Member of Russell Bedford International, a global network of independent professional service firms.

According to the Social Security Administration, as of 2019, 16% of Americans were age 65 or older. Each day approximately 10,000 baby boomers reach the age of 65, with all boomers reaching 65 by 2030. Boomers aren’t the only reason the nation’s overall population is aging – people are living longer due in part to better health care (even though deaths from COVID-19 have lowered life expectancy projections).

With aging comes a greater likelihood of injury. The Centers for Disease Control has stated that falls are the leading cause of injuries among people age 65 and older, and nearly 30% of older adults reported falling at least once in the preceding 12 months. To help minimize falls and accommodate age-related infirmities, many people are adding grab bars in showers, modifying stairways, widening hallways to accommodate a wheelchair, and other projects to make the home safer and more accessible for older occupants. If you are planning to make these type of home improvements, you may be eligible to claim the costs as a medical expense for income tax purposes.

Generally, the costs of home improvements are not deductible except to offset home gain when the home is sold. However, a medical expense deduction may be claimed when the primary purpose of the home modification is a medical reason. The tax law says that deductible medical expenses are those paid for the “diagnosis, cure, mitigation, treatment, or prevention of disease, and the costs for treatments affecting any part or function of the body.”

So, if you are making the modification to accommodate a medical condition or need of you, your spouse, or a dependent, then the cost of the modification may be deductible as a medical expense, but only to the extent that it exceeds any resulting increase in the property’s value.

Example: A doctor recommends that his patient with severe arthritis have daily hydrotherapy, and so the individual has a hot tub installed at a cost of $21,000. The individual then hires a certified home appraiser to determine how much the hot tub addition increased the home’s value. The appraiser concludes the increase is $20,000. The individual’s medical deduction for the year the hot tub is installed will be limited to $1,000 ($21,000 – $20,000). The other $20,000 of expenses will increase the home’s basis, meaning that it will add to the home’s cost and will offset the sales price when the home is sold.

Even though a prescription from a doctor isn’t required for most medically related home modifications, the taxpayer, if questioned by the IRS, needs to be able to demonstrate how the expenditure relates to their medical care or that of a spouse or dependent. Having a letter from the individual’s doctor that explains the type of modifications that would be medically beneficial would help to prove a medical need.

Not all improvements result in an increased home value. In fact, some modifications, such as lowering cabinets for an occupant confined to a wheelchair, may decrease the home’s resale value.

The IRS has identified certain improvements that don’t usually increase a home’s value but for which the full cost can be included as a medical expense. These improvements include, but are not limited to, the following items:

Only reasonable costs to accommodate a home for a disabled condition or for an elderly individual are considered medical care costs. Additional costs for personal preferences, such as for architectural or aesthetic reasons, are not medical expenses (but could be additions to the home’s tax basis).

Unfortunately, the total of all medical expenses can be deducted only to the extent that they exceed 7.5% of the taxpayer’s adjusted gross income (AGI) and only if the taxpayer itemizes deductions. With the current high value of the standard deductions, fewer than 15% of taxpayers are expected to itemize their deductions through 2025. So even if a medically needed home improvement is made and qualifies to be deducted, only a small percentage of taxpayers will end up with a tax benefit because of the expenditure.

All is not lost, though. To the extent that the taxpayer doesn’t claim the expense as an itemized deduction, the improvement costs, including those that might not meet the medically necessary standard, can be added to the home’s purchase cost to determine the home’s tax basis. Thus, when the home is sold, the capital gain from the sale will be lower.

Either to substantiate the currently deductible improvements or with a future home sale in mind, taxpayers should keep records of the home improvements they make, including receipts.

If you would like to discuss the tax deductibility of an improvement you are making to your home for medical purposes, please call the Cray Kaiser tax experts at (630) 953-4900.

The IRS has always required U.S. citizens to report all income from whatever source derived. Understanding that individuals with side businesses may not have reported all their income, the IRS is seeking to crack down on taxpayers who may be underreporting their income, whether it be on purpose or because of a misunderstanding of the rules.

For several years now, the IRS has required payments made to merchants through various marketplaces, payment processors (credit and debit cards), and third-party settlement organizations to be reported on Form 1099-K. The IRS then compares the 1099-K amounts to the amount reported on the individual’s or business’s tax return and follows up by correspondence or by audit if there appears to be an underreporting of income.

Before 2022, the filing threshold for 1099-Ks was reportable payment transactions during a calendar year of more than $20,000, and more than 200 transactions in that same year. Thus, entrepreneurs with a small business selling merchandise on the Internet directly or through Amazon, E-Bay or other online platforms may not have received a 1099-K in the past.

That will all change beginning in January 2023 when reporting begins for 2022 transactions. The American Rescue Plan Act included a provision to reduce the reporting threshold to $600 effective in 2022. So, which businesses are likely to receive 1099-Ks that have not in the past?

The 1099-K only reports gross income, and the cost of the products sold and other business expenses can be deducted to determine a merchant’s net taxable profit. Those renting vacation homes can deduct depreciation, utilities, repairs, and other expenses, while those providing services can deduct certain travel and other expenses. The net profits are subject to income tax and are generally subject to self-employment tax, including rentals where significant personal services are performed.

Because of the new 1099-K reporting, an uptick in the small business tax filings is anticipated. Keeping records of expenses becomes critical to reducing the gross income reported to the IRS. Please contact Cray Kaiser at (630) 953-4900 if you’d like to discuss how these rules may impact you.

Suppose you are fortunate enough to have an estate large enough to be subject to the estate tax upon your death. You might be considering ways to give some of your wealth to your family and loved ones now, thereby reducing the estate tax when you pass on. This tax strategy is important to consider over the next few years. The estate tax is set to revert back to about half of the current lifetime gift and estate tax exclusion beginning in 2026.

Frequently, taxpayers think that gifts of cash, securities, or other assets they give to other individuals are tax-deductible; in turn, the gift recipient thinks they have to pay income tax on the gift received. Nothing can be further from the truth. To fully understand the ramifications of gifting, one must realize that gift tax laws are related to estate tax laws. Uncle Sam does not want you to give away your wealth before you pass away to avoid the estate tax. For individuals who die in 2022, federal law allows $12.06 million (lifetime estate tax exclusion) to pass to heirs estate-tax free. Any excess amount is subject to an estate tax as high as 40%.

Amounts you gift above the annual gift tax exclusion amount prior to your death reduce the lifetime estate tax exclusion and will therefore subject more of your estate to taxation.

Example: Jeff gives his daughter $100,000 in 2022. This is $84,000 more than the $16,000 annual gift tax exclusion. Jeff will need to file a gift tax return reporting the gift. The $84,000 excess (and any additional excess amounts from other years) will reduce his estate tax exclusion, whatever amount it may be, in the year he dies.

The law does provide exceptions where gifts can be made without reducing the lifetime exclusion, including the following:

If the gift giver is married and both spouses agree, gifts to recipients made during a calendar year can be split between the husband and wife, even if only one of them gifted the cash or property. By using this technique, a married couple can give $32,000 in 2022 to each recipient under the annual limitation discussed previously.

High-Wealth Individuals – If you are a high-wealth individual who would like to pass on as much to your heirs as possible while living, without reducing the lifetime exemption, you could directly pay your future heirs’ medical expenses and education expenses in addition to annual gifts of cash or property of up to $16,000 (2022). You may want to do this even if you are not a high-net-worth individual, to avoid filing a gift tax return.

Education Expenses – When you pay the qualified post-secondary education tuition for another individual, it does not mean (as is usually the case for medical expenses) that someone cannot benefit taxwise. Tax law says that whoever claims the student as a dependent is entitled to the American Opportunity Credit or Lifetime Learning Credit for higher education expenses if they otherwise qualify.

Gifts of Appreciated Property – Consider replacing your cash gifts with gifts of appreciated property, such as stock for which you have a “paper gain.” When you gift an appreciated asset, the potential gain on the asset transfers to the recipient. This works for individuals, except for children subject to the kiddie tax, which requires the child’s income to be taxed at the parent’s tax rate if it is higher than the child’s rate. It also works great for contributions to charitable organizations. Although not subject to the gift tax rules, not only does an appreciated asset gifted to a charity get you out of reporting any gain from the appreciation, but you also get a charitable tax deduction equal to the fair market value (FMV) of the asset. The deduction for these gifts is generally limited to 30% of your adjusted gross income (AGI), but the excess carries over for up to five years of future returns.

Remember that to utilize this year’s annual exclusion amount, the gift must be transferred to your designated recipient by December 31. Exclusion amounts not used this year do not carry over to next year. So it’s never too early to start your 2022 gifting.

In addition to the strategies above, you can use more complex gifting strategies involving various trust techniques to minimize future estate tax and take advantage of the current more significant exemption. If you need assistance with planning your gifting strategies, please call Cray Kaiser at 630-953-4900.

The competitive short-term rental marketplace has made taxpayers consider renting their home, rooms or even their backyard! Online sites Airbnb, Vrbo, HomeAway and Craigslist all help facilitate renting property and space. Most offer varying degrees of services and all will charge a fee to access their marketplace. However, whatever method you use to rent your property, room or other space will result in thorny issues on your tax return.

The tax treatment varies based on how long you rent the property during the year as well as the type of activity it is considered in the eyes of the IRS. Once considered a taxable activity, there are two ways your activity can be classified as a traditional passive rental (renting a home) or as a service (renting a home along with your time to provide additional services).

First, the good news.

If you rent your property for less than 14 days and live in the property for more than 15 days in a year, there is no income tax reporting requirement. This is also loosely referred to as the “Augusta” rule, named for members of Augusta National that rent their properties during The Masters weekend for top dollar.

If, however, you rent out your property for more than 14 days, you need to consider what is provided with the rental, which in turn will determine how it is reported on your tax return.

Traditionally, most rentals are viewed as passive activities that are reported on Schedule E. Think of this as renting your property in the mountains during ski season. The renter would be responsible for simple upkeep. You only provide the property to the renter. In this case, the income will be reported on Schedule E. You will be able to deduct expenses related to this rental, such as cleaning, commissions, and repairs (these are direct expenses). Expenses such as mortgages, real estate taxes and depreciation (considered indirect expenses) must be prorated based on the period the property was rented versus used personally. The net income of this activity will be subject to your marginal tax rate and any losses will be offset against other passive income or carried forward if no other passive income exists.

If you provide services in conjunction with the rental, such as daily cleanings, offering breakfast, or other activities that would make it akin to operating a hotel, the rental would be considered a business and reported on Schedule C. The IRS considers the type of service; if the services rendered are substantial to the occupants, then it would be considered more of a business instead of passively renting the property. As in the above example, you still will be allowed the expenses to reduce your income, but the net income would be subject to self-employment (SE) tax. The SE tax is 15.3%, which is broken down as 12.4% for Social Security and 2.9% for Medicare. Keep in mind that this is in addition to regular income taxes, but you will be able to take one-half of the SE tax as a deduction to reduce your net profit. If you have a net loss from this activity, then you will be able to offset it against your other income, whether passive or not.

The IRS assesses short-term rentals based on the facts and circumstances of each case. As each case is unique and one size doesn’t fit all, Cray Kaiser can help you determine the classification along with structuring it favorably for tax purposes. Please contact us today at 630-953-4900.

CPA | Senior

Over the last few years, the Internal Revenue Service has been engaged in a virtual currency compliance campaign to address tax noncompliance related to cryptocurrency use. The IRS’ efforts include outreach to taxpayers through education, audits of taxpayers’ returns and even criminal investigations.

Included by Congress in the Infrastructure Investment and Jobs Act (IIJA) of 2021, cryptocurrency exchanges will be subject to information reporting requirements like those stockbrokers have to follow when a taxpayer sells securities and other assets. These new rules generally apply to digital asset transactions starting in 2023. The first reporting forms related to cryptocurrency transactions will be issued to the IRS and crypto investors in January 2024.

You will start to notice that many if not all, crypto exchanges will request taxpayer-identification numbers (usually a Social Security number), similar to the current application process when opening a bank or brokerage account.

Property transactions, such as the sale of securities, are reported on Form 1099-B. To date, the IRS has not finalized how crypto transactions will be reported, whether on the current version of the 1099-B or a new form that will be created for this purpose. However, like with securities, crypto will be treated as property and sales proceeds, acquisition dates, sale dates, tax basis for the sale, and the character of the gain or loss will be disclosed to you and the IRS. It will be necessary to report the disposition of cryptocurrency when it is sold for cash, used to buy something or traded for another cryptocurrency. But just transferring the currency from an online wallet to an exchange, or vice versa is not a disposition and, therefore, not taxable.

Of course, not every transfer transaction is a sale or exchange. An example would be transferring cryptocurrency from a wallet at Crypto Exchange #1 to the taxpayer’s wallet in Crypto Exchange #2. In this case, Crypto Exchange #1 will be required to provide relevant digital asset information to Crypto Exchange #2. Such a transaction is not a reportable sale or exchange. Similar to when a taxpayer switches stockbrokers, the prior exchange must provide the new exchange with the basis, and purchase dates, just as a stockbroker must when the brokerage firms are changed.

Please note that the above will potentially apply to non-fungible tokens (NFTs) that are using blockchain technology for one-of-a-kind assets like digital artwork. The IRS considers these digital assets.

Starting with the 2020 return, the IRS began asking if you engaged in any transaction with digital currencies. By signing the return, you are attesting under penalties of perjury to filing a true, correct, and complete return. Going forward, as crypto exchanges report digital transactions with the IRS, the IRS will match information received against your tax return to verify that you are reporting these accurately.

Currently, when a business receives $10,000 or more in a cash transaction, the business is required to report the transaction on IRS Form 8300, including the ID of the person from whom the cash was received. Under the IIJA rules, businesses will be required to treat digital assets like cash for purposes of this reporting requirement. The $10,000 may occur in a single transaction or a series of related transactions.

If you have questions about crypto transactions, NFTs or reporting, please call Cray Kaiser at (630) 953-4900 or contact us here.

Individuals with disabilities and parents of children with disabilities may qualify for a number of tax credits and other tax benefits. Listed below are several tax credits and other available benefits if you or someone listed on your federal tax return has a disability.

Since a change in the law more than 35 years ago, taxpayers (or spouses when filing a joint return) who are legally blind have been eligible for a standard deduction add-on. Thus, for 2021, if a taxpayer is filing jointly with a blind spouse, they can add $1,350 to their standard deduction of $25,100; if both spouses are blind, the add-on doubles to $2,700. For other filing statuses, the additional amount is $1,700. In addition, while being age 65 or older isn’t a disability, it should be noted that there is an “elderly” add-on to the standard deduction of $1,350 or $1,700, depending on filing status. These add-ons apply only to the taxpayer and spouse, not to dependents.

Certain disability-related payments, Veterans Administration disability benefits, and Supplemental Security Income are excluded from gross income (i.e., they are not taxable). Amounts received for Social Security disability are treated the same as regular Social Security benefits, which means that up to 85% of the benefits could be taxable, depending on the amount of the recipient’s (and spouse’s, if filing jointly) other income.

Individuals with a physical or mental disability may deduct impairment-related expenses paid to allow them to work.

Impairment-related work expenses are ordinary, necessary business expenses for attendant care services at the individual’s place of work as well as other expenses in the workplace that are necessary for the individual to be able to work.

The EITC is available to taxpayers with disabilities and the parents of a child with a disability, even when the child’s age would normally prevent the child from being a qualifying child. The EITC is a tax credit that not only reduces a taxpayer’s tax liability but may also result in a refund. Many working individuals with a disability who have no qualifying children may qualify for the EITC.

Taxpayers who pay someone to come to their home and care for their dependent or spouse with a disability may be entitled to claim this credit. For children, this credit is usually limited to the care expenses paid only until age 13, but there is no age limit if the child cannot care for himself/herself.

Qualified ABLE programs provide a way for individuals and families to contribute and save to support individuals with disabilities in maintaining their health, independence, and quality of life.

Federal law authorizes states to establish and operate ABLE programs. Under these programs, an ABLE account may be set up for any eligible state resident – someone who became severely disabled before turning 26 – who would generally be the only person who could take distributions from the account. ABLE accounts are very similar in function to Sec. 529 plans. The primary purpose of ABLE accounts is to shelter assets from the means testing required by government benefit programs.

Individuals can contribute to ABLE accounts, subject to per-account gift tax limitations (maximum $16,000 for 2022, up from $15,000, which it has been for several years). For years 2018 through 2025, working individuals who are beneficiaries of ABLE accounts can contribute limited additional amounts to their ABLE accounts, and these contributions can be eligible for the nonrefundable saver’s credit.

Distributions to the individual with a disability are tax-free if the funds are used for qualified expenses of the disabled individual.

For more information on the benefits available to disabled taxpayers or dependents, call the experts at Cray Kaiser (630) 953-4900.

The past few tax seasons have been riddled with new tax laws, pandemic logistic and staffing issues, and extended turnaround times by the IRS for processing returns. Although progress has been made, we anticipate another season of backlog for the IRS. This article talks about the issues at play and a best practice for getting your returns filed timely and accurately.

This could be another rough tax season for the IRS and taxpayers. Although this year’s filing season opened January 24, 2022 (the first day the IRS will accept and start processing 2021 returns), the Service still has a backlog of prior year returns to process and is plagued by staff shortages due to the pandemic and reduced funding in the last few years. Even though the majority of 2020 returns were filed electronically, many of those returns still required manual review, resulting in significant delays in the IRS issuing refunds. This was the case with millions of 2020 returns of taxpayers who received unemployment compensation and had filed before Congress passed a law that retroactively exempted up to $10,200 of 2020 unemployment income per filer (that provision has not been extended to 2021). Human review was also required for a significant number of returns on which the Recovery Rebate Credit had to be reconciled with the Economic Impact Payments #1 and #2.

Similar issues are likely to affect 2021 returns, especially those where taxpayers received Advance Child Tax Credit (ACTC) payments and/or Economic Impact Payment #3, both of which must be reconciled on the 2021 return. Thus, to avoid return processing delays it is important to include the correct amounts received when doing the reconciliation. In January, the IRS began issuing Letters 6419 (for the ACTC) and 6475 (for EIP #3) to taxpayers; these letters provide the information needed for making the reconciliation calculations. Be sure you provide these letters to your tax return preparer. Having an accurate tax return can avoid processing delays, refund delays and later IRS notices.

Despite reduced staffing and the continuing pandemic, the IRS projects that for this tax season they’ll process electronically filed returns and pay refunds that are designated to be direct deposited in the taxpayer’s bank account within 21 days of receiving the return. While this turnaround time can’t be guaranteed, the earlier you file, the better the chance that you’ll see your refund within that time frame. If the IRS systems detect a possible error, missing information, or there is suspected identity theft or fraud, the IRS may need to correspond with the taxpayer, requiring special handling by an IRS employee. In that case, it may take the IRS more than the normal 21 days to issue any related refund. Sometimes the IRS can correct the return without corresponding, in these instances the IRS will send an explanation to the taxpayer.

To stop the filing of fraudulent returns, the IRS is prohibited by law from issuing a refund from a return where the Earned Income Tax Credit or Advance Child Tax Credit is claimed until mid-February. However, that doesn’t prevent taxpayers from filing their returns before then.

Taxpayers generally will not need to wait for their 2020 return to be fully processed to file their 2021 tax returns and can file when they are ready. So, if you filed your 2020 return, but the IRS has still not processed it, don’t let that stop you from preparing and filing your 2021 return.

The best advice is don’t procrastinate in filing your return, even though the IRS may be bogged down.

In addition to return processing woes, the IRS has had customer service problems, specifically the lack of enough IRS representatives to answer the phone in response to taxpayers’ questions. Last tax season, because of Covid-19-related tax changes and staffing challenges, more than 145 million calls were received by the IRS phone system between January 1 and May 17, more than four times the number of calls in an average year. Alas, the Service was able to answer only about 10% of those calls, and callers who were lucky enough to have their calls answered generally had extremely long wait times before actually being able to speak with an IRS employee.

The IRS encourages taxpayers to go to the IRS.gov website to search for answers to their tax questions instead of calling the Service, but that often isn’t an adequate substitute for talking personally to a knowledgeable individual. Those who have their returns prepared by a tax pro have the benefit of being able to contact their tax professional with tax questions instead of being frustrated trying to reach or deal with the IRS. Given how understaffed the IRS is, it is more important than ever for taxpayers to have their returns professionally prepared.

If you are an existing Cray Kaiser client and have questions, please give our office a call at (630) 953-4900. If you have forwarded this on to a potential client who has been having troubles preparing their own tax return and would like professional preparation, we are also here to assist them.

For tax purposes, the term “basis” refers to the monetary value used to measure a gain or a loss. For instance, if you purchase shares of a stock for $1,000, your basis in that stock is $1,000. If you then sell those shares for $3,000, the gain is calculated based on the difference between the sale price and the basis: $3,000 – $1,000 = $2,000. This is a simplified example, of course. Under actual circumstances, purchase and sale costs are added to the basis of the stock.

The basis of an asset is a very important concept for tax purposes because it is used to calculate deductions for depreciation and casualties, as well as gains or losses on the disposition of that asset.

It is important to keep in mind that the basis is not always equal to the original purchase cost. It is determined in different ways for purchases, gifts and inheritances. In addition, the basis is not a fixed value, as it can increase as a result of improvements or decrease as a result of credits claimed, business depreciation or casualty losses. Below is a primer on how basis is determined in various circumstances.

Cost Basis – The cost basis (or unadjusted basis) is the amount originally paid for an item before any improvements, as well as before any credits, business depreciation, expensing, or adjustments as a result of a casualty loss.

Adjusted Basis – The adjusted basis starts with the original cost basis (or gift or inherited basis) and then incorporates the following adjustments:

Example: You originally purchased a home for $250,000. You added a room for $50,000, installed an electric solar system for $25,000, and replaced the old windows with energy-efficient, double-paned windows at a cost of $36,000. You claimed tax credits of $7,700 for the solar system and the windows, leaving you with an adjusted basis of $353,300 for your home. ($250,000 + $50,000 + $25,000 + $36,000 = $361,000 – $7,700 = $353,300)

Example: As the owner of a welding company, you purchased a generator for $6,000. After owning it for three years, you sell it to another welder. This was business property and you had taken depreciation of $3,376 over the three years. Your adjusted basis of the generator prior to the sale was $2,624. ($6,000 – $3,376 = $2,624)

Gift Basis – If you receive a gift, you assume the donor’s adjusted basis for that asset. In effect, the donor transfers any taxable gain from the sale of the asset to you (but not necessarily the loss).

Example: Your mother gives you stock shares that have a market value of $15,000 at the time of the gift. She originally purchased the shares for $5,000. You assume your mother’s basis of $5,000. If you then immediately sell the shares, your taxable gain is $10,000.

There is one significant catch. If the fair market value (FMV) of the gift is less than the donor’s adjusted basis and you then sell it for a loss, your basis for determining the loss is the gift’s FMV on the date of the gift.

Example: Let’s again assume your mother purchased stock shares for $5,000. However, this time the shares were worth $4,000 when she gave them to you, and you subsequently sold them for $3,000. In this case, your tax-deductible loss is only $1,000. (The sale price of $3,000 minus the $4,000 FMV on the date of the gift.)

Inherited Basis – Generally, a beneficiary who inherits an asset uses the asset’s FMV on the date of the owner’s death as the tax basis. The tax on the decedent’s estate is based on the FMV of the decedent’s assets at the date of death.

Example: You inherit your uncle’s home after he died in 2020. Your uncle’s adjusted basis on the home which he purchased in 1995 was $50,000, and its FMV was $400,000 when he died. Your basis on the home is equal to its FMV or $400,000.

Example: You inherit your uncle’s car after he died in 2020. Your uncle’s adjusted basis in the car which he purchased in 2015 was $50,000, and its FMV was $20,000 at his date of death. Your basis in the car is equal to its FMV or $20,000.

An inherited asset’s FMV is very important because it is used to determine the gain or loss after the sale of that asset. For vehicles, online valuation tools such as the Kelly Blue Book can be used to determine FMV. The value of publicly traded stocks can similarly be determined using website tools.

For most other assets, like real estate or family businesses, valuations generally require the use of certified appraisal services. The valuation team at Cray Kaiser is well versed in assisting clients with these more complex assets. If you have questions about your tax basis or business valuation and want to discuss how it might affect your tax situation, please call us at (630) 953-4900.

Did you know that tax planning can affect your future Medicare premium costs? If not, you are not alone. Part B and Part D premiums are determined by a number of factors, the most important one being your Income-Related Monthly Adjustment Amount or IRMAA.

IRMAA was put in place to require wealthier participants to share more in the cost of Medicare premiums. How exactly is “wealthier” determined? This may surprise you – it’s based on your income from two years prior to the time the premium is determined. In other words, your 2022 premiums will be based on your 2020 tax return. For single individuals, the cost of your premiums will increase if you report 2020 modified adjusted gross income (MAGI) in excess of $91,001. For a married couple, a MAGI in excess of $182,001 will result in higher premiums. Below is a chart outlining Part B premiums for 2022:

HOW MODIFIED ADJUSTED GROSS INCOME (MAGI) IMPACTS MEDICARE PREMIUMS

IRMAA is particularly harsh because it operates on a “cliff”. One extra dollar of MAGI can be very costly. Consider a couple who has a MAGI of just over $170,000. Their premiums are more than $100 per month higher than a couple who has a MAGI just under $170,000. Managing your MAGI is key to managing the cost of your Medicare premiums. So how can you plan?

Converting a traditional IRA to a Roth IRA is not ideal in your later years, specifically because of IRMAA. A conversion is considered additional income under IRMAA and could quickly propel you into a higher MAGI with the associated higher monthly premium. However, performing a Roth conversion well before your Medicare years is a great planning tool to avoid IRMAA issues. Why? Because qualified Roth IRA distributions are not included in your MAGI. Also, by shifting assets out of your traditional IRA, you are reducing the required minimum distributions that you’ll need to take during your retirement years.

While we don’t have complete control over life events, it is possible to control your future income. To the extent it makes tax sense to do so, consider accelerating other income items ahead of your Medicare years. For example, you may consider selling appreciated assets earlier than two years before you claim Medicare. The capital gain is included in MAGI, but your effective federal tax rate on the gain could be as low as 0%.

Working with your financial advisor to ensure that you understand how your holdings impact your MAGI is important as well. There are some holdings that are still good investments but are more tax-efficient than others. We can help if you have questions about tax planning in association with IRMAA considerations. Just call our office at (630) 953-4900.

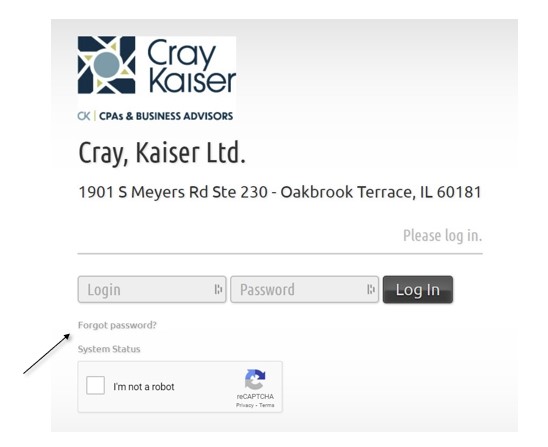

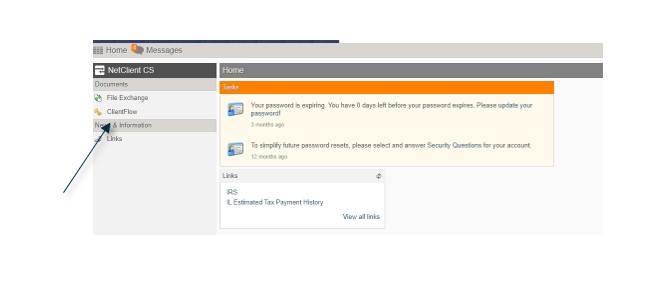

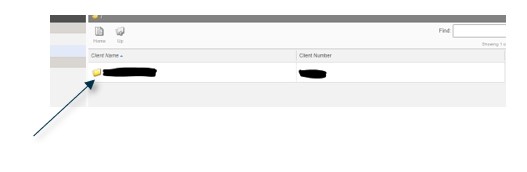

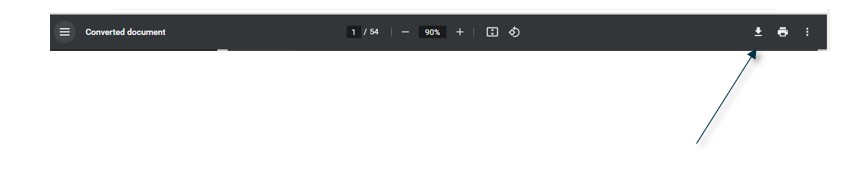

You already know we at Cray Kaiser thrive on the personal relationships we develop with our clients. But even the best relationships can benefit from the use of technology. That’s why we developed our online portal – to allow us and our clients to safely and securely share the documentation we all need, especially during tax season. It is easy to navigate, however, if you run into difficulties, the following tips and tricks should help.

We hope these instructions help you to navigate our online portal. However, if you still have questions or issues, please don’t hesitate to contact us at 630.953.4900.