Member of Russell Bedford International, a global network of independent professional service firms.

John’s skills and talent have resulted in a great deal of success for the company. His sales job involves quite a bit of driving throughout the Midwest. You’ve decided you want to reward his efforts and success with a company car. Before you tell John, you have a decision to make. Will his car be leased? Or will the company buy it outright? What kind of impact does leasing versus owning have on the company’s tax situation? Several factors impact this decision, including how long the car will be kept and how consistently the car will be driven.

How long will the company keep the car?

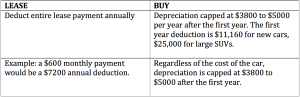

If the company plans for John to keep the car longer than a leasing period, it likely makes sense to buy the car outright. If the company plans to reward John with new cars fairly frequently, a lease may make more sense. Weigh the annual lease payments against the annual deductions.

Will the use of the car be consistent year-to-year?

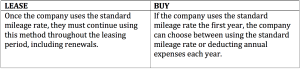

Regardless of whether you lease or buy John’s car, the company has a choice to make. They can either deduct all expenses, including gas, service, repairs, depreciation/lease expenses and insurance, or use the standard mileage rate (54¢ per mile in 2016). Tolls and parking can be expensed in addition to the standard mileage rate.

Only mileage associated with business use can be deducted, and a log must be kept to separate business mileage from personal use. In order for the expenses/mileage to be fully deductible to the company, the employee using the car must have the personal portion of the auto use recorded on their W2 as a fringe benefit. The pretax benefit to the employee far outweighs the small amount of additional income associated with the fringe benefit.

Different rules apply to switching between deduction methods for leasing versus buying.

If John’s use of the company car will vary from year to year, buying the car will offer more flexibility. In addition, inconsistent use can also create costly leasing expenses. Leases include an annual mileage allowance with per mile surcharges for overages.

Choosing the best option between leasing and buying John’s new car means considering tax implications and predicting the use of the car. Careful planning including consideration of when John’s car will be replaced and how consistent his travel will be will help you reach the best decision for your company.

If you are facing a similar decision and want to talk through the tax implications, we would be happy to help. Contact us today.

Intrapreneurship embodies risk taking and innovation within an established business. When evaluating the sustainability of any organization, one might revisit the business model and consider new business lines that could resist the numerous tugs experienced in the lifecycle of any business.

Remember when you first started working and the idea of traveling for business sounded exotic and adventurous? Then you discovered that business travel means seeing too many hotels and convention centers and not leaving much time for exploring new cities. You also discovered the limitations of your employer’s travel and expense policies. For most business travelers, images of fine dining and staying in 5-star hotels are quickly replaced by the reality of keeping travel costs down to keep profitability up.

Travel and expense policies may take away some of the mystique of travel, but they benefit both employers and employees. Having a travel and expense policy protects employers from fraud and employee error. It also prevents conflict and confusion for employees, providing boundaries and clarity that helps them do their jobs better.

While business travel can quickly lose its allure, good travel and expense policies will stand the test of time. By clearly communicating the policies, travelers and employers will be on the same page, avoiding tax issues, preventing conflict and reducing expensive fraudulent submissions and inadvertent errors. Contact Cray Kaiser today for help creating your travel and expense policies, developing an internal control system or reviewing your policies to identify opportunities for improvement.

Suppose you’re a partner in a partnership where the agreement requires you to work some of the time for the business. Can you ever be treated as an employee of the partnership for tax purposes instead of as a partner? The lines may become blurry, but the IRS has maintained, at least up until this point, that partners aren’t employees.

New regulations concerning disregarded entities shed some light on this issue. Traditionally, the IRS has said that if you’re a partner who provides services to the partnership, you aren’t treated as an employee of the partnership. The regulations clarify that this result can’t be avoided if you become an employee, based on state law, of a single-member limited liability company owned by the partnership.

What is the tax significance? Unlike corporations, partnerships pass through items of income and loss to partners. You report the appropriate share on your personal tax return. Instead of receiving Forms W-2 as employees do, the partnership issues a Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc., to partners. In addition, you must pay income tax on guaranteed payments made during the year even though you don’t receive a taxable salary. Guaranteed payments are amounts paid to partners no matter the partnership’s income.

Similarly, although employment taxes aren’t deducted from wages, you pay equivalent self-employment taxes. The tax rate is double the usual rate for employees, but half of the amount is deductible on your return.

This tax structure can be problematic if fringe benefits are provided to workers. Because you, as a partner, aren’t treated as an employee, you generally aren’t eligible for the tax exclusion for certain statutory fringe benefits. That means the fringe benefit payments can represent taxable income to you.

Do you have questions about how your business ventures affect your tax return? Contact us for help.

Partnership Tax Terms and What They Mean:

Puzzled by tax-related partnership lingo? Here’s the definition of key terms in partnership tax rules.

It’s awkward. And complicated. And emotional. But dealing with what happens to your estate after your death is an unavoidable and essential task. Like many people, you may have consulted an estate attorney to create a trust and will, ensuring that assets pass along to selected family, friends or institutions. However, like many people, you may not realize there is another step to take. A step that, if missed, could mean your wishes are not followed or your beneficiaries pay more taxes or wait longer to have access to their inheritance.

That is, regardless of who is named on your will and trust, those wishes have no bearing on accounts that have a different beneficiary designated.

As an example, imagine that your uncle goes through a terrible divorce but then meets the woman of his dreams and gets remarried. Being a responsible person, Uncle Charles revises his will and trust naming his new wife as his beneficiary. However, he neglects to update his beneficiary designation on his life insurance policy and his IRAs. When he passes away unexpectedly, his insurance and IRA benefits are paid out to his ex-wife while his new wife receives nothing, even though she’s listed in the will and trust.

As another example, let’s say that you and your spouse created a will and trust that equally distributes your $5 million insurance policy among your four children. However, unfortunately, you had not updated the policy beneficiary designations between the births of your second and third children, listing only the older two by name. Since the beneficiary designation on the account takes precedence over the will and trust, only your oldest two children would receive any inheritance from the policy. The younger two children would receive nothing, which would likely create conflict and drama at an already emotional time.

What if there is no beneficiary listed on an account?

If there is no beneficiary designation on an account, the will or trust will be consulted. However, if there is no beneficiary designation and no will or trust, a court determines your beneficiaries for you.

Even if you have a will or trust to turn to in the case that an account has no beneficiary designated, there can be tax implications for the heir. For example, some accounts must be paid out within five years of death, like annuities, qualified plans and IRAs. A named beneficiary can rollover to a qualified plan or stretch out their withdrawals from the IRA over the rest of their lives, deferring their income taxes. If the beneficiary is named by the will or trust or determined by a court, the funds must be drawn out during a five-year period or possibly even taken out as a lump sum distribution, both of which would be taxed at a much higher tax rate than funds rolled into a qualified plan.

What should you do next?

First, review your estate plan and ownership of your assets. Consider whether your trust should be the beneficiary rather than specific people’s names. Listing your trust has two main benefits:

For example, let’s say you have a $2 million qualified plan that you are leaving to your son. To be fair, you leave the rest of your estate, also worth two million dollars, to your daughter. You feel that you’ve balanced the inheritance perfectly and that both your children will receive equal shares. However, because your son is named, he can take the assets out of the account throughout his life, paying a much lower tax rate. While your daughter, unfortunately, may be required to pay the entire inheritance tax, which is at a much higher rate. While you intended to be fair, tax implications of the various kinds of inheritance leave your son with a much larger amount than your daughter. Naming your trust as the beneficiary and then designating inheritance within the trust will allow you to achieve the balance you desire.

Second, check the following list of accounts to be sure your designated beneficiaries are up to date:

When should you update your beneficiaries?

Some experts suggest checking your beneficiaries annually; others suggest every three to five years. One easy way to remember which accounts to check is to gather the 1099 tax forms from the financial institutions holding your assets, which you should receive in February of each year.

You should also update your beneficiaries any time there is a major change in your life, including:

How do you check who is listed as your beneficiaries?

Simply call your financial institution or see if you can access the information through your online account. Typically, the only information you need to provide about your beneficiary is their name and address, although sometimes a social security number is also required.

While thinking about what happens to your assets after your death can feel overwhelming, awkward and emotional, taking the time to update your beneficiaries prevents animosity and expense for your beneficiaries after your death. If you have any questions about trusts, wills or beneficiary designations, contact us today.

Are you considering a merger or acquisition as the best solution for your business’ growth or exit plan? As shared in last month’s blog post When Mergers and Acquisitions Make Sense, mergers and acquisitions (M&A) can provide a more efficient, cost-effective way to grow a company, whether it’s by adding people, processes, or products. M&A can also be the perfect way to secure the financial goals you have for yourself and your family as you exit the company you built.

Being proactive and creating a simple M&A strategy sets you up to use your time wisely and to secure a financially-beneficial deal. It is wise to review these top six mistakes business owners make when considering a merger or acquisition and how to prevent them as you create your own strategy:

You hear it all the time: “mergers and acquisitions.” However, there are few true mergers. Merging two companies almost always results in one company acquiring the other. Why? It all boils down to the fact that there can only be one true leader, one chief.

Consider this an acquisition, not a merger. Are you being acquired or are you acquiring? Who will be the leader? Addressing this in the beginning avoids tension down the line.

If you do not have a strong grasp of M&A goals, you may move forward with a deal that does not help you achieve your goals or, worse yet, moves you further from your desired results.

Your very first step in the process is identifying your goals. Determining when mergers and acquisitions make sense can help you along this process.

Not spending enough time identifying targets that help you achieve growth or exit-plan goals means wasting both time and money on negotiating with the wrong potential partners.

Before you find yourself responding to interested parties, identify who you believe would be the best match for your company.

Which roles will be duplicated? What will happen to the people in those jobs now? Which company’s process will be used for which tasks? Not answering these questions before they’re asked puts your company into a state of turmoil, creating unhappy team members and risking losing the exact talent you are attempting to acquire.

Plan for changes in people and process. Be transparent with all involved. Communicate plans to reduce tension and create internal support.

It is easy to get drawn in by a strong connection with people you would love to do business with. Pressure to find a solution to growth or exit planning issues can make a deal look more attractive than it truly is.

Involve objective advisors from the start to guide you with an unbiased, impartial perspective.

Having unrealistic expectations about the time involved in the M&A process can frustrate you and the other people involved and create rushed decisions. Both parties involved will be interrupted with the challenges and responsibilities of running their businesses. As time goes on, expectations and projections can change, requiring everyone to maintain flexibility throughout the process.

Stay grounded and realistic in your expectations around the pace of the process. Lean on your advisors to take some of the work load.

The M&A process is an adventure, one that can end with a new entity that helps all involved meet goals or with one or all parties regretting their choices. To have a successful M&A process, be proactive rather than reactive. Understand when mergers and acquisitions make sense. Prevent the six common M&A mistakes. And involve objective advisors from the start.

If you’re considering a merger or acquisition, contact Cray Kaiser today. We can help you review your options.

Growing companies often choose to create a board of directors or an advisory board to bring in outside influence and perspective. While the two kinds of boards have similar responsibilities, differences in how the boards are managed influence which type of board should be used. Most companies bringing in outside advisors for the first time start with an advisory board because it is less formal and less constricting.

Out of the blue, you’re approached with what sounds like a great deal, almost too good to be true. An owner of a company in a similar industry wants to merge. You’ve been thinking about how to boost your flat-lining sales. Could this be the solution? Mergers and acquisitions can be the perfect answer to issues around growth or exit planning, but exploring them can also cause more problems than they solve, wasting both time and money. How do you tell the difference? First, understand the beneficial reasons to consider mergers and acquisitions (M & A). Second, learn and avoid mistakes commonly made by businesses when considering M & A.

If you’re considering a merger or acquisition, being proactive rather than reactive gives you the most control and keeps you in the best position for negotiations. Typically, your main motivation to even consider a merger or acquisition is to fuel growth or fuel your exit. Understanding yours and your company’s goals and needs in relation to these motivations before approaching an M & A situation is your best strategy.

Most companies seek development – organically or by acquisition. When considering expansion, many keep their focus a little too broad by simply thinking that they want to increase profits. Strategically, it is important to dive down into the three main areas of growth and determine which one (or which combination) will drive opportunities for financial impact.

If you’re not planning on gifting or selling your company to family or other team members, a merger or acquisition may be the exit plan that provides you with the retirement you’re seeking. Having a plan in place for the change of ownership ensures that you secure a desirable deal to reach the financial goals you set for yourself and your family. Achieving financial objectives and a smooth transition of ownership occurs when the business owner plans in advance, takes the time to view the business from the perspective of a prospective buyer, and makes changes necessary to make the business more marketable and desirable to buyers. The value of your business will be determined based on anticipated future cash flow of the operations. Fully examining your operations and “getting your house in order” ahead of time is key to securing the valuation you may seek.

Another benefit when considering a merger or acquisition is that, even if the deal does not go through, you will have learned a lot. First, the next time you consider a merger or acquisition, you and your team have a much better understanding of the process and can manage it more quickly and cost-effectively. Secondly, the process teaches you a great deal about your business. Looking at your organization through the eyes of someone considering you for a merger or acquisition gives an entirely new perspective on your businesses. This perspective can help you to identify changes that will make your business even more appealing in the next opportunity, like securing non-compete agreements with key employees.

If you are considering a merger or acquisition, be sure to seek legal and financial advice before connecting with potential new business partners. Click here to review six mistakes companies make when considering a merger or acquisition. The biggest mistake companies make is to move far along in the process before seeking legal and financial advice.

If you have questions about mergers and acquisitions, please contact Cray Kaiser today.

On the surface, a franchise seems like a low-risk investment with promising rewards. You don’t need to start your own business from scratch and a lot of the hard work seems to come with preset directions. It can’t be that bad, right? The reality is, buying a franchise is not just an investment of hundreds of thousands dollars, but also a healthy investment of analysis and skepticism.

All business have varying degrees of success. But all successful businesses have a realistic, useful and dynamic business plan in place. It’s more than a pointless exercise. Your plan should help you make attainable financial goals and formulate time-tested strategies to reach those goals. Have you started drafting your business plan?