Member of Russell Bedford International, a global network of independent professional service firms.

As your business grows, you may find yourself hiring employees out of state. While the growth associated with having an employee in another state is great, keeping up with the payroll compliance in each state can feel like trudging through murky waters. States have varying requirements related to withholding income tax and paying unemployment tax. Additionally, states have increased their tax compliance efforts over the years making it even more necessary that employers be aware of their responsibilities. So, if you have an out-of-state employee, here’s what you need to consider:

Generally, you are required to withhold income tax and pay unemployment tax in the state in which the employee physically works. Makes sense, right? But it’s not always so straightforward. If your employee travels into several states, you need to be familiar with each state’s requirements. Some states require withholding from the first day an employee works in the state while other states have thresholds (minimum numbers of days or minimum amount earned) that determine when withholding is required.

If your employee works in one state but lives in a neighboring state, he or she may have to file tax returns in both states. However, if the two states have entered into a reciprocal agreement, the employee would only need to file in the resident state.

Some states have formed reciprocal agreements, which exempt employees from paying income tax on wages earned within the state if the employee lives in a bordering state. That means that wages are only taxed by the employee’s resident state. This simplifies compliance for the employee, who would otherwise be required to file income tax returns both in the resident state and the state in which the wages were earned.

When an employee has a reciprocal exemption, the employer withholds income tax in the employee’s resident state but generally pays unemployment tax to the state in which the wages were earned. For example, consider an employee working in Illinois but living in Michigan. The employer would report the wages as Michigan wages on the payroll withholding reports, but the wages would be reported as Illinois wages for Illinois unemployment tax reports.

Payroll taxes are an obvious consideration when you have employees working in other states. You will also need to consider other workforce requirements of each state, including:

Additionally, be sure your workers’ compensation policy includes all employees, even those working remotely. In the case of remote workers, be sure to inform your workers’ compensation company of the employees’ duties, work area and work hours.

Asking yourself these questions is the first step in being compliant with the states and also providing the best possible state withholding for your employees. Cray Kaiser is available to assist you when these issues come into play. Please contact us anytime at 630-953-4900.

Does your company know how it would handle a death, disability or departure of one of its owners? Whether you are part of a family business or not, buy-sell agreements are important to any company. But what makes it so important? A buy-sell agreement, also known as a business continuity contract, spells out how the assets and business interests would be distributed if an owner leaves the business, becomes disabled or passes away.

Without a plan in place, an otherwise thriving company can be thrust into turmoil. For example, the remaining owners may become entangled in legal disputes over business assets and management. If the company’s ownership seems doubtful or its future uncertain, its performance will suffer. And that performance doesn’t stop at the leadership team. Employees may feel less confident in and connected to the work they’re doing without the stability of a clear path forward and a unified leadership team.

The possible departure of an owner isn’t the only reason to prepare a buy-sell agreement. Sometimes an owner voluntarily decides to leave a company to pursue another business opportunity or a well-earned retirement. A carefully crafted buy-sell agreement will facilitate the transfer of ownership by assessing a firm’s value and ensuring that all parties are treated fairly.

A buy-sell agreement is instrumental to create at the outset of the company when all the other organizational documents are being crafted. It’s important not to think of a buy-sell agreement as something that you need down the road. Rather, it’s better to proactive in its creation since many of the scenarios a buy-sell agreement addresses are unpredictable. For businesses that have been in existence for a while and still don’t have one, it’s never too late to establish a buy-sell agreement.

Even if you already have a buy-sell agreement in place, you should review and revise it periodically to make sure it reflects your company’s current situation. Contact Cray Kaiser today if you’d like to learn more about preparing or reviewing your buy-sell agreement.

It’s a difficult thing to think about, but one day you could be taking care of an elderly parent who’s in declining physical or mental health. Whether or not you work with your parents in a family business, it’s important to recognize the financial stress and list of “to dos” that come with the emotions of this phase of life and to know how to talk about finances. By taking steps to ensure finances are in order now, you’ll be more prepared to handle those matters down the road. In turn, you’ll have the ability to focus on the health and quality of life of your parents as they age.

While your parents may be reluctant at first, it’s important to talk to them about their financial affairs. Knowing information such as where important documents are kept and the name of their accountant will better equip you to help them settle their affairs.

To open the conversation with your parents, here’s how to talk about finances with your aging parents:

Find out where your parents keep the following records:

Make a list of these items and review them with your parents:

Find out if your parents have these planning assets. If they don’t, talk to them about how you can support them in putting these plans in place:

Learn about your parents’ current financial situation, including:

At Cray Kaiser, we recommend keeping all of this vital information in a Crash Card. You can learn more about Crash Cards and download a template here.

Don’t worry about gathering every bit of information in one sitting. Rather, think of this list as a starting point for a series of conversations. Wherever possible, involve your parents in putting their own affairs in order. If you’d like additional guidance on how to talk about finances with your family, contact us today.

Employee benefit plan (EBP) audits are much more than a simple audit of net assets and income contained in the benefit plan’s financial statements. They also serve as a safeguard to participants, plan management, and plan fiduciaries through compliance testing procedures. In addition to testing the plan’s operational compliance in accordance with DOL/IRS regulations and the plan document, auditors will also note areas for improvement in internal controls and other matters through written communications with management.

It is very important to operate the benefit plan in accordance with the DOL/IRS and plan document for many reasons, such as:

Cray Kaiser has extensive experience with EBP audits. Often, when we work with a new client on an EBP audit, it’s their very first benefit plan audit. We also see many cases where the client’s plan was previously audited by a firm without the training and expertise needed in the complex area of EBP audits. During the most recent audit season, we performed an EBP audit for a plan whose previous auditor had stopped performing EBP audits altogether. We discovered numerous operational deficiencies, which if left uncorrected could have jeopardized the plan’s tax-exempt status and potentially exposed the plan sponsor and fiduciaries to fines and penalties. We worked with plan management to identify corrections and processes to prevent the issues from occurring again. Internal control weaknesses were also brought to management’s attention.

Often, plan auditors are selected solely based on fees. While fees are an important consideration, there are other crucial factors to consider when selecting a plan auditor. EBP auditing is a specialized area with complexities not found in traditional audit engagements of company financial statements. For this reason, it is essential to select a firm that:

At Cray Kaiser, we are committed to quality EBP audit engagements. Our highly experienced EBP audit team continually monitors developments and changes in the industry. Cray Kaiser is also a member of the American Institute of Certified Public Accountants’ Employee Benefit Plan Audit Quality Center, a select group that provides EBP audit resources and industry updates to member firms. Our experience and resources ensure that our EBP audit clients receive rigorous, precisely executed audits to support plan operations and help plan fiduciaries fulfill their responsibilities. If you would like more information on EBP audits, please contact us.

If you have the means, making extra payments on your mortgage before the end of its term seems like a no-brainer. After all, who wouldn’t want to reduce that substantial debt and be done with those monthly principal and interest payments? But paying off your mortgage early may not be the best choice for every household.

Before you start paying off your mortgage early, here are five questions to ask yourself.

Let’s say your credit card company is charging 15% on your outstanding balance. You can earn a guaranteed 15% by paying off that debt. It makes the most sense to pay off high-interest accounts before putting extra funds toward your low interest rate mortgage. This is especially important if you’re in a higher tax bracket, because home mortgage interest is tax deductible, whereas interest on consumer debt is not.

Life happens. If you haven’t set aside funds in an easy to access “rainy day” account, you could be forced to acquire additional debt if an emergency comes along. Your emergency account should cover at least a few months of living expenses. Before supplementing your mortgage payments, make sure that you’re financially protected in case of an emergency.

Many companies will match a percentage of funds that you contribute to a 401(k) retirement account. For example, your employer might match 50% of the money you contribute, up to a maximum of 6% of your salary. Don’t pass up the opportunity to save for retirement. It’s easy and it earns a better return than dollars paid toward your mortgage principal.

Investing in stocks for a speedy windfall is tempting. But the stock market is notoriously unpredictable. Paying off your mortgage is very low risk, but if you can handle the uncertainty of stock based mutual funds or similar accounts, you could benefit with a much higher rate of return.

Starting your retirement without mortgage debt may be one of your financial goals. But it’s important to base your decisions on facts, not wishful thinking. Before you retire from full-time employment and paychecks are replaced by social security payments, pensions, and/or retirement account withdrawals, do the math. Your life on a fixed income could look very different from now, so make sure you have enough saved to maintain a comfortable lifestyle.

There are many implications to paying off your mortgage early, and they all depend on your unique circumstances. Contact us today to discuss which path is right for you.

If you own a business that operates out of your home, you may be able to deduct a wide variety of expenses. These deductions could include part of your rent or mortgage costs, insurance, utilities, repairs, maintenance and even cleaning costs. This can be a tricky area of the tax code, so make sure you have professional guidance.

Here are some of the top mistakes people make when taking home office deductions:

The most common mistake for home office users is simply not taking the deduction! Taking the deduction seems too complicated for some, while others believe taking it increases your chances of being audited. The rules can be complex, but a home office structured correctly would allow for the home office deduction. There is even a simplified method that can be used to compute the deduction. Contact Cray Kaiser for any questions you may have.

The IRS mandates that the space you use must be exclusive and regular for your business. In a nutshell, here’s what that means:

Exclusively: If you use a spare bedroom as a business office, it can’t double as a guest room, a playroom for the kids or a place to store your hockey gear. Any kind of non-business use can invalidate the deduction.

Regularly: Your home office needs to be the primary place you conduct your regular business activities. That doesn’t mean that you must use it every day or that you can’t ever work outside the office. However, it should be the primary place for activities such as recordkeeping, billing, making appointments, ordering equipment or storing supplies.

If you work for someone else in addition to running your own business, you need to be extra careful. IRS rules state that you can use a home office deduction as an employee only if you work remotely for your employer.

Unfortunately, this means if you run a side business out of your home, you can’t bring work home from your employer’s office and do it in your home office. Doing so would invalidate your use of the home office deduction.

If you own your home and have been using your home office deduction, you could be in for a future tax surprise. If you sell your house, you will need to account for the depreciation of your home office. This rule, called the Depreciation Recapture Rule, often creates a tax liability for many unsuspecting home office users.

There are special rules that apply to your use of the home office deduction. If any of the below statements are true for you, contact us for support with navigating the deduction.

While there are benefits of utilizing the home office deduction, there are many details that are important not to overlook. If you have questions about your home office and the deductions available to you, please contact us today.

Struggling to find and retain tradespeople? Deciding when the timing is right to replace that 30-year-old machine? Noticing that your technology systems are slowing you down rather than making you more efficient? You’re not alone. Our 2017 manufacturing outlook addresses the biggest issues facing manufacturers this year and offers perspective from a firm that’s been working with numerous manufacturing companies for 45 years.

When Linda, CEO of Greenville Insurance, asked Gary, Vice President of Melville Manufacturing, for his experience with their accounting firm, she was surprised that his response was based on more than tax and accounting expertise. Gary shared how his accounting firm has also had a significant impact on Melville’s workplace culture. He went on to describe how they assisted with hiring their new bookkeeper, created a control system to correct exposure to fraud and developed a compensation system that was in line with industry best practices.

Gary’s shared experience exemplifies several ways that accountants help their clients evaluate and improve company culture. Accounting is more likely to conjure images of spreadsheets and tax forms than team meetings and high fives. But your accounting firm knows more about your workplace culture than you might imagine.

Today, many headlines for hiring and retention articles reference “workplace culture”. As competition across all industry sectors is on the rise, companies are realizing that workplace culture plays a significant, although often undetected, role in the success of their business. However, it’s often overlooked as day-to-day operating needs take precedence over building a strong workplace environment.

Yet, strengthening workplace culture is not as overwhelming as it may seem. It starts with the individuals you hire, the internal controls you have in place to allow them to work efficiently and the ways in which you compensate them. Just as Gary shared with Linda, be sure your company benefits from ways your accounting firm can add value to your company culture.

Hiring the best person for the job the first time has a major impact on company culture. When mistakes are made in hiring, company culture is negatively affected. The entire group suffers when a team member doesn’t do their job well or is terminated. For example, if a bookkeeper is hired who interviews well but is not truly skilled at their work, they may make mistakes that could create problems for other team members, taking up time in identifying and correcting errors, all causing frustration in the workplace environment.

Small business owners are charged with being the expert in their industry, running the operations and providing leadership. They are typically not the expert in the accounting arena. As with any industry, having an expert in the field on the hiring team helps to ensure a successful hire.

Your accountant can help you hire the right person first by assisting you with job descriptions, referrals and interviewing. Your accountant…

…knows the skills, talents and expertise needed for the job, and they know the right questions to ask to evaluate those skills and talents.

…can clearly and accurately communicate the job requirements and roles.

…can network on your behalf, refer people to you, and share best hiring practices.

Another way your accounting firm can help is by setting up proper control processes to prevent conflict with team members and upset the culture. These controls typically involve separation of duties and ensuring that more than one person is involved in accounting functions. Without control processes, fraud, theft and frequent errors can occur and affect not only your financial results but your culture. Control processes also divide labor, sharing the workload more evenly and leaving the team feeling like workload is fair.

Fair and reasonable compensation impacts company culture. Companies with teams who feel fairly compensated attract better talent, have higher retention rates and are more efficient. Your accountant can help by providing industry comparisons and evaluating budgets and projections.

Company culture is also affected by auxiliary compensation like incentive plans and benefit packages. Your accountant can share best practices and help you evaluate benefit package costs and value to your team. For example, while a tuition reimbursement benefit might be appreciated by a team of younger employees wanting to continue their education, it could be a wasted expense on a team of older employees who do not intend to further their education.

Take advantage of the objective, outside perspective your accounting firm has of your company. When he or she visits, ask about their observations.

After her conversation with Gary, Linda decided to ask her accounting firm to weigh in on a few workplace culture issues. She was pleased to discover that, like Melville Manufacturing, Greenville Insurance benefited from the recommendations they had on their company culture. Specifically, soon after meeting with the internal accounting team, their accountant pointed out that their bookkeeper had considerable skill and could easily be relied upon to manage some control processes.

Next time you meet with your accounting firm, be sure to consider how they can help you evaluate and improve your company culture. If you’d like to talk to Cray Kaiser about how we can assist you, please contact us today.

We all know we are supposed to have an annual check-up with our doctor to prevent health problems and catch issues early. Of course, whether we do it is another topic. An annual check-up can do the same thing for the financial health of your business and can be simple and straightforward when you know what to do. Evaluate these areas of your business to start your year off right.

A big-picture evaluation can start with a fresh strategic plan for the next several years.

Are your accounting records supplying the data necessary for making sound decisions?

When you own a business, your personal finances can be affected by your company’s activities.

Conduct an audit of your company website.

As you sit down with your New Year’s resolutions and schedule your annual physical with your doctor, remember to conduct an annual check-up for the financial health of your business as well. If you have any questions or would like some help, please contact Cray Kaiser.

John’s skills and talent have resulted in a great deal of success for the company. His sales job involves quite a bit of driving throughout the Midwest. You’ve decided you want to reward his efforts and success with a company car. Before you tell John, you have a decision to make. Will his car be leased? Or will the company buy it outright? What kind of impact does leasing versus owning have on the company’s tax situation? Several factors impact this decision, including how long the car will be kept and how consistently the car will be driven.

How long will the company keep the car?

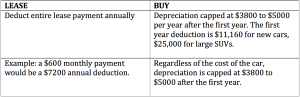

If the company plans for John to keep the car longer than a leasing period, it likely makes sense to buy the car outright. If the company plans to reward John with new cars fairly frequently, a lease may make more sense. Weigh the annual lease payments against the annual deductions.

Will the use of the car be consistent year-to-year?

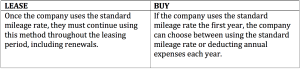

Regardless of whether you lease or buy John’s car, the company has a choice to make. They can either deduct all expenses, including gas, service, repairs, depreciation/lease expenses and insurance, or use the standard mileage rate (54¢ per mile in 2016). Tolls and parking can be expensed in addition to the standard mileage rate.

Only mileage associated with business use can be deducted, and a log must be kept to separate business mileage from personal use. In order for the expenses/mileage to be fully deductible to the company, the employee using the car must have the personal portion of the auto use recorded on their W2 as a fringe benefit. The pretax benefit to the employee far outweighs the small amount of additional income associated with the fringe benefit.

Different rules apply to switching between deduction methods for leasing versus buying.

If John’s use of the company car will vary from year to year, buying the car will offer more flexibility. In addition, inconsistent use can also create costly leasing expenses. Leases include an annual mileage allowance with per mile surcharges for overages.

Choosing the best option between leasing and buying John’s new car means considering tax implications and predicting the use of the car. Careful planning including consideration of when John’s car will be replaced and how consistent his travel will be will help you reach the best decision for your company.

If you are facing a similar decision and want to talk through the tax implications, we would be happy to help. Contact us today.