Member of Russell Bedford International, a global network of independent professional service firms.

At Cray Kaiser, trust is more than a core value—it’s the foundation of every client relationship. We believe trust is earned through consistent dedication, transparency, and a deep understanding of our clients’ needs. This commitment to building trust is reflected in our work, and as our 2024 NPS score reveals, it continues to resonate with those we serve. Our clients’ trust in us is an honor and a driving force behind the high levels of satisfaction and loyalty we’re proud to see year after year.

NPS Demystified

For anyone unfamiliar with it, Net Promoter Score, or NPS, is a standardized metric used across industries to gauge customer loyalty and satisfaction. How does it work? Customers are asked one straightforward question: “On a scale from 1 to 10, how likely are you to recommend our business to a friend or colleague?”

From the responses, customers fall into one of three groups:

The formula to derive the NPS is as straightforward as the question itself—subtract the percentage of detractors from the percentage of promoters.

To give some context: A score above zero is already good, surpassing 50 is deemed excellent, and anything beyond 80 is simply incredible.

Cray Kaiser: Continuing to Set New Industry Standards in 2024

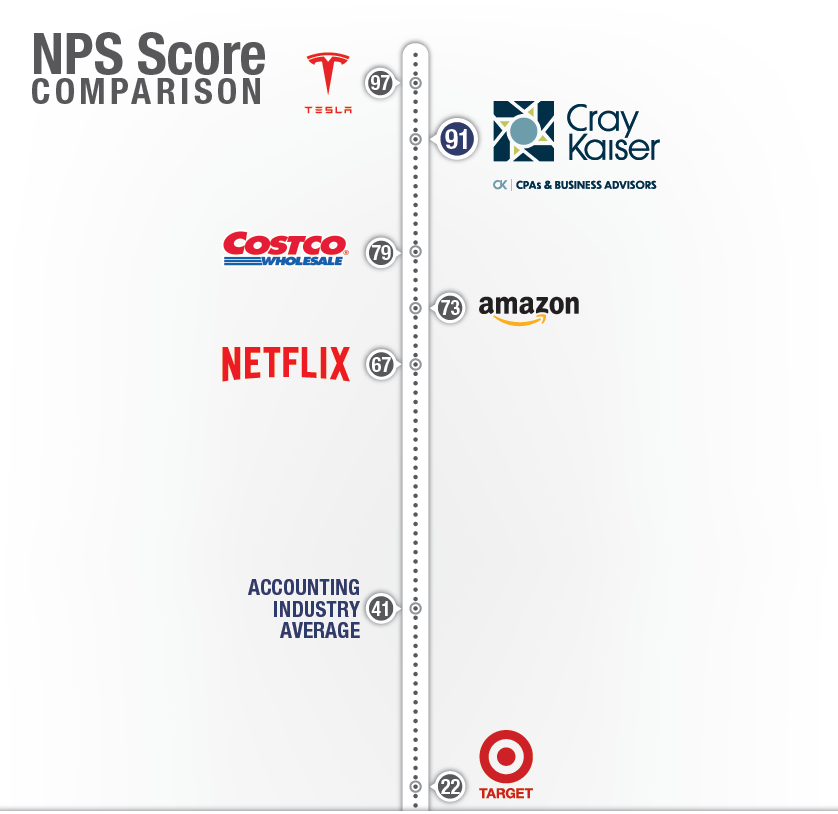

Just as your numbers tell the story of your business, ours tell the story of our commitment to excellence. This year, we’re proud to have achieved an NPS score of 91, far surpassing the accounting industry’s average of 41. But our success doesn’t stop there—our score also outpaces market leaders like Costco, Amazon, and Netflix.

For us, it’s more than just a number—it’s a powerful affirmation that our clients trust and genuinely value the service we provide.

Your Trusted Advisors

At Cray Kaiser, our success hinges on your success. In 2024 and beyond, our commitment remains steadfast: prioritizing your needs, delivering impeccable accuracy in our numbers, and providing unmatched people skills. We’re here to support your growth, navigate challenges, and celebrate every milestone with you. We look forward to another year of achieving success together!

We are pleased to announce Deanna Salo, Managing Principal at Cray Kaiser has been named a 2024 Chicago Titan 100. The Titan 100 program recognizes Chicago’s Top 100 CEO’s & C-level executives. They are the area’s most accomplished business leaders in their industry using criteria that includes demonstrating exceptional leadership, vision, and passion. Collectively, the 2024 Chicago Titan 100 and their companies employ upwards of 325,000 individuals and generate over 42 Billion dollars in annual revenues.

“The Titan 100 are visionary leaders that inspire the Chicago business community. These preeminent leaders have built a distinguished reputation that is unrivaled and preeminent in their field. We are humbled to recognize the Titan 100 for their efforts to shape the future of the Chicago business community” says Jaime Zawmon, President of Titan CEO.

Deanna has been a CK Principal since 2001 and a Managing Principal since 2021. She executes assurance, strategic and tax planning services across the client portfolio. For closely-held and family-owned businesses, she focuses on the value she can bring to the family and owners. For nonprofit clients, she instills best practices in budgeting, governance issues and audit compliance procedures. Using her technical and creative talents, Deanna also performs M&A engagements for the buyer and seller sides.

When asked her thoughts about becoming a 2024 Chicago Titan 100, Deanna responded, “Success is not just about achieving personal goals; the Cray Kaiser way is to inspire and uplift others along the way. As a Chicago Titan 100 recipient, I believe in the power of collaboration, innovation, and a relentless pursuit of excellence. Together, we can shape the future and leave a lasting impact on our community and beyond.”

DuPage County received approximately $15,000,000 in federal funds made available through the 2021 American Rescue Plan Act (ARPA). Those funds have been approved for use in the Reinvest DuPage Grant Program beginning Monday, June 28, 2021. The grant program will be administered by the nonprofit economic development group, Choose DuPage.

The grant program is available to small businesses, non-profit organizations, and certain independent contractors. The grant awards can be up to $50,000 for small businesses and non-profits, and $15,000 for certain independent contractors. The disbursement of the grant funds will be based upon eligible expenses such as operating costs consisting of payroll, rents, and utilities as well as a determination of revenue decline due to COVID-19. Key eligibility components are as follows:

In applying for the grant funds certain documentation will need to be provided such as:

You will need to complete an application online at www.choosedupage.com. The application will request a description of how your business was impacted by COVID-19 as well as information such as number of employees, NAICS/industry codes, and other business demographics. During the online application process, you will be required to disclose other COVID-19 funding received. As your application moves throughout the process, the documentation noted in the previous section will be requested.

It is recommended that any questions you have for the agency during the application process be directed to reliefgrant@choosedupage.com. Phone inquiries may not be responded to.

The grant program will accept completed applications on a first-come, first-served basis as long as funding is available. Once it is determined that there are more applications than funding, the agency will stop accepting new applications.

Cray Kaiser is available to guide you through the grant application process. Please reach out to us for additional assistance.

Cray Kaiser has decades of experience in audits, including specialized audits for nonprofits and employee benefit plans. And today, we’re excited to announce the addition of another specialization: transnational audits.

Working with Russell Bedford, our firm underwent a strict AQC process to ensure the quality of our audit practice. From this certification process, it was determined that CK:

We are incredibly proud of our audit team for completing this rigorous certification process over the course of the last few months. As a result of the Approved Transnational Audit Firm certification, we are now able to perform audits for organizations across the globe through Russell Bedford. We look forward to offering our services and extending the CK family internationally.

To learn more about Cray Kaiser’s audit services, please click here. If you’d like assistance with an audit you can contact us at 630-953-4900.

At Cray Kaiser, we believe the relationships we build with our clients make us more than just an accounting firm. Client satisfaction is our number one goal, which is why we solicit feedback each year via an online survey. Through the use of the Net Promoter Score (NPS) method, we are able to determine if “the CK way” is providing our clients with long-term value while developing their loyalty.

We are proud of our most recent NPS score of 94 which indicates our clients are highly satisfied with our services and are likely to recommend Cray Kaiser to their friends and colleagues. We continue to be appreciative of our clients that remain committed to the CK team.

Here’s what our clients are saying:

We are thankful to all our clients who participated in the 2020 survey. We promise to do our best to continue to meet and exceed your needs. If you have any questions, please contact us today.

We are proud to announce our membership with Russell Bedford International (RBI), a global network of independent firms of accountants, auditors, tax advisers and business consultants. Ranked amongst the world’s leading accounting and audit networks, RBI is represented by over 1,000 partners, 9,000 staff members and 350 offices in almost 110 countries worldwide. RBI is a member of the IFAC Forum of Firms and a member of the European Group of International Accounting Networks and Associations.

Cray Kaiser is excited to join this expanding network and will leverage the new opportunities that our membership will yield to support our business goals. “As a highly ambitious firm, our association with a leading global brand is exactly the type of support we were looking for.” said James K. Scherzinger, partner at Cray, Kaiser Ltd. “For our team, maintaining our high-touch, personal approach while offering our clients access to comprehensive global services is a key benefit of our membership. We are already seeing results by building relationships with other members around the globe.”

RBI is also happy to have Cray Kaiser join their esteemed network. “I am delighted to welcome Cray, Kaiser as our latest member in North America, a move which comes following significant network development efforts in the region,” said Stephen Hamlet CEO at RBI. “Having met two of Cray, Kaiser’s partners at recent Russell Bedford events, I was struck by the enthusiasm of the partners and their eagerness for firm development, which we intend to support them with through their network membership. Cray, Kaiser is the perfect fit for our ambitious international network, I look forward to seeing the firm flourish among our other high-achieving members and to continuing to develop the network in North America as we seek to recruit new members in more states, strengthening our position in the region.”

To learn more about Russell Bedford International, please click here.

On June 21, 2018 the U.S. Supreme Court held that states can assert nexus for sales and use tax purposes without requiring a seller’s physical presence in the state. While you may have heard about the Wayfair case in the news, have you thought about what this may mean for your business?

Prior to the Wayfair case, mail, phone, or internet retailers of tangible goods used the Quill case for protection from the burden of collecting sales tax. According to Quill, the protection from sales tax burdens was possible because these retailers did not have a physical presence in the form of an office, storefront, warehouse, or merely having an employee solicit the sale of goods in that state. Therefore, without stepping foot in a given state, sales in that state could be made without charging sales tax. That meant it was up to the purchaser to pay use tax on the sale.

With the Wayfair case, everything changes. Here’s what happened:

Justice Anthony Kennedy, who wrote the decision, reasoned that modern e-commerce no longer aligns with the Quill case. Essentially, the Quill case is outdated with the large amount of commerce that is conducted via the internet. The Wayfair decision essentially overturns the Quill case and physical presence is no longer a requirement for states to assert sales tax collection requirements.

The Wayfair case will now allow all states to set their own laws in connection with interstate online sales. In fact, 31 states already have some form of laws in place. Effective October 1, 2018, retailers making sales of tangible personal property to Illinois purchasers will have to collect sales tax once Illinois sales reach $100,000 in outside sales or 200 transactions.

It is thought that the $100,000 in sales or over 200 transactions as determined in South Dakota may be the standard to determine economic sales tax nexus in other states. As noted above, this is the new standard for Illinois. If you are a retailer exceeding these numbers in states in which you don’t have physical presence, you may now have a sales tax collection and filing requirement moving forward. Congress may decide to move ahead with legislation on this issue to provide a national standard for online sales and use tax collection. We will keep you informed of future changes.

Cray Kaiser is here to help. Please contact us if you have any questions or would like guidance on a specific state’s current stance on sales tax nexus.