Member of Russell Bedford International, a global network of independent professional service firms.

Every business, no matter its size, needs to have enough cash to pay the bills. Focusing solely on sales and profits could create issues when invoices arrive and you find that there aren’t enough funds available to pay them. Below are five ways you can be proactive and improve cash management for your business:

1. Create a cash flow statement and analyze it monthly. The primary objective of a cash flow statement is to help you budget for future periods and identify potential financial problems before they get out of hand. This doesn’t have to be a complicated procedure. Simply prepare a schedule that shows the cash balance at the beginning of the month and add cash you receive (from things like cash sales, collections on receivables, and asset dispositions). Then, subtract cash you spend to calculate the ending cash balance. If your cash balance is decreasing month to month, you have negative cash flow and you may need to make adjustments to your operations. If it’s climbing, your cash flow is positive.

Note that once you have a cash flow statement that works for you, you can automate the report in your accounting software. Or, you can create a more traditional cash flow statement that begins with your net income, then make adjustments for non-cash items and changes in your balance sheet accounts.

2. Create a history of your cash flow. Build a cash flow history by using historical financial records over the course of the past few of years. This will help you discover if there is a particular time of year which needs more attention.

3. Forecast your cash flow needs. Use your historic cash flow and project the next 12 to 24 months. This process will help identify how much excess cash is required in the good months to cover payroll costs and other expenses during the low-cash months. To smooth out cash flow, you might consider establishing a line of credit that can be paid back as cash becomes available.

4. Implement ideas to improve cash flow. Now that you know your cash needs, consider ideas to help improve your cash position. For example:

5. Manage your growth. Be cautious when expanding into new markets, developing new product lines, hiring employees, or ramping up your marketing budget. All of these activities require cash and you don’t want to travel too far down that road before generating accurate cash forecasts.

Understanding cash flow needs is one of the key success factors in any business. If you are in need of tighter cash management practices, contact Cray Kaiser and we’d be happy to help you.

As a business owner, your day is primarily focused on fulfilling your overall mission, meeting customer needs and keeping up with day-to-day obligations. While less of your time is likely to be focused on the accounting policies that your company is using, we’re here to remind you just how important those policies are.

The accounting policies you adopt create the internal reporting standard that’s reflected in the financial statements of your business – all of which impact how you benchmark and communicate success. What story are you communicating to the outside world? How can you report the story in a way that is easy to understand but still communicates who you are, what you do and how you are achieving success?

First, when selecting accounting policies to use, your first goal should be reporting operational activity and not necessarily based upon ease of recordkeeping. For example, cash basis reporting is easy as we record transactions on the flow of cash in and out of the organization. But it doesn’t account for the significant operational activity that takes place between the use of cash funds and the collection of such funds. Operational activities, such as the conversion of raw materials to finished goods, are central to our operations but are omitted in this process. In this case, using an accrual basis reporting, which tends to be more complex, would tell your story with more clarity.

Another missed opportunity is not prioritizing book reporting objectives over tax objectives. Your operational story becomes diluted when you select accounting policies based solely upon your tax strategies. While minimizing tax obligations is important, reduced profitability is not a story you want the outside world to know. You want your story to be one of steady growth and investment. This occurs when you choose accounting policies based upon operational objectives rather than tax objectives.

As you review your internal financial statements, take a moment to reflect on the story they are telling the outside world about your business. Is it a story of steady growth and investment? Or is it sending a mixed message? We recommend revisiting your accounting policies to ensure that they convey your operational story in a positive, more accurate light. Should you need any assistance, please don’t hesitate to contact Cray Kaiser. You can also click here to learn about our Accounting Services.

As a business owner, your day is primarily focused on fulfilling your overall mission, meeting customer needs and keeping up with day-to-day obligations. While less of your time is likely to be focused on the accounting policies that your company is using, we’re here to remind you just how important those policies are.

The accounting policies you adopt create the internal reporting standard that’s reflected in the financial statements of your business – all of which impact how you benchmark and communicate success. What story are you communicating to the outside world? How can you report the story in a way that is easy to understand but still communicates who you are, what you do and how you are achieving success?

First, when selecting accounting policies to use, your first goal should be reporting operational activity and not necessarily based upon ease of recordkeeping. For example, cash basis reporting is easy as we record transactions on the flow of cash in and out of the organization. But it doesn’t account for the significant operational activity that takes place between the use of cash funds and the collection of such funds. Operational activities, such as the conversion of raw materials to finished goods, are central to our operations but are omitted in this process. In this case, using an accrual basis reporting, which tends to be more complex, would tell your story with more clarity.

Another missed opportunity is not prioritizing book reporting objectives over tax objectives. Your operational story becomes diluted when you select accounting policies based solely upon your tax strategies. While minimizing tax obligations is important, reduced profitability is not a story you want the outside world to know. You want your story to be one of steady growth and investment. This occurs when you choose accounting policies based upon operational objectives rather than tax objectives.

As you review your internal financial statements, take a moment to reflect on the story they are telling the outside world about your business. Is it a story of steady growth and investment? Or is it sending a mixed message? We recommend revisiting your accounting policies to ensure that they convey your operational story in a positive, more accurate light. Should you need any assistance, please don’t hesitate to contact Cray Kaiser. You can also click here to learn about our Accounting Services.

If you have children (or grandchildren) you have an opportunity to give them a jump-start on their journey to becoming financially responsible adults. While teaching your child about money and finances is easier when you start early, it’s never too late to impart your wisdom. Below are some age-relevant suggestions to help develop a financially savvy young adult:

Knowing about money – how to earn it, use it, invest it and share it – is a valuable life skill. Simply talking with your children about its importance is often not enough. Find simple, age-specific ways to build their financial IQ because a financially savvy child will hopefully lead to a financially wise adult. If you have any questions about raising a financially savvy child, please contact your trusted advisor at Cray Kaiser.

Small business owners are constantly looking for ways to save money and streamline processes in order to stay competitive. Using a cloud-based accounting software, such as QuickBooks Online, is one way to save time and money. Cloud-based platforms require little capital outlay for equipment while offering access to massive data storage and computing power. And because the software handles calculations, you can spend time growing your business instead of crunching numbers. Whether you are a small or mid-size business, moving to the cloud is one way to become more efficient and boost profitability. Here are the top five benefits of moving to the cloud:

Manual data entry is not only inefficient, but it is also prone to errors and compliance risks. With cloud-based accounting, automation of manual processes is possible and allows for automatic synchronization and reconciliation without the need for countless hours of work. Cloud accounting software will check for data entry errors, multiple entries, or other common accounting mistakes, which improves your data’s reliability.

Typical accounting software only allows access to a single user. With the cloud, multiple authorized users, including your accountant, can access the software simultaneously from anywhere with an internet connection. Business owners can now login in real time with their accountants and view the same screen to discuss specific transactions. This makes it easy for your team to collaborate and can help streamline internal controls and reduce error. In addition, teams can stay connected to their data and their accountants.

Maintaining a traditional accounting software can be costly. The cloud spares companies the expense and disruption of needing to update installed software company-wide and cuts the cost of maintaining secure servers in an inhouse data room. With the cloud, everything is done online, which means regular upgrades push automatically and inhouse storage isn’t needed. This helps streamline software maintenance and reduces administrative costs, as they are managed by the cloud service provider.

The cloud provides a secure way to store information. Unlike a hard drive, it can’t be lost, stolen or wiped out. Cloud technology provides backup functionality to prevent the possibility of data loss. You can also control the privacy access of your confidential data with login details. This provides the user with the flexibility to log in using any computer or mobile device, which is great for those on the move.

Most cloud accounting software can integrate with other cloud-based software which allows you to automatically transfer data into your accounting system – or vice versa. Third party applications provide users with options to customize their software and processes – doing away with the “one-size-fits-all” notion. These add-ons can help business owners with specific needs like payroll services, job management and a more robust inventory system to name a few

Businesses in any industry will find a myriad of benefits when moving their accounting processes to the cloud. Cloud-based software isn’t limited to any particular industry, but here are a few examples of how certain industries benefit from cloud-based software such as QuickBooks Online (QBO):

The world of accounting will continue to change and be impacted by advancements in technology. It is vital for businesses of any size to keep up with these changes in order to grow and stay healthy. If you are interested in learning more about moving to the cloud, contact Cray Kaiser today.

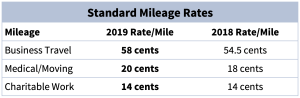

The updated mileage rates for travel for 2019 have been confirmed by the IRS. The standard business mileage rate is increasing by 3.5 cents to 58 cents per mile. The medical and moving mileage rates are also increasing by 2 cents to 20 cents per mile. Charitable mileage rates remain unchanged at 14 cents per mile. Please see the chart below for quick reference:

It is important to properly document your mileage in order to receive full credit for your miles driven. As always, should you have any questions or concerns please contact Cray Kaiser at 630-953-4900.

Financial literacy in today’s economic climate is more than just receiving reconciled accounts in periodic financial statements from your accounting firm. It is the ability to know where you are today, where you are going, and the plan to achieve it. To achieve your goals, you need to invest in a system, process and an advisor who can relay knowledge to you in a way that is easy to understand. This will allow you to change direction, set measurable goals and celebrate your successes.

Business owners often get caught in the weeds and believe the way to solve a problem is by digging deeper into the soil. Have you ever paused to look at the key financial drivers that are causing the problem? Understanding the underlying problem and the impact it is having on your business is key. A skilled accounting firm has the ability to educate you on the meaning behind the numbers reported in your financial statements.

Accounting is based on a double entry system, meaning we must have a debit and credit that are in balance. You can also think of accounting as the study of financial relationships, meaning as we debit one account, we have a corresponding credit in another. To provide meaning we need to understand the relationships. Your financial statements are simply the summation of your transactions for a given period. By taking these financial statements and using ratios or non-financial data, you can begin to unravel the context behind these relationships – allowing you the opportunity to transform your business.

In the restaurant industry the key components of cost of goods sold includes food, beverage, paper goods and labor costs. The summation of these costs is also referred to as the prime costs. Often, your financial statements may report these costs on one line called cost of goods sold. By performing a simple ratio such as cost of goods sold divided by sales, we can determine how efficiently we are utilizing our resources to generate sales. By benchmarking this ratio month after month, we can begin to identify changes in the ratio that may need to be investigated. The benchmarking can be against your own data but should also be compared against industry data to better evaluate how you are performing.

To bring even more meaning to the relationships within cost of goods sold, you will need to investigate costs in more detail. One way to do this is to extract data on your costs individually such as having a food cost percentage to sales along with separate calculations on beverage, paper goods and labor. As these ratios fluctuate over time, you can determine the reason why and how it may affect your future selling prices. The outcome of this analysis may lead you to raise prices, change a supplier or review labor schedules.

You can also track non-financial data such as number of patrons served, number of hours open, and facility square footage. When comparing the non-financial data to sales we can get average sales per patron, per hour and per square foot. These averages can be compared over a period of time to gain an understanding of changes in your business or peak times for your business. This information in turn can be used to schedule your workers, order inventory or even adjust your restaurant hours.

Your accountant can provide significant value by educating you on ratio and non-financial data to help you analyze your financial statements and guide you in discussing the efficiency of your business, forecasting operating results and providing the strategic direction for your business. We often refer to these tools as key performance indicators (KPIs). By tracking KPIs on a regular basis and keeping ongoing communication with your accountant, you can begin to understand the relationships in your financial statements. This understanding will provide you the ability to make decisions in your business that will allow you to track the realization of your strategic goals.

If you are not already having these discussions with your accountant, now is the time to tap into the value they can provide. As you begin the new year, we recommend identifying KPIs to track. Please contact Cray Kaiser today if you would like to discuss your financial reports.

The Tax Cuts and Jobs Act of 2017 – with its many changes impacting the 2018 tax year and beyond – brought the Qualified Business Income deduction (sometimes called the QBI deduction or 199A deduction). This new deduction can be up to 20% of the net income of a qualified business, meaning only 80% of your QBI is taxed on the federal level. But, if you are a real estate investor you are probably wondering if this deduction will apply to you. The answer is, of course, not so simple.

Defining a Qualified Trade or Business

The biggest limitation of the QBI deduction is that it only applies to a “qualified trade or business”. There is not a lot of clarity within IRS regulations in determining what exactly is a trade or business in the real estate arena and there are many unique situations concerning real estate.

The IRS cites “key factual elements” that are relevant to whether an activity is a trade or business: (a) the type of property (commercial versus residential versus personal); (b) number of properties rented; (c) day to day involvement of the owner or agent; and (d) type of lease (triple-net versus traditional). Therefore, due to the large number of actual combinations that exist in determining whether a rental activity rises to the level of a trade or business, the IRS says bright-line definitions are impractical.

Below are a few example situations that demonstrate when real estate investments would likely or likely not pass as a qualified trade or business.

We can help you determine if your rental activity facts and circumstances can give rise to a trade or business and thus allow you to be eligible for QBI. If you are not eligible, we can develop some operational strategies which can allow you to qualify for the deduction. Please contact us today at 630-953-4900.

Fraud. The dreaded word that none of us are comfortable addressing or discussing, especially when it comes to how it may impact you or your business. But it’s important not to avoid conversations about fraud. Why? Because several studies and statistics support that businesses may lose approximately 5% of their revenues every year due to fraud. And when fraud is concealed, it may continue for years before being discovered. Further, fraud remains a strong indicator as to the failure of a business. Although attempts are made to recover, many businesses cannot overcome the negative impacts both financially and reputationally and are ultimately forced to close their doors within a few years.

So, what can you do to prevent fraud?

First, it’s important to remember that no controls or systems are perfect. Due to limited resources and personnel, opportunity for fraud will always exist. Thus, as technology and the ways of doing business continue to evolve, so too must your control processes and procedures. Periodic and systematic evaluations and assessments of your controls should be designed to mitigate or detect misstatements or misappropriations in a timely manner. So, while a control may not prevent fraud, it will at least detect it quickly so that you can take appropriate action.

Here are a few suggestions we recommend when it comes to preventing fraud:

If you have any questions or would like to know how Cray Kaiser can help you develop and implement internal controls, please contact us today.

Your business partner(s) should balance your strengths and support you through the good times and the bad. They should also be willing to communicate with you freely and often. And while you and your partner may agree about everything now, disagreements and unexpected events are inevitable. That’s why a written partnership agreement is so valuable. Do you and your partner(s) have one?

The need for a partnership agreement can be summed up in two words: things change. It’s important to sit down now and hammer out potential scenarios and solutions in a written agreement. You never know what the future may hold for you, your partner(s) or your business. Your agreement will make sure that you have a plan ready no matter what may come your way.

A partnership agreement should anticipate major business changes and spell out how to deal with them. The agreement should also indicate what initial capital contributions (or services) will be made when additional capital contributions will be required, and how profits and losses will be shared.

Questions to discuss include:

A partnership agreement can’t address every possible contingency, so consider an arbitration clause to handle disputes that you and your partner aren’t able to resolve on your own. Without such a clause, your only alternative could be costly litigation.

With a carefully designed partnership agreement, your business will run more smoothly and provide you and your partner(s) with peace of mind. Your attorney can assist you with the legal aspects of the agreement and you can contact Cray Kaiser with questions regarding your finance and tax-related aspects.