Member of Russell Bedford International, a global network of independent professional service firms.

In Cray Kaiser’s first audio blog, CK Principal Deanna Salo shares the journey of a closely-held business as they craft their buy-sell agreement. When the owners of the company were looking to exit, they decided it was time to dust off their original buy-sell agreement from the 1980s. What followed was a two-year process of education, emotion, and collaboration, ending with the signing of their brand-new buy-sell agreement.

As Deanna tells the story of this business’ journey, she gives insights into why buy-sell agreements are so important, what timing might look like in the process, aha moments that business owners often experience, and common questions she’s asked about buy-sell agreements.

Click below to listen:

If you have questions about your company’s buy-sell agreement or would like assistance putting one together, please don’t hesitate to contact Cray Kaiser today.

It’s hard to believe that summer is in full swing and in just another few weeks we’ll be at the halfway point of 2019! The first quarter of the year focused on getting the financial reporting and tax returns filed for the previous year and the second quarter was spent getting the current year up-to-date. Before we knew it, we were transacting business as usual. Somehow those goals of cleaning up accounting records became long forgotten. But we’re here to remind you not to forget the importance of accounting clean up projects!

It’s vital to get your accounting cleaned up before the year-end activities kick in and this is the perfect time of year to do it. Below are a few accounting projects you may want to consider taking on over the next few months. In the end it will set you up for success come December.

When was the last time you reviewed your record retention policies? If you are like many organizations, you retain hard copies until space runs out, then you look to discard old items. However, this may subject you to added scrutiny when you are unable to produce key documents for your business. The IRS and AICPA have guidelines to help you in formulating your record retention policy. We recommend that you formalize your current policy utilizing both physical and electronic storage. Remember, the goal of record retention is to be able to retrieve key documents in a reasonable period of time and this should be considered as you formalize your policy.

Your accounting records should be locked down for the previous year so no additional changes can be made to the year-end balances. If not done already, you should request a copy of year-end adjusting journal entries and a trial balance report from your accountant. These adjustments need to be recorded in your accounting system and a process needs to be performed in which you are able to lock the period so that additional changes cannot be made. Depending on the accounting system you are using this may be as simple as setting a password for the file. Doing this will provide assurance that you are starting 2019 with accurate balances.

Each year certain adjusting journal entries are recorded such as depreciation/amortization, prepaid expenses, and certain accrual items. Many of these adjustments can be maintained throughout the year to normalize your operating results and to help you to forecast year-end results. Reviewing the year-end adjustments prepared by your staff or an outside accountant is one way of identifying potential standard journal entries to record throughout the year.

It’s always a good idea to take some time to review the chart of accounts you are using to summarize your financial reporting. Are there significant accounts that you have to dig into the details to understand the fluctuations from one period to another? If so, it may be time to create accounts or sub-accounts to appropriately track certain transactions so that you can easily monitor fluctuations.

Do you have accounts set up to handle the record keeping for the various stages of your operating processes? For instance, are you tracking raw materials, work in progress and finished goods? If not, you may want to consider adding accounts and journalizing the flow of the inventory process.

Now is a good time to take an inventory of your outstanding agreements and contracts to identify any key performance requirements that you must meet to stay in compliance with the established terms. Often times, bank financing has compliance requirements such as ratios and bank balance levels that must be met on a monthly, quarterly or annual basis. Do you have processes in place to monitor the compliance of these key performance requirements? Routinely performing a review of these requirements will allow you time to make any necessary corrective actions in the event the requirements will not be met.

By being proactive and keeping your accounting organized now, you’ll be in the best position possible when it comes to closing out the year and preparing for taxes next spring. If you have questions or would like assistance with any of these accounting clean up projects, please don’t hesitate to contact Cray Kaiser today!

Click here to learn about Cray Kaiser’s Accounting Services.

Major life changes are an exciting and emotional time. But with the positive changes, there can sometimes be challenges too. If you’re facing a change in your life in the near future, have you thought about what the tax implications might be? Below are four examples of life changes that can have complicated effects on taxes that come with them:

Whether it’s a new, exciting opportunity or the result of being laid off, a job change is going to affect your tax obligation. The termination of your previous job likely adds additional taxable income in the form of accrued vacation or a severance package. Review how your former employer handles tax withholdings, especially for big payouts. Your new job also brings new tax implications with a new salary, new benefits and possibly different taxing jurisdictions if you also move to a new location.

The extra money you earn when adding a second job or business also brings extra taxes. How much additional tax this second income creates depends on your specific situation. Employment status, type of business, and how it relates to your other tax activities need to be considered. The extra income alone can send you into a higher tax bracket.

Your retirement plans and timing of retirement plan distributions play a big role in how much tax you will pay on your retirement earnings. For example, with traditional IRAs, there are early withdrawal penalties before you reach age 59½ and required minimum distributions after reaching age 70½ years old. For Social Security, collecting benefits early means less in monthly benefits and potentially a higher tax obligation if you have additional earnings. Each source of retirement income has its own set of taxation rules which can create a very complicated tax environment.

When selling a house or other residential property, the first thing to determine is whether it’s your primary residence. If so, the IRS provides an exemption from tax for up to $250,000 ($500,000 for joint couples) of the gain realized from the sale of your home as long as you lived in it for at least two of the previous five years. Any gain above the exemption is subject to capital gains tax. If the property you are selling is not your primary residence, capital gains tax applies, and you also have to deal with other more complicated tax code issues.

We hope this helps you become more aware of how your tax situation might change in the future based on any decisions you make in your personal or professional life. Always remember to carefully weigh your options and speak with your accountant if you’re unsure about how a future decision will impact your taxes. Contact Cray Kaiser if you have any questions.

The benefits package that your company offers is extremely important to your employees. How important? A survey performed by the Society of Human Resource Management (SHRM) found that benefits are directly tied to overall job satisfaction for 92% of employees. More importantly, 29% of employees cited the overall benefits package at their current employer as the top reason to look for new employment in the next 12 months.

So, what can you do to keep your employees satisfied when it comes to their benefits package? Here are a few tax-free ways that you can help bolster your benefits package and retain your staff:

According to SHRM, health insurance still remains one of the most important employee benefits. Health insurance benefits come in all shapes and sizes, so you will need to constantly evaluate plans and costs. From a tax standpoint, employers can deduct this expense, and your employees do not report health insurance premiums or employer contributions to health savings accounts (HSAs) as additional income. This includes premiums paid for the employee and qualified family members. Even better, the employee portion of premiums can still be paid in pre-tax dollars.

Employers are able to provide employees with up to $5,000 per year in tax-free dependent care assistance under a qualified plan. There are a few ways to provide this benefit, but a common method is to set up a flexible spending account (FSA) that both the employer and employee can use to make contributions. The employer portion is tax-free, and the employee portion reduces taxable income as long as the total benefit is $5,000 or less.

By offering tuition reimbursement, you can add another quality benefit to your package while investing in your employee’s career. Up to $5,250 of tuition expenses can be reimbursed tax-free to your employee each year.

This is a good benefit for outside sales or other employees that travel frequently. If you have a corporate credit card program, consider passing the points on to the employee. If you reimburse employee expenses under an accountable plan, estimate the value of points your employee earns on reimbursed business purchases and include it in your annual benefits presentation. Generally, the IRS considers credit card points as rebates and not taxable income.

You can generally exclude the cost of up to $50,000 of group term life insurance from your employee’s wages.

Some examples of other nontaxable fringe benefits are employee wellness programs, onsite fitness gyms, adoption assistance, retirement planning services and employee discounts.

The IRS calls these “de minimis” benefits. Small-valued benefits are not included in income and can include things like the use of the company copy machine, occasional meals, small gifts and tickets to a sporting event.

With historically low unemployment levels, employees have more options than normal to look around if they aren’t satisfied in their current position. The benefits package you offer is an important tool to help you retain your valued employees. While each is an additional expense to the employer, the perceived benefit by employees may far outweigh these costs. If you have any questions, please contact Cray Kaiser today.

Every business, no matter its size, needs to have enough cash to pay the bills. Focusing solely on sales and profits could create issues when invoices arrive and you find that there aren’t enough funds available to pay them. Below are five ways you can be proactive and improve cash management for your business:

1. Create a cash flow statement and analyze it monthly. The primary objective of a cash flow statement is to help you budget for future periods and identify potential financial problems before they get out of hand. This doesn’t have to be a complicated procedure. Simply prepare a schedule that shows the cash balance at the beginning of the month and add cash you receive (from things like cash sales, collections on receivables, and asset dispositions). Then, subtract cash you spend to calculate the ending cash balance. If your cash balance is decreasing month to month, you have negative cash flow and you may need to make adjustments to your operations. If it’s climbing, your cash flow is positive.

Note that once you have a cash flow statement that works for you, you can automate the report in your accounting software. Or, you can create a more traditional cash flow statement that begins with your net income, then make adjustments for non-cash items and changes in your balance sheet accounts.

2. Create a history of your cash flow. Build a cash flow history by using historical financial records over the course of the past few of years. This will help you discover if there is a particular time of year which needs more attention.

3. Forecast your cash flow needs. Use your historic cash flow and project the next 12 to 24 months. This process will help identify how much excess cash is required in the good months to cover payroll costs and other expenses during the low-cash months. To smooth out cash flow, you might consider establishing a line of credit that can be paid back as cash becomes available.

4. Implement ideas to improve cash flow. Now that you know your cash needs, consider ideas to help improve your cash position. For example:

5. Manage your growth. Be cautious when expanding into new markets, developing new product lines, hiring employees, or ramping up your marketing budget. All of these activities require cash and you don’t want to travel too far down that road before generating accurate cash forecasts.

Understanding cash flow needs is one of the key success factors in any business. If you are in need of tighter cash management practices, contact Cray Kaiser and we’d be happy to help you.

As a business owner, your day is primarily focused on fulfilling your overall mission, meeting customer needs and keeping up with day-to-day obligations. While less of your time is likely to be focused on the accounting policies that your company is using, we’re here to remind you just how important those policies are.

The accounting policies you adopt create the internal reporting standard that’s reflected in the financial statements of your business – all of which impact how you benchmark and communicate success. What story are you communicating to the outside world? How can you report the story in a way that is easy to understand but still communicates who you are, what you do and how you are achieving success?

First, when selecting accounting policies to use, your first goal should be reporting operational activity and not necessarily based upon ease of recordkeeping. For example, cash basis reporting is easy as we record transactions on the flow of cash in and out of the organization. But it doesn’t account for the significant operational activity that takes place between the use of cash funds and the collection of such funds. Operational activities, such as the conversion of raw materials to finished goods, are central to our operations but are omitted in this process. In this case, using an accrual basis reporting, which tends to be more complex, would tell your story with more clarity.

Another missed opportunity is not prioritizing book reporting objectives over tax objectives. Your operational story becomes diluted when you select accounting policies based solely upon your tax strategies. While minimizing tax obligations is important, reduced profitability is not a story you want the outside world to know. You want your story to be one of steady growth and investment. This occurs when you choose accounting policies based upon operational objectives rather than tax objectives.

As you review your internal financial statements, take a moment to reflect on the story they are telling the outside world about your business. Is it a story of steady growth and investment? Or is it sending a mixed message? We recommend revisiting your accounting policies to ensure that they convey your operational story in a positive, more accurate light. Should you need any assistance, please don’t hesitate to contact Cray Kaiser. You can also click here to learn about our Accounting Services.

As a business owner, your day is primarily focused on fulfilling your overall mission, meeting customer needs and keeping up with day-to-day obligations. While less of your time is likely to be focused on the accounting policies that your company is using, we’re here to remind you just how important those policies are.

The accounting policies you adopt create the internal reporting standard that’s reflected in the financial statements of your business – all of which impact how you benchmark and communicate success. What story are you communicating to the outside world? How can you report the story in a way that is easy to understand but still communicates who you are, what you do and how you are achieving success?

First, when selecting accounting policies to use, your first goal should be reporting operational activity and not necessarily based upon ease of recordkeeping. For example, cash basis reporting is easy as we record transactions on the flow of cash in and out of the organization. But it doesn’t account for the significant operational activity that takes place between the use of cash funds and the collection of such funds. Operational activities, such as the conversion of raw materials to finished goods, are central to our operations but are omitted in this process. In this case, using an accrual basis reporting, which tends to be more complex, would tell your story with more clarity.

Another missed opportunity is not prioritizing book reporting objectives over tax objectives. Your operational story becomes diluted when you select accounting policies based solely upon your tax strategies. While minimizing tax obligations is important, reduced profitability is not a story you want the outside world to know. You want your story to be one of steady growth and investment. This occurs when you choose accounting policies based upon operational objectives rather than tax objectives.

As you review your internal financial statements, take a moment to reflect on the story they are telling the outside world about your business. Is it a story of steady growth and investment? Or is it sending a mixed message? We recommend revisiting your accounting policies to ensure that they convey your operational story in a positive, more accurate light. Should you need any assistance, please don’t hesitate to contact Cray Kaiser. You can also click here to learn about our Accounting Services.

If you have children (or grandchildren) you have an opportunity to give them a jump-start on their journey to becoming financially responsible adults. While teaching your child about money and finances is easier when you start early, it’s never too late to impart your wisdom. Below are some age-relevant suggestions to help develop a financially savvy young adult:

Knowing about money – how to earn it, use it, invest it and share it – is a valuable life skill. Simply talking with your children about its importance is often not enough. Find simple, age-specific ways to build their financial IQ because a financially savvy child will hopefully lead to a financially wise adult. If you have any questions about raising a financially savvy child, please contact your trusted advisor at Cray Kaiser.

Small business owners are constantly looking for ways to save money and streamline processes in order to stay competitive. Using a cloud-based accounting software, such as QuickBooks Online, is one way to save time and money. Cloud-based platforms require little capital outlay for equipment while offering access to massive data storage and computing power. And because the software handles calculations, you can spend time growing your business instead of crunching numbers. Whether you are a small or mid-size business, moving to the cloud is one way to become more efficient and boost profitability. Here are the top five benefits of moving to the cloud:

Manual data entry is not only inefficient, but it is also prone to errors and compliance risks. With cloud-based accounting, automation of manual processes is possible and allows for automatic synchronization and reconciliation without the need for countless hours of work. Cloud accounting software will check for data entry errors, multiple entries, or other common accounting mistakes, which improves your data’s reliability.

Typical accounting software only allows access to a single user. With the cloud, multiple authorized users, including your accountant, can access the software simultaneously from anywhere with an internet connection. Business owners can now login in real time with their accountants and view the same screen to discuss specific transactions. This makes it easy for your team to collaborate and can help streamline internal controls and reduce error. In addition, teams can stay connected to their data and their accountants.

Maintaining a traditional accounting software can be costly. The cloud spares companies the expense and disruption of needing to update installed software company-wide and cuts the cost of maintaining secure servers in an inhouse data room. With the cloud, everything is done online, which means regular upgrades push automatically and inhouse storage isn’t needed. This helps streamline software maintenance and reduces administrative costs, as they are managed by the cloud service provider.

The cloud provides a secure way to store information. Unlike a hard drive, it can’t be lost, stolen or wiped out. Cloud technology provides backup functionality to prevent the possibility of data loss. You can also control the privacy access of your confidential data with login details. This provides the user with the flexibility to log in using any computer or mobile device, which is great for those on the move.

Most cloud accounting software can integrate with other cloud-based software which allows you to automatically transfer data into your accounting system – or vice versa. Third party applications provide users with options to customize their software and processes – doing away with the “one-size-fits-all” notion. These add-ons can help business owners with specific needs like payroll services, job management and a more robust inventory system to name a few

Businesses in any industry will find a myriad of benefits when moving their accounting processes to the cloud. Cloud-based software isn’t limited to any particular industry, but here are a few examples of how certain industries benefit from cloud-based software such as QuickBooks Online (QBO):

The world of accounting will continue to change and be impacted by advancements in technology. It is vital for businesses of any size to keep up with these changes in order to grow and stay healthy. If you are interested in learning more about moving to the cloud, contact Cray Kaiser today.

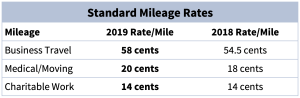

The updated mileage rates for travel for 2019 have been confirmed by the IRS. The standard business mileage rate is increasing by 3.5 cents to 58 cents per mile. The medical and moving mileage rates are also increasing by 2 cents to 20 cents per mile. Charitable mileage rates remain unchanged at 14 cents per mile. Please see the chart below for quick reference:

It is important to properly document your mileage in order to receive full credit for your miles driven. As always, should you have any questions or concerns please contact Cray Kaiser at 630-953-4900.