a favorite after a tax season as there is minimal planning ahead of time. I can enjoy relaxation, socialization, reading, exercise and some Vitamin D! However, I’d like to jump across the pond and expand into Europe in the next couple of years.

Everything! My Spotify starts with the 1940s and contains every decade through current. I warn colleagues that I usually have Spotify on shuffle and you never know what you are going to get – some jazz, classical, hair bands, hip hop, 80’s hits, etc.