Member of Russell Bedford International, a global network of independent professional service firms.

Are you earning money from a side hustle or creative pursuit? It’s important to understand how the IRS classifies that activity. Is it a legitimate business or just a hobby? In this video, Matt Richardson, a Senior Tax Accountant at CK, explains how the IRS makes that distinction, what factors they consider and why it matters. Whether you’re selling art, playing music or driving for a rideshare app, Matt breaks down what you need to know.

Transcript

My name is Matt Richardson. I’m a senior tax accountant at Cray Kaiser. So if you do anything that earns money on your own time, the IRS will either consider it a hobby or a trade or business. And for the IRS, a trade or business is something that you’re doing to earn a profit or to make a living. Whereas a hobby is something that you do mostly for fun. And to decide whether your activity is a hobby or a business, the IRS will look for a profit- seeking motive. So the IRS has a few different ways to look for a profit-seeking motive. But the big theme is whether you operate your activity like a for-profit business would. A major part of that is whether it is something a lot of people would do recreationally. Whether or not you made or lost money. And for example, a lot of people might play music just for fun. So the IRS might question whether your weekend rock band is a true business. But not many people do accounting just for fun. So that’s a kind of business that’s less likely to get questioned by the IRS.

Other sources of income are also part of what the IRS looks at. If it’s your only means of support, they’ll usually accept that it’s a business that you’re trying to earn a living from. But if you also receive a six-figure salary from a day job, then they’re more likely to question the business aspect of your activity.

And a few other things they look at can include your expertise in the activity, how much time and effort you put in, the amount of profit you’ve earned in past years, whether you keep detailed financial records, how actively you seek out customers, and whether you have a written business plan, including a budget and growth strategies.

So for taxes, the main difference is if you’re a business, you’re allowed to deduct your expenses. You’re only taxed on what’s left over after you take what you earned and subtract what you spent in the process of doing that. If it’s a hobby, you have to pay taxes on all the money that you earn, but you can’t deduct those expenses. So, obviously, that makes a pretty big difference in your tax liability, so the IRS can be pretty assertive in questioning things that it thinks might really be a hobby.

So, unfortunately, there’s no clear-cut dividing line between a business and a hobby. As the IRS likes to say it depends on all the facts and circumstances. So they’ll look at the activity in the context of everything that you do to decide whether it looks like a hobby or it looks like a business. They do have one general rule that will protect you in most cases, which is if you if you earn a profit in three out of the last five years then they’ll usually accept your classification as a business.

So overall the IRS is more likely to ask questions if the activity would let you claim expenses on property that you’d likely own anyhow, especially if it’s recreational. Some specific examples are horse racing has a lot of specific rules, things like auto racing, creative things like arts, crafts, and design. Writing, especially self-published books or blogs that might earn income are things they might look at. For social media, if you’re posting or live streaming and earning some money on the side that’s something that they might look at as being a hobby and not a real business. Music is another thing they’ll look at. A lot of people wish they could deduct their $60,000 Fender Stratocaster guitar, but if you’re just playing a couple of gigs a month with some friends, they’re probably not going to consider that to be a true business. Aviation is another area they look at. People might own an airplane and charge their friends a few dollars to ride around in it, hoping that they can deduct the expense as a business but chances are the IRS will will question you on that. And even rideshare driving like Uber or Lyft if you’re doing it just a few hours a week on the side that’s even something that the IRS might question you on is whether it’s a true business or not.

So a simple example of something that could go either way would be someone who paints watercolors in their spare time and decides to sell them. So you’ll probably be considered a business if you’re actively promoting your paintings and going to arts and crafts shows. If you’re keeping detailed financial records of your costs and supplies and booth rental fees. And if you’re charging a price for those paintings comparable to what most people would charge for those at similar arts and crafts shows. You’ll probably get classified as a hobby, if you’re only customers are friends, family, neighbors, people that you already know, and you don’t really advertise more widely. If you keep no records of how much you’ve spent on supplies, and make no effort to track expenses separately from personal expenses, and if you charge less for paintings than the canvas and the materials cost, chances are that will get you classified as a hobby.

So nothing can totally guarantee that the IRS won’t challenge you, they can essentially challenge you on anything. But there are four things that will help you be pretty secure. Keep detailed financial records, keep detailed records of the time you spend in the activity, maintain written business records, including a budget and a business plan, and of course talk to your tax advisor. That’s what we’re here for.

Bringing a new employee into your organization involves more than evaluating their skills and cultural fit, it also requires a clear understanding of the financial impact. A new hire can significantly affect your company’s cash flow, both in the short term and long term. Here are key financial considerations to keep in mind when making this important decision:

1. Salary and Compensation Structure

The most immediate and ongoing cost of hiring is the employee’s compensation. Your company must decide whether to offer a fixed salary, performance-based pay or a hybrid approach. Each structure has unique implications for cash flow:

Project how these structures will impact your monthly budget and cash flow to ensure financial stability during and after onboarding.

2. Onboarding and Training Costs

Investing in onboarding and training is essential for long-term productivity but also comes with costs. You must consider:

Tracking these costs and evaluating their return on investment (ROI) can help determine when the new hire will begin contributing to the bottom line.

3. Employee Benefits and Related Expenses

Beyond direct compensation, employee benefits can be a significant part of total employment costs. Common benefits include:

Understanding the full cost of your company’s benefits package and how it impacts your cash flow is vital for effective financial planning.

4. Technology and Tools

Ensuring that new hires are equipped with the right tools to do their job is a cost that shouldn’t be overlooked. You need to factor in:

While these tools are necessary, their costs must be integrated into your hiring budget.

5. Revenue or Productivity Potential

One of the most important items to factor into hiring expenses is estimating how and when the new employee will contribute value. Make sure you consider:

This analysis helps ensure your hiring decision supports the company’s profitability goals.

6. Ramp-Up Time and Cash Flow Impact

New employees often need time to become fully productive. It’s important to prepare for this adjustment period:

Accurate forecasting helps set expectations and supports smoother financial management during transitions.

7. Long-Term Financial Considerations

Beyond initial costs, hiring decisions should align with your company’s broader financial strategy. Keep in mind:

Hiring a new employee is a strategic decision that affects more than just your team dynamics, it can have lasting financial implications. With thoughtful planning and financial foresight, the right hire can become a long-term asset. By considering these financial factors, upfront, your business can better manage costs while building a stronger, more capable team.

If you’re evaluating the financial impact of a new hire, Cray Kaiser offers expert financial analysis and business consulting to support smart, sustainable growth. Our team can help you assess hiring costs, forecast cash flow and align your staffing strategy with your financial goals. Contact us at 630.953.4900 or fill out our contact form to learn more about how we can support your hiring decisions.

CPA | CK Principal

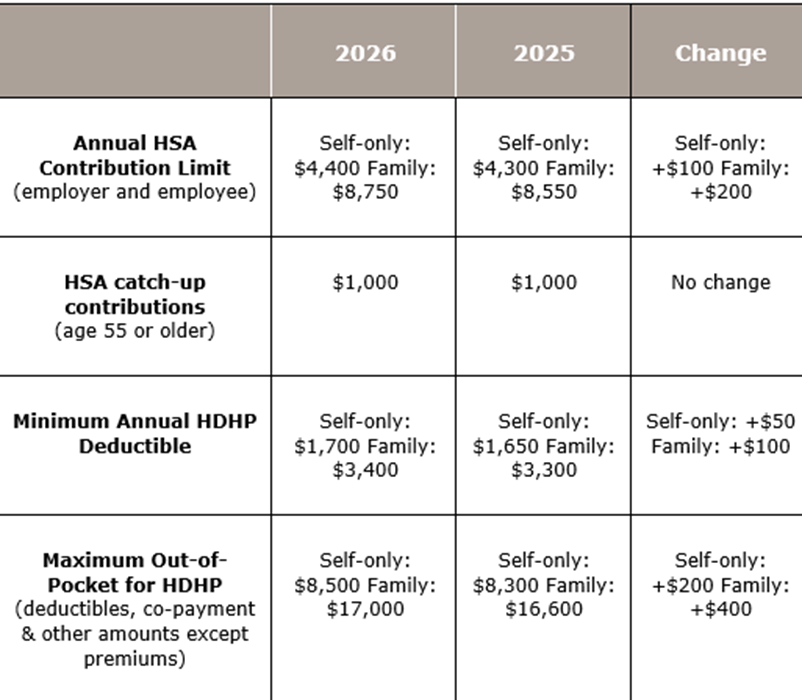

As we await possible significant changes to the 2026 tax law, the IRS has provided guidance on Health Savings Accounts (HSA). Specifically, they’ve recently released the inflation-adjusted contribution limits for 2026 related to HSAs and high-deductible health plans (HDHPs). While there are modest increases in the contribution limits, the HSA catch-up contribution amount remains unchanged.

Important Reminder: You can only contribute to an HSA account if you are enrolled in a High Deductible Health Plan (HDHP). The IRS sets specific criteria for what qualifies as an HDHP, including minimum deductibles and maximum out-of-pocket expenses.

One key tax benefit of HSAs that stands out is that contributions are tax-deductible even if you don’t itemize deductions. Additionally, these funds grow tax-free over time.

When HSA funds are used for qualified medical expenses, such as doctor visits, prescriptions, and certain medical procedures, withdrawals from an HSA are tax-free. However, if you use HSA funds for non-medical purposes, you will owe income tax plus a 20% penalty (10% after age 65).

To read more about the benefits of an HSA, click here. If you’d like to explore how an HSA could fit into your financial planning, please contact our office at 630.953.4900 or fill out this form.

CPA | CK Principal

In a world where resources are stretched thin and regulatory compliance is more demanding than ever, many organizations are asking the same question: How can we effectively plan for and manage our external financial statement audits?

The answer for many is to leverage outsourced support, particularly through Client Accounting Advisory Services (CAAS). If you’re skeptical about how an external team can integrate with your team’s processes, you’re not alone. But with the right support, you can significantly reduce the workload on your team, meet deadlines and stay in compliance, without sacrificing accuracy or transparency. Here’s how CAAS can help you simplify and strengthen your external audit process.

Many firms have dedicated teams specializing in client accounting and advisory services (CAAS or CAS). These teams are experts in audits, financial reporting and compliance. When you engage a CAAS team, you gain access to seasoned professionals who can assist your in-house accounting functions in planning for the year-end financial statement audit without disrupting your day-to-day operations. Here are several key areas where CAAS support can make a real difference:

Planning for your next external audit doesn’t have to be stressful or overwhelming. If you consider the topics discussed above and look to outsource some of these tasks to professionals who can guide you through the process, you will be able to save time and resources for your internal team.

Let CK’s CAAS team help. We offer tailored solutions to support your audit readiness and financial transparency. Reach out today to learn how our experts can help your organization move through the audit process with ease.

Deanna Salo, Managing Principal at Cray Kaiser, shares valuable insights for business owners navigating the complex process of selling their company. She discusses the various payment structures sellers might encounter and the tax implications of each. Deanna also highlights common pitfalls that can be encountered throughout a merger or acquisition. Whether you’re beginning to explore a sale or already deep into negotiations, this video offers practical guidance to help you make informed decisions.

Transcript:

My name is Deanna Salo and I’m the Managing Principal here at Cray Kaiser, Limited CPAs and Advisors.

When a seller receives a letter of intent and is trying to understand how much money am I going to get and when am I going to get it, you know, in the current market we’ve seen a lot of private equity firms coming in and they’ve got a lot of cash to spend on new investments. And so they’ll come in and provide a full cash deal at closing. The seller looks at that and says, “Wow, that’s fantastic.” That also might indicate a lower value for your company because they’re willing to absorb that risk of what might happen after they purchase your company. We do see sometimes that in private equity deals while I might get all my cash up front, what happens if my company grows exponentially because I’m still here with maybe an employment agreement, maybe I’m helping them around the corner of maybe some existing big deals that I’ve had already in the hopper when I sold them my company. In that situation, I may want some additional cash on the on the prospect of me getting additional profits in the company and I might even want an earn out what might be some future compensation to me as the seller for me doing really great work while I’m still hanging around. So the benefit of getting all the money at closing is that the seller can turn around and reinvest that and kind of look to retirement. Some sellers want to stick around for a little longer. Some buyers need the sellers to stick around a little longer. So in that case, you’ll want to make sure that you, as the seller, have some uptick, up game, on the back end of maybe some of these deals. When private equity, excuse me, when a privately held company comes in to buy another privately held company, oftentimes we see that they don’t maybe have as much liquid cash. They may be financing it with a bank and maybe they need the seller to finance a little bit more of that. In that situation, the seller has a little bit more risk. What if I don’t get all my money at closing? I then, as the seller, am bearing the risk of maybe not getting paid the rest of my money over the set amount of time that I was told that I was going to be able to receive my money. So, in either situation, cash at close, cash at close plus earn up, or maybe the seller has to take financing on the proceeds of the sale of their company. Each one of them have different tax effects to the seller. Each one of them may adjust the value of the company because there’s a risk and reward element of timeliness of getting all my money up front versus timeliness of getting my money a little bit over time versus me having to wait as the seller for five to seven years before I get my money. We often see our sellers, our clients not wanting to wait very long for their full cash outlay of their sale of their company. But again that might also indicate a risk of the buyer that they have to come up with all the money at closing and it might affect the value of the of the company and might reduce it a little bit more too. So there’s a lot of numbers that play into a fact of do I get my money all at closing? Do I get my money at closing with some additional uptick on an earn out? And lastly, will I get some money at closing and maybe get the rest of my money over a period of time?

A common mistake I see is going too fast. This is a process and with due care and listening to your advisors in each of the phases of a transaction is really important. If a buyer is really eager and wants to go really fast through the transaction, you as the seller might be really excited and want to go as fast with them, But we really need to be thoughtful in each phase of a transaction because it affects the future of your company, the future of your people, as well as the future of your customers and vendors that you’ve been serving for the many years you’ve been in business. So I think sometimes, you know, people want to get the deals done, they want to get the deals done quickly. There is a point of it’s taking too long versus it’s going too fast and somewhere in between is probably the right speed by which these transactions are best processed.

I think the red flags that companies need to look at is if you’re looking at a buyer, I would suggest that you’re looking at more than one buyer before you sign a letter of intent. If you have multiple buyers that are courting you to sell your business to them, I think that is a good position for the seller to be. If you really only have one buyer in the market for yourself, it may not be the right time to sell your company. Again, sellers get really excited because they may be done. They may be mentally, physically ready to be out of their business and they may want to go too fast, as I mentioned before, going too fast through the process. Jumping into the wrong conclusion is one of the red flags I see and that’s even on the buyer and the seller side.

So, in terms of the communication and what role we play in the very large group of advisors as we talked about, the buyer is going to have its group of advisors and the seller is going to have its group of advisors and you don’t want to be tripping on one another. So, having a clear line of roles and responsibilities in the process of selling your company is really important. Somebody needs to take the lead. Sometimes Cray Kaiser is called upon to set up the data room, which is an electronic space for all the information that’s going to be shared. There’s folders set up in there so it really identifies the attorney’s lane, the accountant’s lane, maybe payroll and HR lane. And so being very organized in this process and making sure that people are communicating. At the very front of all of this, the owners are going to be overwhelmed. The sellers, our clients, are usually very overwhelmed. So we typically have weekly calls with them just to make sure that we’re on pace, information is being shared. Both the buyer and the sellers use a lot of checklists to make sure all the work is getting completed and we can have a timeline for which the transaction is supposed to transpire. So making sure you’re organized to get set up. The attorneys, they’ll talk to one another. The accountants typically are the ones talking to one another. We, Cray Kaiser, get involved. Sometimes talking to the attorneys, we’ll get drafts of the agreements as they’re getting drafted by the buyer to just make sure that it makes numerical sense. But clearly the attorneys are used to make sure that the companies are protected from any of the things that we need to be protected on in the seller’s position. So if everybody does what they’re supposed to do and communicates at a high level, stays in their lane to the extent that they are hired to do a specific task. But certainly raising their hand during the course of these conversations as well as, you know, having some memorial timeline points that we each have to come and connect on to make sure we’re moving through the transaction as efficiently as possible. So being organized, a timeline of communication, setting forth the roles and responsibilities of your advisors, the data room is super helpful. It’s an electronic place to keep everybody organized to what they’re looking at, and, again, keeping the owners involved as much as they need to be. But also they’re relying on us as professionals to get the work done and get to the goal line.

All of this process, there’s lots of phases to this process, and at Cray Kaiser, you know, we’re here to help our clients, again, to and through their transactions at whatever point in their life cycle they’re at. And if you need any further assistance on that, please feel free to give us a call. Cray Kaiser is here for you during any part of this transaction.

If you’re a business owner considering a sale or acquisition, understanding the key differences between mergers and acquisitions is crucial. In this third installment of our series about mergers and acquisitions, Deanna Salo, Managing Principal at Cray Kaiser, breaks down these concepts in simple terms and shares essential advice for navigating the transition. Deanna offers insights that can help make your transaction smoother. She also highlights the critical role an accountant plays in guiding business owners through financial readiness, due diligence, and post-sale planning.

Transcript:

My name is Deanna Salo, and I’m the Managing Principal here at Cray Kaiser, Limited CPAs and Advisors.

There’s probably thousands of definitions on mergers and acquisitions if you Google it, and I think the best way that I like to quantify it is with a math problem. A merger is A plus B equals C. That’s where two joining companies come together and they decide to create something brand new. So C is the new company. An acquisition is a little bit different math problem. It’s A plus B equals A or B. And this is where somebody’s relayed the buyer and somebody’s the seller of the company. And whoever survives the acquisition is who absorbs the target. So, you know, I think in today’s environment, we really don’t see very many mergers going on anymore. They’re pretty much acquisitions where somebody at the end is absorbing the target or the selling company and they become part of the existing or the buyer’s company.

I think the best piece of advice I have actually given to most of my clients who have gone through the process of thinking about selling their business is keep your eyes on your business. This effort to sell your business, while it might only be 45 to 60 to 90 days, it may take much longer than that. Certainly the readiness of getting ready to sell your company is a long and can be a longer process, if you take your eyes off of the business, you may fall upon economic hardship. You may not be pressing all the different strategies that you have within the company. So keeping your eyes on the business to keep it running successfully while you’re taking a lot of energy and time to this acquisition sale process is really the best piece of advice. It’s easy to get rolled up in the acquisition process because it’s an exciting time. A lot of people ask in your questions about a lot of things but keeping your eyes on the business is probably the single best piece of advice that I have actually given clients and they look at me and they say oh yes we definitely need to keep our eyes on the business during this process.

In sharing the news with your organization, I would suggest a best practice is you start with your C-suite in terms of understanding what this process is going to be because many of the executive team will need to be a participant in the due diligence. So start small. What happens sometimes is the deals don’t go through. We actually had a client who went all the way up until a week or two. I think it was 10 days before the actual closing was to happen and the seller decided not to sell their business and they were wise to only really include the ownership team and some executive team members within the journey that got them even there. They did not tell the entire company. What happens oftentimes is there’s going to be little, mini tornadoes in your company of information being shared and so you could lose employees, you could lose customers, you could lose vendors if there would be a word on the street that you could be sold. So keeping the information, which is super hard to do because most owners are very excited with this new opportunity and they want to share it with everybody, that keeping the information to the tight group until such time as it’s appropriate to tell the rest of the organization about the great new news is a best practice. I think in smaller organizations where everybody knows everybody’s birth dates and anniversaries and they know when they’re feeling well and they know when they’re not feeling well it’s much more difficult to hold back the news when there’s an opportunity to acquire another business. I think as owners and businesses we have to let our employees know that we’re constantly looking to improve our organizations and we may be looking at acquiring another firm, another practice, another group of professionals. I think that’s a growth mindset and so if that’s part of the tenor of the company to tell the team that you’re looking to acquire other businesses, other practices, other specialists. I think when it does in fact happen, it’s an easier conversation because it’s already part of the strategic plan that’s been shared within your existing small organization that we’re constantly looking to buy and acquire other companies, other specialties. And then when it does happen, It’s not really new news, it’s just, oh, we have these new team members that are going to be coming to join us. And I think that’s really, if it can be set the course in your strategic plan, which you’re sharing with your existing smaller company, I think it becomes less of a hurdle once the target is identified and once the target is acquired and you’ve got new people joining the firm or your organization, it’s just an easier transition because everybody was already in the know that you are already out seeking this opportunity.

As the seller, when that needs to be announced to your team, when it is really time to tell your team, it’s a very delicate matter. And I think if ownership has been clear with their team that they are selling, that we are looking to connect ourselves with other resources so that we can deploy our services and goods at a much more efficient pace and have a lot more resources. And yes, I’m here to ensure that the transition is going to take place between where we’re at now and when we join the new company, giving them some conversations around it, meeting individually. Sometimes it takes meeting individually with people to let them have a surety that you will be with them throughout this next process is an important part of that conversation.

I think for a company who’s looking to sell, again, there’s a lot of what I call head and heart. Head knows that it’s time to sell, I’m ready, but the heart is my people, my clients, my customers, my vendors, all the people that got me to here, I need to make sure that they’re well taken care of. And if you start those conversations a little bit earlier on, meaning you’re not going to tell them you’re going to be getting that you’re going to be sold, but you’re letting them know that we need to be, we can be better and bigger and greater by aligning ourselves with another organization and start that in your own strategic plan that we may be acquired, we may merge into another company because I want all of us to have the benefit of being able to do bigger, better, bolder work going forward. I think that that’s an important message to give to your existing employees so that they know that they want to stay with you for that next great opportunity and put some really positive energy around it is an important part of transitioning your company from who you are to the next owner.

The role Cray Kaiser plays in a merger or acquisition process is really one of a consultant first. We really want to make sure that the client is ready for the transaction, that they’ve gotten their checks and balances with their financial warehouse, that they understand that the value is not going to be how much the seller needs to retire. It’s really providing them the consultancy piece, the reality check of what this next process is going to be. It’s kind of phase one. Phase two is really when we become the financial advisors and help them review the letter of intent before they sign it and sure it’s got all the right pieces that we believe are important. Certainly, we are not attorneys and we let legal counsel take care of the legalese of these letters of intent. And then we participate in the third phase, which is really the due diligence phase, supporting their internal accountants, controllers, CFOs and helping them provide the buyer with whatever information they need, making sure that the information is scrubbed in a great format so that the buyer has an ease of looking through it efficiently and with accuracy. And then lastly, we assist with the after-tax cash flow. We, you know, sometimes we start that at the beginning. Clients say, “Well, if I sell my company for X dollars, how much money am I actually going to be able to keep?” And we’ll help our clients provide those proformas, those projections of if I sell my company for $10 million, how much will I receive after tax? And what’s my actual cash flow? Which also helps the investment advisors understand how much money is that owner actually going to receive out of that 10 million when everything comes to close. So we are there from the beginning to help get them, get their mind and their mindset around the sale of their business. And we also help them through each of the phases as much or as little as they need us. And certainly in the life thereafter, many of our clients who have in fact sold their companies, we’re helping them in their next level of enterprise. Some of them become real estate enthusiasts and we help them with their accounting and tax on the real estate side. So we’re here to help clients throughout the entire cycle, life cycle of their existing business, and even in the life cycle after their business. All of this process, there’s lots of phases to this process, and at Cray Kaiser, you know, we’re here to help our clients, again, to and through their transactions at whatever point in their life cycle they’re at. And if you need any further assistance on that, please feel free to give us a call. Cray Kaiser is here for you during any part of this transaction.

CPA | CK Principal

The death of a spouse is a profoundly challenging time, both emotionally and financially. Amidst the grieving process, surviving spouses must also navigate a complex array of tax issues. Understanding these tax implications is crucial to ensuring compliance and optimizing financial outcomes. This article explores the key tax considerations for surviving spouses, including filing status, inherited basis adjustments, home sale exclusions, notifications to relevant agencies, estate tax considerations, and trust issues.

If you have a team of trusted advisors – accountants, attorneys, insurance, and/or financial professionals – these individuals are adept at advising clients during this trying time. They have experience in dealing with these difficult issues and can advise in a non-partial way. Let them help you as you grieve your loss.

Ideally, determining the key advisors should not be a difficult process. In some cases, prepared individuals may have created a crash card to assist their families upon their passing. The crash card may help you identify advisors and to know where important documents are stored.

It is imperative for the surviving spouse to notify the Social Security Administration (SSA) of the spouse’s death to adjust benefits accordingly. Usually, the funeral home will notify SSA, but to be safe, the surviving spouse should also contact SSA. Similarly, any payers of pensions or retirement plans must be informed to ensure the proper distribution of benefits and to avoid potential overpayments that would have to be repaid.

To prevent future complications, it is essential to change the title of jointly held assets to the survivor’s name alone. This includes real estate, vehicles, and financial accounts. It is also an opportunity to determine whether ownership should be held individually or in trust. Properly updating titles ensures clear ownership and facilitates future transactions.

Surviving spouses should also review and update their own beneficiary designations on life insurance policies, retirement accounts, and wills.

Many couples establish living trusts to manage their assets. Upon the death of one spouse, the trust may split into two separate trusts: one revocable and one irrevocable. The irrevocable trust typically requires a separate tax return. Understanding the terms of the trust and its tax implications is crucial for compliance and effective estate planning.

In the year of a spouse’s death, and provided the surviving spouse has not remarried, the surviving spouse has several filing status options. The option most often used is to file a joint tax return with the deceased spouse. This option is generally more favorable than filing as a single individual, as it allows for higher income thresholds and deductions. If the surviving spouse chooses not to file jointly, they may file as married filing separately or, if they qualify, as head of household.

If the surviving spouse has not remarried and has a dependent child, they may qualify as a “Qualifying Surviving Spouse” for up to two years after the year of the spouse’s death. This status offers benefits similar to those of filing jointly.

When a spouse passes away, the surviving spouse may receive an adjustment in basis for the inherited assets, which can significantly affect future capital gains taxes. The extent of this basis adjustment depends on how the title to the assets was held:

The rationale behind these basis adjustments is to align the tax basis of inherited assets with their current market value, thereby reducing the potential capital gains tax burden on the surviving spouse. This adjustment reflects the change in ownership and the economic reality that the surviving spouse is now the sole owner of the asset.

To establish the inherited basis, obtaining a qualified appraisal of the assets as of the date of death is often necessary. This appraisal serves as documentation for the basis and is crucial for accurately calculating capital gains or losses upon the future sale of the assets.

Surviving spouses may benefit from the home gain exclusion, which allows for the exclusion of up to $500,000 of gain from the sale of a primary residence, provided the sale occurs within two years of the spouse’s death, and the requirements for the exclusion were met prior to the death. This exclusion can be a valuable tool for minimizing taxes on the sale of a home, although in most cases, any gain within the two years is likely to be minimal because of the basis step-up provision. After the two-year period has elapsed, the exclusion drops to $250,000.

If the deceased spouse’s estate exceeds the federal estate tax exemption, an estate tax return may be required. Even if the estate is below the exemption threshold, filing an estate tax return can be beneficial to elect portability. Portability allows the surviving spouse to utilize the deceased spouse’s unused estate tax exemption, potentially reducing estate taxes upon the surviving spouse’s death. Not only federal estate tax laws should be considered, but state estate tax laws as well.

In addition to the primary tax considerations, surviving spouses must also be aware of how tax attributes are treated following the death of a spouse. Tax attributes include various tax-related characteristics such as net operating losses, capital loss carryovers, and passive activity losses. This can be complicated based on whether the attributes are related to a specific spouse or jointly.

The tax issues facing surviving spouses are multifaceted and require careful consideration. By understanding filing status options, inherited basis adjustments, home sale exclusions, and other critical tax matters, surviving spouses can navigate this challenging period with greater confidence and financial security.

Contact CK’s office at 630.953.4900 for professional tax assistance to ensure compliance and optimize financial outcomes during this difficult time. Our trusted team of advisors will be there to guide you every step of the way.

Senior Tax Accountant

If you’re running a small or medium-sized business, you know that cash flow is everything. Keeping up with payroll, replenishing inventory, and funding growth can feel like a never-ending balancing act. But what if there was a hidden way to free up cash?

Enter tax credits. These aren’t just numbers on a financial statement; they’re tools that can give your cash flow the boost it needs. Let’s explore how you can unlock these hidden advantages and give your cash flow a much-needed boost.

Unlike tax deductions, which only reduce taxable income, tax credits directly cut down your tax bill. That means more money stays in your business, strengthening your financial position and fueling growth. Here are some key credits to consider:

Why It’s a Win: Hiring new employees doesn’t just build your team, it can also boost your cash flow. The WOTC rewards businesses for hiring individuals from specific target groups, such as veterans, individuals from low-income areas, and long-term unemployment recipients.

How It Works: You may be able to claim a tax credit for a percentage of an employee’s wages during their first year on the job. This can help offset hiring costs while reducing your tax liability.

How to Qualify: Hire employees who meet WOTC eligibility, submit a certification request during the hiring process, and maintain precise hiring and detailed payroll records.

Why It’s a Win: Innovation pays off, literally. If your business is developing new products, improving processes, or advancing technology, you may qualify for the R&D tax credit.

How It Works: You can claim a percentage of qualifying R&D expenses, including any wages and supplies involved with the research. This directly reduces your tax bill, making it a valuable incentive for businesses pushing the envelope in their industry.

How to Qualify: Keep detailed records of your R&D activities, including project descriptions, expenses, and outcomes to support your claim.

Why It’s a Win: Startups and smaller businesses don’t have enough income to benefit from the R&D tax credit, but there’s a workaround. The payroll tax credit allows eligible businesses apply up to $250,000 of their R&D credit toward their payroll taxes instead.

How It Works: This option provides cash flow relief right away rather than waiting to offset future tax liability.

How to Qualify: Meet startup eligibility criteria (typically having less than $5 million in gross receipts) and ensure your R&D activities meet the requirements. Accurate documentation of expenses is key.

Why It’s a Win: Certain industries, such as renewable energy, manufacturing, and tech—benefit from specialized tax credits to encourage innovation and sustainability. These credits reward activities like energy efficiency improvements, eco-friendly initiatives, and technological advancements.

How They Work: Whether you are upgrading to energy-efficient equipment or investing in new technologies or adopting eco-friendly practices, these incentives help cut your tax bill and boost your cash flow.

How to Qualify: Research the credits available in your industry and ensure compliance with all relevant requirements to make the most of these opportunities.

Claiming tax credits is just the beginning. Once you secure them, they can be a powerful tool in your financial strategy. Use the extra cash inflow to invest in growth opportunities, pay down debt, or build a financial cushion for the future. By incorporating tax credits into your planning, you are setting your business up for stability and success.

Tax credits could be the key to unlocking new financial opportunities for your business. If you’re ready to explore which credits apply to you, Cray Kaiser is here to help. As experienced advisors, we specialize in helping businesses navigate the complexities of tax credits.

In this second installment of our series on navigating business mergers and acquisitions, Deanna Salo, Managing Principal at Cray Kaiser Ltd., shares valuable insights on preparing your business for a successful transition. Whether you’re planning to pass your company to the next generation, sell to a third party, or position your business for future growth, preparation is crucial. Join us as we delve into the foundational practices that set the stage for a smooth and strategic process.

Transcript:

My name is Deanna Salo, and I’m the Managing Principal here at Cray Kaiser, Limited CPAs and Advisors.

The next point is probably where people get really close to signing something, and that’s a letter of intent, also known as an LOI. My next part here is to talk about what really needs to be in that letter of intent. Our clients receive letters of intents from prospective buyers and they can be very vague. And in the vagueness, they may feel that it’s giving each party a balance of opportunity to future, to negotiate in the future on these various points. I see the letter of intent, the LOI, as the framework of your purchase agreement. So I believe the letter of intent does need to be far more specific in terms of what it needs to include and I believe they need to include the following items.

The purchase price and the purchase structure definitely is the first line of every letter of intent. I’m going to give you X dollars for your company and this is going to be an asset purchase or it’s going to be a stock purchase. The difference between an asset purchase and a stock purchase is probably its own audio blog at its own time, but often people understand when they go into selling their business that those are the two structural options that they have in terms of how the purchase of their company may be transacted.

How much is going to be paid in cash? Sometimes if I’m going to be selling my company for X dollars, I may get a certain percentage of it in cash at closing, and the rest of it might be paid to me over time in an earn out with interest or with not interest with a promissory note. So being very specific as to what is the dollar amount for sure, what is the structure of the deal for sure, and then more importantly is how much am I going to get at close. So if the buyer needs to finance this purchase, you as the seller need to know that very early in the conversations.

An escrow, similar to selling a house, there might be an escrow requirement. Most deals that I’ve seen in the last five to six years, they all have escrows. And an escrow is effectively a certain percentage of the purchase price that’s held in a separate account in the name of the buyer and the seller for a certain period of time, until such time is all of the post-closing adjustments have been handled by the post-closing activities. It’s really to keep money aside for some of those loose ends of the deal, and then at the end of the period, the escrow is finally released to the seller. Another important part of the escrow is to understand how long do I have to wait for this escrow to be released. We see anywhere from six months to twenty-four months on these escrows. So it’s really important for the buyer to understand that the seller needs to know how long is that escrow going to need to be in place.

The networking capital requirement is also a very important part of a definition in a letter of intent. Networking capital is really current assets, less current liabilities. If you can picture the first day of operations of the new buyer with your company. They open on day one and they need operating assets to operate. They need receivables to be coming in and they certainly still might have some of your net payables that they need to pay out. So understanding how much of the networking capital component requirement will be of the buyer is another important part of the LOI in terms of specifying what that would be. Most times we just see that there will be a networking capital requirement, and most times the buyer may not yet be ready to understand what that amount might be because they haven’t completed their due diligence. But I would say that at the very least, it should say that there is going to be a networking capital component, and it will be agreed to by both parties. So this way, you as the seller, make sure that you have a voice to that final amount of what might be needed in that networking capital component.

The letter of intent should also be very specific as to how much time the buyer has to complete their due diligence. You know as a seller time can be in your favor and time can be your worst enemy. With economic conditions changing so very quickly, if the buyer takes way too long to do their due diligence within the LOI framework, you may have economic conditions that will hamper the company’s ability and might actually reduce the value of your company. So making sure that the buyer has a specific period of time, we’ve seen it as few as forty-five days to complete their due diligence, all the way up to ninety days to complete their due diligence. Understand that letter of intent is an exclusivity arrangement between you and the buyer meaning at the time you sign the LOI, you are precluded from talking to anyone else. While an LOI is not binding, it does keep you both kind of on the same course to be honoring that LOI and being good stewards of the process to ensure that it gets completed in the right amount of time.

One of the other things that I see in LOIs that sometimes is missed is the transaction costs, professional fees. Professional fees should be taken on and each of the parties, the buyer and the seller, should take care of their own bills. As the seller, you can’t control how much attorney costs, advisory costs, will be generated by the buyer. And conversely, the buyer doesn’t have any control of the seller’s professional services from their accountants and attorneys. Ensuring that the transactional costs are paid for by each of their own parties and kept separate also commits to the letter of intent that should this deal not get done, meaning either party decides to walk away, that each party takes care of their own transaction costs at the end of the transaction.

The Non-Compete Agreement. Most times, the buyer will want to make sure that the seller, once they sell their company, they can’t turn around the next day and go open up a competing company down the block. So a non-compete is a very common additional bullet point in the letter of intent to suggest there will be a non-compete agreement, there will be a dollar amount assigned to the non-compete, and the seller will be precluded from operating in this industry for a certain sum of time. Perhaps a year, two years, three years, but it should be commented on that you as the seller will be committed to a non-compete. There’ll be a compensatory amount assigned to it and that you don’t want to have this non-compete to be for five or ten years. You want it to be a reasonable amount of time because if something goes wrong, you sell the company, the buyer is not really doing well with your company and you see it happening, you may want to open up your company again and having the non-compete understanding in the letter of intent protects both parties from doing the right thing during that period of time after the closing of the sale of your business.

Each company has key executives in their company, we wouldn’t get to where we are without having key personnel and ensuring that your key personnel are taken care of, I think is one of the head-to-heart conversations that most of our clients have. You know when you’re selling a business it’s a very emotional process and you’ve worked your lifetime to create the value, to create the place that you’ve created for your employees and your customers and your vendors and making sure that your key personnel are taken care of is very important to most sellers. So in the letter of intent, it’s another important part to have that the key executives in the company will be executing their own employment agreements with the buyer. So this ensures that you as the seller have a place for each of your key employees in the new company.

So we’ve talked a lot about mergers and acquisitions today mostly on the acquisition side and getting ready to be sold. Again, I think it’s important for any company in their strategic planning process to have many of these tools in their toolbox, being ready for a transaction, whether you’re going to buy a company or whether you’re positioning yourself to close, getting your financial warehouse in check, and getting ready operationally with your organizational structure to ensure that you have all the pieces laid out, the footprint of your company, understanding what should be included in a letter of intent, whether you’re buying again or selling your business, and making sure that your people at the end of the day are going to also be taken care of through employment agreements and be part of the team even in the in the new company if you’re selling your company.

All of this process there’s lots of phases to this process and at Cray Kaiser you know we’re here to help our clients again to and through their transactions at whatever point in their life cycle they’re at and if you need any further assistance on that please feel free to give us a call. Cray Kaiser is here for you during any part of this transaction.

CPA | Tax Supervisor – SALT

Beginning January 1, 2025, all out-of-state shipments into Illinois will be subject to the Retailer’s Occupation Tax (ROT). This tax includes state and local sales taxes and is determined based on the destination of the sale.

Key Changes

Previously, Illinois retailers with a physical presence in the state who sold tangible personal property from locations outside Illinois were only required to charge Illinois Use Tax (state, not local tax) on such sales. Under the new regulations, such sales will be subject to ROT, including local taxes.

Who Is Affected

This change only applies to retailers with a physical presence in Illinois who make sales into Illinois from an out-of-state location. The change does not impact remote retailers with no physical presence in the state.

Further Guidance

The State of Illinois provides Bulletin FY 2025-10 to assist sellers in navigating these changes including what actions to take in response to this change.

ROT Rules by Seller Type

1. Illinois Retailers

Sellers with a physical presence in Illinois shipping from locations within the State must collect and remit ROT based on the origin of the shipment.

2. Out-of-State Sellers

Retailers with a physical presence in Illinois and shipping from both in-state and out-of-state locations follow these rules:

3. Remote Sellers

Retailers with no physical presence in Illinois who meet a threshold of $100,000 or more in gross receipts or 200 or more separate transactions must collect ROT based on the destination of the shipment.

Need Assistance

Cray Kaiser can answer your questions on the changing landscape of sales and use taxes. Please contact us here or call us at 630-953-4900 if you have any questions.