Member of Russell Bedford International, a global network of independent professional service firms.

Welcome to the first episode of Small Business Focus with CK, where we explore practical topics to help entrepreneurs and self-employed individuals navigate the financial side of running a small business. In this episode, Tax Manager, Eric Challenger discusses the essentials of estimated taxes, including what they are, who needs to pay them, how to calculate them and when they’re due. Whether you’re a freelancer or a business owner, understanding estimated taxes can help you avoid penalties and better manage your cash flow throughout the year.

Transcript

Hi everyone and welcome to another edition of Small Business Focus with CK. I’m Eric Challenger, a tax manager here at CK and today’s focus topic is estimated taxes. Estimated taxes are payments made throughout the year to the government for income that is not already subject to automatic withholding. These payments help taxpayers avoid a large tax bill when they go to file their return. So who needs to pay them? As an employee, estimated tax payments are normally not needed. That’s because employers are required to withhold and remit taxes to the IRS on behalf of employee wages. Normally, this automatic withholding fulfills the burden of paying in taxes and eliminating the need for estimated tax payments. However, individuals that earn income not subject to withholding such as freelancers, self-employed persons, business owners, or others with income from investments, rental properties, or other sources will need to make estimated tax payments.

Estimated taxes are calculated based on projected current year taxable income. This requires understanding of your estimated income, deductions, and then applying related IRS tax tables to the estimated amount. You can use online calculators, tax software, or a tax professional to assist you with determining your estimated tax liability.

The IRS is a pay-as-you-go system. For wages, this means every check you earn will have your share of taxes withheld and then remitted by your employer. For all other taxpayers, the IRS requires that you make quarterly estimated tax payments based on the following schedule. First quarter, April 15th, second quarter, June 15th, third quarter, September 15th, and fourth quarter, January 15th of the following year. Any remaining balance must be paid by the return filing deadline of April 15th of the following year. Although you may extend the filing date of your return, you cannot extend the payment due date.

Yes, as we stated before, the IRS is a pay-as-you-go system, and you must pay in taxes quarterly if you do not have any other withholding mechanism. Failure to pay your taxes timely will result in the IRS charging you underpayment penalties. This is really just another form of interest on the underpaid balance. This is applied at the current IRS interest rate multiplied by the number of days late. In addition, if you fail to make any payment by the filing deadline or fail to file your return timely, you may also be subject to late payment penalty and failure to file penalty. Each have a maximum penalty of an additional 25% of the unpaid balance due.

Yes. The IRS understands that tracking your current and your income in related taxes isn’t always easy or an exact science, especially for small taxpayers. To help ease this burden, the IRS has a safe harbor policy. Under the safe harbor, you have two ways to meet the exception for being assessed underpayment penalties. There are as follows. Number one, the current year safe harbor exception. If you pay in at least 90% of your current year tax and make the remaining 10% by the filing deadline of April 15th, then you will avoid underpayment penalty. However, this requires accurate tracking of your current year income and tax. This may be hard to do if you’re not a tax expert. Number two, the prior year safe harbor exception. The IRS will not assess underpayment penalties for taxpayers that paid 100% of their prior tax. For taxpayers with prior year adjusted gross income, AGI, greater than $150,000, this amount needs to be 110% of your prior tax.

Well, in years of rising income, it’s best to use the prior year rule to ensure that you at least meet the prior year test. Any remaining amount due will not be penalized if you pay by the filing deadline of April 15th. In years of declining income, it’s best to use the 90% of the current year income, although this requires additional planning and accurate calculations. In most cases, it is better than overpaying the government and reducing your working capital or cash flow.

In summary, estimated taxes are designed to spread out to tax burden over the year. They apply mainly to self-employed individuals or people with income not subject to withholding. By making quarterly estimated tax payments based on your income, you can avoid underpayment penalties and manage your taxes more effectively. This has been another edition of the CK Small business focus. We hope our discussion on estimated taxes has given you some guidance you can implement in your tax planning for next year. For additional knowledge and understanding please visit our website at www.craykaiser .com.

In this video, Brian Kot, a Principal at CK, shares valuable insights into the most common questions clients ask about tax planning, document retention, business sales and financial reporting. From strategies to reduce your tax liability and organize your financial records to best practices when selling your business and improving accounting processes, Brian highlights the importance of proactive planning and collaboration with your CPA.

Transcript

My name is Brian Kot and I am a principal with Cray Kaiser Ltd. I’m often asked by my clients, “How can I reduce my tax liability?” The answer to this question comes with a lot of strategic planning between the client and your CPA. You want to at least minimally have an annual meeting with your CPA to discuss your tax situation and your financial planning on what’s going on with your business.

There are many suggestions typically that are offered such as contributing to an IRA or a sub-contribution or vehicle expenses might be missed or maximizing the depreciation deductions and purchasing certain assets within your business. In that conversation, it’s also very important to discuss the current tax rates and future tax planning. For example, you may want to try to defer income, or you might want to accelerate certain income to maximize current tax rates that are in effect today, for example, the capital gains tax rate. So having an effective meeting with your CPA in discussing these strategies is the optimal way of reducing your taxes, and it’s different between each individual and organization.

I’m often asked how long should I keep my documents for, especially in this age of digital world. The answer depends on the type of organization and also the type of documents that we’re discussing. Some documents you need to keep indefinitely, such as your corporate resolutions, your bylaws, your tax returns, your financial statements. We should always keep those forever and never destroy those and keep them in a digital format. There are other documents such as a lot of payroll documents need to be kept for a minimum of seven years and then there’s other documents especially on the individual side that you only need to keep for only three years and it also depends on the statute of limitations on how long you need to keep these documents for. I definitely recommend you check out our website if you click on the resource tab and search document retention. We have a guide that explains and gives an example of what documents you should keep either indefinitely or for seven years and remember that’s just a guide but it can be used as a rule of thumb.

You’re considering selling your business and often I’m asked how much do I owe in taxes? That’s a very challenging question to answer right off the bat, and a lot of planning needs to go involved. The first thing is to determine the market value of your business. And we recommend that you use an outside third party to assist you in determining the market value. Once the market value is determined, the way that the deal is structured and the sale is put together will significantly have an impact on how much you will pay in taxes, along with your personal tax situation. So we recommend before you, at any time, sign any agreement or sell your business. You consult with your tax advisor to go over that agreement in detail to determine if it is the most cost and tax efficient way for you to sell your business. Too often, we hear after the fact that our clients may have sold their business, or for that matter, entered into any type of a transaction. And if you would have consulted your tax advisor before entering that transaction, you may have saved a significant amount of taxes, as the transaction could have been structured differently.

Often, my clients will ask me, “How can I improve my financial reporting or get more timely reports, or I’ve lost my accountant, what do I do?” Here at Cray Kaiser, we have a dedicated team to assist you in your financial reporting. If you use a software such as QuickBooks or similar to QuickBooks, we can offer training on the program to ensure your employees properly know how to use the software. And we can also offer customization and create customized reports to help you understand your business. Having timely and accurate financial information available to you will enable you to make business decisions and help you grow your business.

Please consult a member of Cray Kaiser to understand the benefits that we can offer your organization to help you improve your financial reporting. Please review our website at craykaiser.com as we recently launched our Client Accounting Advisory Services webpage. You can find more information there and you can contact a member of our team at 630-953-4900.

CPA | CK Principal

Corporate credit cards are a valuable tool for businesses. They simplify purchasing, make expense tracking easier, and give employees flexibility to do their jobs. However, with this convenience comes the responsibility to ensure that these cards are used wisely and ethically.

That’s where a clear credit card policy and the right technology come in. Together, they help protect company resources, reduce fraud and build trust across the organization.

A strong credit card policy serves as both a safeguard and a roadmap. It clearly sets expectations for appropriate usage and explains the reasons behind the rules. When paired with expense management platforms such as Bill.com, Expensify and Ramp, to name a few, it can provide solutions to track transactions in real time, flag suspicious activity automatically, and simplify reporting and receipt collection. This combination of policy and technology gives finance teams the ability to detect irregularities before they escalate into larger issues, along with fostering transparency, accountability, and trust, ensuring that employees understand not only how to use their cards, but also the rationale behind the guidelines.

To create an effective policy, organizations should begin by considering both the operational needs of their teams and the inherent risks associated with credit card programs. This thoughtful approach lays the foundation for a culture of fiscal responsibility.

Technology makes monitoring and enforcement easier. Sometimes, business applications may require specific credit cards, so app selection should align with company policies. The right tools give firms both flexibility and control over purchase and expense management.

A clear, well-communicated policy, supported by the right technology, protects companies while giving the employees the resources they need to succeed. For more information on strengthening your credit card policies and integrating technology into your accounting systems, please contact Cray Kaiser.

At CK, our mission is to help business owners move beyond the day-to-day challenges of managing their finances and step confidently toward growth. In this audio blog, Amy Langfelder and Eva Koziel discuss how our Client Accounting and Advisory Services (CAAS) provide the tools, insights and support needed to transform financial confusion into clarity.

Transcript

I am Amy Langfelder and I am one of the principals here at CK. In my role, I lead the client accounting and advisory services. We often call this CAAS. In our CAAS department, we want to help move clients from surviving to thriving. To do this, we come alongside them where they are at and provide them various services to help them along the way. Today we want to highlight some of those services. Today, I am joined by Eva Koziel, our manager of accounting and advisory services. She is going to provide some ways that she is helping our clients grow.

First things first, we start by assessing your current accounting state. Imagine you’re struggling to keep your financials organized. We conduct a thorough review of your existing systems, identifying strengths and weaknesses. For example, if you’re using outdated software or inefficient manual processes, we highlight these issues and help you understand where improvements can be made.

How can companies achieve more through outsourcing some of their accounting functions? Once we’ve assessed where you’re at, we move into providing recurring services. Whether it’s monthly or quarterly, we can prepare your day-to-day accounting or review the work your team has done. Think about it as your business having its own financial health checkup. We’re there to ensure everything looks good and even catch issues before they escalate. We can also assist with streamlining processes, particularly through AP and AR automation. Imagine you’re spending hours manually processing invoices. We can help you implement software that automates these tasks, drastically reducing the time spent and minimizing errors. For example, our clients have seen up to a 30% reduction in time spent on AP simply by switching to an automated solution.

As owners look to the future, how can CAAS come alongside them and help them on their journey to thriving? We know that many business owners find their financials confusing. Our team provides personalized explanations, breaking down your income statements, balance sheets, and cash flow statements. For example, one of our clients was unsure why their cash flow was fluctuating. We took the time to walk them through their statements, allowing them to make informed decisions for the future.

Finally, let’s focus on the future. We don’t just stop at the numbers. Our advisory services help you strategize for growth. Let’s say you’re looking to expand, whether that’s a new employee or opening a new location. We provide insightful analysis and recommendations tailored to your business goals.

Thank you for your time today. We look forward to ways we can help you on your journey to thriving. Visit our website, craykaiser.com for more information.

Are you earning money from a side hustle or creative pursuit? It’s important to understand how the IRS classifies that activity. Is it a legitimate business or just a hobby? In this video, Matt Richardson, a Senior Tax Accountant at CK, explains how the IRS makes that distinction, what factors they consider and why it matters. Whether you’re selling art, playing music or driving for a rideshare app, Matt breaks down what you need to know.

Transcript

My name is Matt Richardson. I’m a senior tax accountant at Cray Kaiser. So if you do anything that earns money on your own time, the IRS will either consider it a hobby or a trade or business. And for the IRS, a trade or business is something that you’re doing to earn a profit or to make a living. Whereas a hobby is something that you do mostly for fun. And to decide whether your activity is a hobby or a business, the IRS will look for a profit- seeking motive. So the IRS has a few different ways to look for a profit-seeking motive. But the big theme is whether you operate your activity like a for-profit business would. A major part of that is whether it is something a lot of people would do recreationally. Whether or not you made or lost money. And for example, a lot of people might play music just for fun. So the IRS might question whether your weekend rock band is a true business. But not many people do accounting just for fun. So that’s a kind of business that’s less likely to get questioned by the IRS.

Other sources of income are also part of what the IRS looks at. If it’s your only means of support, they’ll usually accept that it’s a business that you’re trying to earn a living from. But if you also receive a six-figure salary from a day job, then they’re more likely to question the business aspect of your activity.

And a few other things they look at can include your expertise in the activity, how much time and effort you put in, the amount of profit you’ve earned in past years, whether you keep detailed financial records, how actively you seek out customers, and whether you have a written business plan, including a budget and growth strategies.

So for taxes, the main difference is if you’re a business, you’re allowed to deduct your expenses. You’re only taxed on what’s left over after you take what you earned and subtract what you spent in the process of doing that. If it’s a hobby, you have to pay taxes on all the money that you earn, but you can’t deduct those expenses. So, obviously, that makes a pretty big difference in your tax liability, so the IRS can be pretty assertive in questioning things that it thinks might really be a hobby.

So, unfortunately, there’s no clear-cut dividing line between a business and a hobby. As the IRS likes to say it depends on all the facts and circumstances. So they’ll look at the activity in the context of everything that you do to decide whether it looks like a hobby or it looks like a business. They do have one general rule that will protect you in most cases, which is if you if you earn a profit in three out of the last five years then they’ll usually accept your classification as a business.

So overall the IRS is more likely to ask questions if the activity would let you claim expenses on property that you’d likely own anyhow, especially if it’s recreational. Some specific examples are horse racing has a lot of specific rules, things like auto racing, creative things like arts, crafts, and design. Writing, especially self-published books or blogs that might earn income are things they might look at. For social media, if you’re posting or live streaming and earning some money on the side that’s something that they might look at as being a hobby and not a real business. Music is another thing they’ll look at. A lot of people wish they could deduct their $60,000 Fender Stratocaster guitar, but if you’re just playing a couple of gigs a month with some friends, they’re probably not going to consider that to be a true business. Aviation is another area they look at. People might own an airplane and charge their friends a few dollars to ride around in it, hoping that they can deduct the expense as a business but chances are the IRS will will question you on that. And even rideshare driving like Uber or Lyft if you’re doing it just a few hours a week on the side that’s even something that the IRS might question you on is whether it’s a true business or not.

So a simple example of something that could go either way would be someone who paints watercolors in their spare time and decides to sell them. So you’ll probably be considered a business if you’re actively promoting your paintings and going to arts and crafts shows. If you’re keeping detailed financial records of your costs and supplies and booth rental fees. And if you’re charging a price for those paintings comparable to what most people would charge for those at similar arts and crafts shows. You’ll probably get classified as a hobby, if you’re only customers are friends, family, neighbors, people that you already know, and you don’t really advertise more widely. If you keep no records of how much you’ve spent on supplies, and make no effort to track expenses separately from personal expenses, and if you charge less for paintings than the canvas and the materials cost, chances are that will get you classified as a hobby.

So nothing can totally guarantee that the IRS won’t challenge you, they can essentially challenge you on anything. But there are four things that will help you be pretty secure. Keep detailed financial records, keep detailed records of the time you spend in the activity, maintain written business records, including a budget and a business plan, and of course talk to your tax advisor. That’s what we’re here for.

Bringing a new employee into your organization involves more than evaluating their skills and cultural fit, it also requires a clear understanding of the financial impact. A new hire can significantly affect your company’s cash flow, both in the short term and long term. Here are key financial considerations to keep in mind when making this important decision:

1. Salary and Compensation Structure

The most immediate and ongoing cost of hiring is the employee’s compensation. Your company must decide whether to offer a fixed salary, performance-based pay or a hybrid approach. Each structure has unique implications for cash flow:

Project how these structures will impact your monthly budget and cash flow to ensure financial stability during and after onboarding.

2. Onboarding and Training Costs

Investing in onboarding and training is essential for long-term productivity but also comes with costs. You must consider:

Tracking these costs and evaluating their return on investment (ROI) can help determine when the new hire will begin contributing to the bottom line.

3. Employee Benefits and Related Expenses

Beyond direct compensation, employee benefits can be a significant part of total employment costs. Common benefits include:

Understanding the full cost of your company’s benefits package and how it impacts your cash flow is vital for effective financial planning.

4. Technology and Tools

Ensuring that new hires are equipped with the right tools to do their job is a cost that shouldn’t be overlooked. You need to factor in:

While these tools are necessary, their costs must be integrated into your hiring budget.

5. Revenue or Productivity Potential

One of the most important items to factor into hiring expenses is estimating how and when the new employee will contribute value. Make sure you consider:

This analysis helps ensure your hiring decision supports the company’s profitability goals.

6. Ramp-Up Time and Cash Flow Impact

New employees often need time to become fully productive. It’s important to prepare for this adjustment period:

Accurate forecasting helps set expectations and supports smoother financial management during transitions.

7. Long-Term Financial Considerations

Beyond initial costs, hiring decisions should align with your company’s broader financial strategy. Keep in mind:

Hiring a new employee is a strategic decision that affects more than just your team dynamics, it can have lasting financial implications. With thoughtful planning and financial foresight, the right hire can become a long-term asset. By considering these financial factors, upfront, your business can better manage costs while building a stronger, more capable team.

If you’re evaluating the financial impact of a new hire, Cray Kaiser offers expert financial analysis and business consulting to support smart, sustainable growth. Our team can help you assess hiring costs, forecast cash flow and align your staffing strategy with your financial goals. Contact us at 630.953.4900 or fill out our contact form to learn more about how we can support your hiring decisions.

CPA | CK Principal

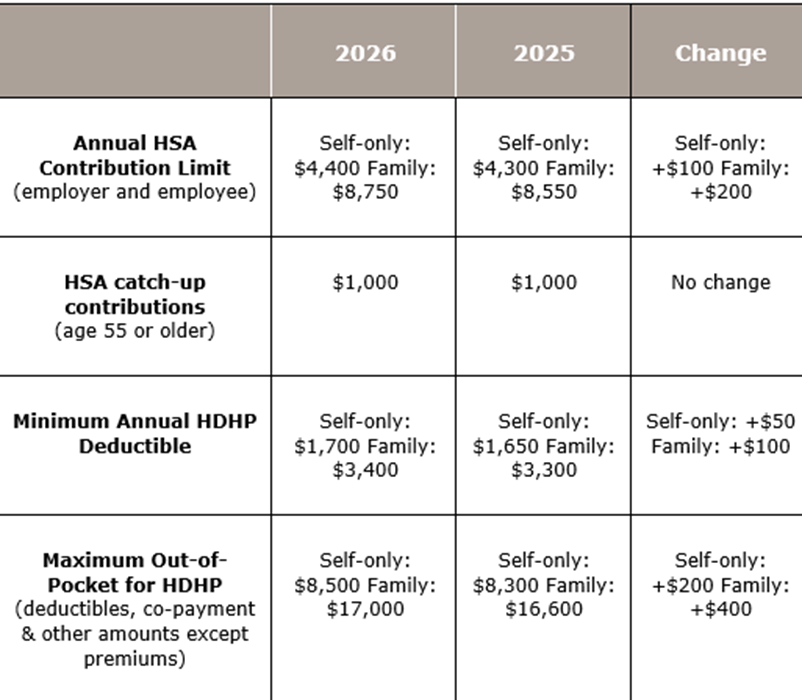

As we await possible significant changes to the 2026 tax law, the IRS has provided guidance on Health Savings Accounts (HSA). Specifically, they’ve recently released the inflation-adjusted contribution limits for 2026 related to HSAs and high-deductible health plans (HDHPs). While there are modest increases in the contribution limits, the HSA catch-up contribution amount remains unchanged.

Important Reminder: You can only contribute to an HSA account if you are enrolled in a High Deductible Health Plan (HDHP). The IRS sets specific criteria for what qualifies as an HDHP, including minimum deductibles and maximum out-of-pocket expenses.

One key tax benefit of HSAs that stands out is that contributions are tax-deductible even if you don’t itemize deductions. Additionally, these funds grow tax-free over time.

When HSA funds are used for qualified medical expenses, such as doctor visits, prescriptions, and certain medical procedures, withdrawals from an HSA are tax-free. However, if you use HSA funds for non-medical purposes, you will owe income tax plus a 20% penalty (10% after age 65).

To read more about the benefits of an HSA, click here. If you’d like to explore how an HSA could fit into your financial planning, please contact our office at 630.953.4900 or fill out this form.

CPA | CK Principal

In a world where resources are stretched thin and regulatory compliance is more demanding than ever, many organizations are asking the same question: How can we effectively plan for and manage our external financial statement audits?

The answer for many is to leverage outsourced support, particularly through Client Accounting Advisory Services (CAAS). If you’re skeptical about how an external team can integrate with your team’s processes, you’re not alone. But with the right support, you can significantly reduce the workload on your team, meet deadlines and stay in compliance, without sacrificing accuracy or transparency. Here’s how CAAS can help you simplify and strengthen your external audit process.

Many firms have dedicated teams specializing in client accounting and advisory services (CAAS or CAS). These teams are experts in audits, financial reporting and compliance. When you engage a CAAS team, you gain access to seasoned professionals who can assist your in-house accounting functions in planning for the year-end financial statement audit without disrupting your day-to-day operations. Here are several key areas where CAAS support can make a real difference:

Planning for your next external audit doesn’t have to be stressful or overwhelming. If you consider the topics discussed above and look to outsource some of these tasks to professionals who can guide you through the process, you will be able to save time and resources for your internal team.

Let CK’s CAAS team help. We offer tailored solutions to support your audit readiness and financial transparency. Reach out today to learn how our experts can help your organization move through the audit process with ease.

Deanna Salo, Managing Principal at Cray Kaiser, shares valuable insights for business owners navigating the complex process of selling their company. She discusses the various payment structures sellers might encounter and the tax implications of each. Deanna also highlights common pitfalls that can be encountered throughout a merger or acquisition. Whether you’re beginning to explore a sale or already deep into negotiations, this video offers practical guidance to help you make informed decisions.

Transcript:

My name is Deanna Salo and I’m the Managing Principal here at Cray Kaiser, Limited CPAs and Advisors.

When a seller receives a letter of intent and is trying to understand how much money am I going to get and when am I going to get it, you know, in the current market we’ve seen a lot of private equity firms coming in and they’ve got a lot of cash to spend on new investments. And so they’ll come in and provide a full cash deal at closing. The seller looks at that and says, “Wow, that’s fantastic.” That also might indicate a lower value for your company because they’re willing to absorb that risk of what might happen after they purchase your company. We do see sometimes that in private equity deals while I might get all my cash up front, what happens if my company grows exponentially because I’m still here with maybe an employment agreement, maybe I’m helping them around the corner of maybe some existing big deals that I’ve had already in the hopper when I sold them my company. In that situation, I may want some additional cash on the on the prospect of me getting additional profits in the company and I might even want an earn out what might be some future compensation to me as the seller for me doing really great work while I’m still hanging around. So the benefit of getting all the money at closing is that the seller can turn around and reinvest that and kind of look to retirement. Some sellers want to stick around for a little longer. Some buyers need the sellers to stick around a little longer. So in that case, you’ll want to make sure that you, as the seller, have some uptick, up game, on the back end of maybe some of these deals. When private equity, excuse me, when a privately held company comes in to buy another privately held company, oftentimes we see that they don’t maybe have as much liquid cash. They may be financing it with a bank and maybe they need the seller to finance a little bit more of that. In that situation, the seller has a little bit more risk. What if I don’t get all my money at closing? I then, as the seller, am bearing the risk of maybe not getting paid the rest of my money over the set amount of time that I was told that I was going to be able to receive my money. So, in either situation, cash at close, cash at close plus earn up, or maybe the seller has to take financing on the proceeds of the sale of their company. Each one of them have different tax effects to the seller. Each one of them may adjust the value of the company because there’s a risk and reward element of timeliness of getting all my money up front versus timeliness of getting my money a little bit over time versus me having to wait as the seller for five to seven years before I get my money. We often see our sellers, our clients not wanting to wait very long for their full cash outlay of their sale of their company. But again that might also indicate a risk of the buyer that they have to come up with all the money at closing and it might affect the value of the of the company and might reduce it a little bit more too. So there’s a lot of numbers that play into a fact of do I get my money all at closing? Do I get my money at closing with some additional uptick on an earn out? And lastly, will I get some money at closing and maybe get the rest of my money over a period of time?

A common mistake I see is going too fast. This is a process and with due care and listening to your advisors in each of the phases of a transaction is really important. If a buyer is really eager and wants to go really fast through the transaction, you as the seller might be really excited and want to go as fast with them, But we really need to be thoughtful in each phase of a transaction because it affects the future of your company, the future of your people, as well as the future of your customers and vendors that you’ve been serving for the many years you’ve been in business. So I think sometimes, you know, people want to get the deals done, they want to get the deals done quickly. There is a point of it’s taking too long versus it’s going too fast and somewhere in between is probably the right speed by which these transactions are best processed.

I think the red flags that companies need to look at is if you’re looking at a buyer, I would suggest that you’re looking at more than one buyer before you sign a letter of intent. If you have multiple buyers that are courting you to sell your business to them, I think that is a good position for the seller to be. If you really only have one buyer in the market for yourself, it may not be the right time to sell your company. Again, sellers get really excited because they may be done. They may be mentally, physically ready to be out of their business and they may want to go too fast, as I mentioned before, going too fast through the process. Jumping into the wrong conclusion is one of the red flags I see and that’s even on the buyer and the seller side.

So, in terms of the communication and what role we play in the very large group of advisors as we talked about, the buyer is going to have its group of advisors and the seller is going to have its group of advisors and you don’t want to be tripping on one another. So, having a clear line of roles and responsibilities in the process of selling your company is really important. Somebody needs to take the lead. Sometimes Cray Kaiser is called upon to set up the data room, which is an electronic space for all the information that’s going to be shared. There’s folders set up in there so it really identifies the attorney’s lane, the accountant’s lane, maybe payroll and HR lane. And so being very organized in this process and making sure that people are communicating. At the very front of all of this, the owners are going to be overwhelmed. The sellers, our clients, are usually very overwhelmed. So we typically have weekly calls with them just to make sure that we’re on pace, information is being shared. Both the buyer and the sellers use a lot of checklists to make sure all the work is getting completed and we can have a timeline for which the transaction is supposed to transpire. So making sure you’re organized to get set up. The attorneys, they’ll talk to one another. The accountants typically are the ones talking to one another. We, Cray Kaiser, get involved. Sometimes talking to the attorneys, we’ll get drafts of the agreements as they’re getting drafted by the buyer to just make sure that it makes numerical sense. But clearly the attorneys are used to make sure that the companies are protected from any of the things that we need to be protected on in the seller’s position. So if everybody does what they’re supposed to do and communicates at a high level, stays in their lane to the extent that they are hired to do a specific task. But certainly raising their hand during the course of these conversations as well as, you know, having some memorial timeline points that we each have to come and connect on to make sure we’re moving through the transaction as efficiently as possible. So being organized, a timeline of communication, setting forth the roles and responsibilities of your advisors, the data room is super helpful. It’s an electronic place to keep everybody organized to what they’re looking at, and, again, keeping the owners involved as much as they need to be. But also they’re relying on us as professionals to get the work done and get to the goal line.

All of this process, there’s lots of phases to this process, and at Cray Kaiser, you know, we’re here to help our clients, again, to and through their transactions at whatever point in their life cycle they’re at. And if you need any further assistance on that, please feel free to give us a call. Cray Kaiser is here for you during any part of this transaction.

If you’re a business owner considering a sale or acquisition, understanding the key differences between mergers and acquisitions is crucial. In this third installment of our series about mergers and acquisitions, Deanna Salo, Managing Principal at Cray Kaiser, breaks down these concepts in simple terms and shares essential advice for navigating the transition. Deanna offers insights that can help make your transaction smoother. She also highlights the critical role an accountant plays in guiding business owners through financial readiness, due diligence, and post-sale planning.

Transcript:

My name is Deanna Salo, and I’m the Managing Principal here at Cray Kaiser, Limited CPAs and Advisors.

There’s probably thousands of definitions on mergers and acquisitions if you Google it, and I think the best way that I like to quantify it is with a math problem. A merger is A plus B equals C. That’s where two joining companies come together and they decide to create something brand new. So C is the new company. An acquisition is a little bit different math problem. It’s A plus B equals A or B. And this is where somebody’s relayed the buyer and somebody’s the seller of the company. And whoever survives the acquisition is who absorbs the target. So, you know, I think in today’s environment, we really don’t see very many mergers going on anymore. They’re pretty much acquisitions where somebody at the end is absorbing the target or the selling company and they become part of the existing or the buyer’s company.

I think the best piece of advice I have actually given to most of my clients who have gone through the process of thinking about selling their business is keep your eyes on your business. This effort to sell your business, while it might only be 45 to 60 to 90 days, it may take much longer than that. Certainly the readiness of getting ready to sell your company is a long and can be a longer process, if you take your eyes off of the business, you may fall upon economic hardship. You may not be pressing all the different strategies that you have within the company. So keeping your eyes on the business to keep it running successfully while you’re taking a lot of energy and time to this acquisition sale process is really the best piece of advice. It’s easy to get rolled up in the acquisition process because it’s an exciting time. A lot of people ask in your questions about a lot of things but keeping your eyes on the business is probably the single best piece of advice that I have actually given clients and they look at me and they say oh yes we definitely need to keep our eyes on the business during this process.

In sharing the news with your organization, I would suggest a best practice is you start with your C-suite in terms of understanding what this process is going to be because many of the executive team will need to be a participant in the due diligence. So start small. What happens sometimes is the deals don’t go through. We actually had a client who went all the way up until a week or two. I think it was 10 days before the actual closing was to happen and the seller decided not to sell their business and they were wise to only really include the ownership team and some executive team members within the journey that got them even there. They did not tell the entire company. What happens oftentimes is there’s going to be little, mini tornadoes in your company of information being shared and so you could lose employees, you could lose customers, you could lose vendors if there would be a word on the street that you could be sold. So keeping the information, which is super hard to do because most owners are very excited with this new opportunity and they want to share it with everybody, that keeping the information to the tight group until such time as it’s appropriate to tell the rest of the organization about the great new news is a best practice. I think in smaller organizations where everybody knows everybody’s birth dates and anniversaries and they know when they’re feeling well and they know when they’re not feeling well it’s much more difficult to hold back the news when there’s an opportunity to acquire another business. I think as owners and businesses we have to let our employees know that we’re constantly looking to improve our organizations and we may be looking at acquiring another firm, another practice, another group of professionals. I think that’s a growth mindset and so if that’s part of the tenor of the company to tell the team that you’re looking to acquire other businesses, other practices, other specialists. I think when it does in fact happen, it’s an easier conversation because it’s already part of the strategic plan that’s been shared within your existing small organization that we’re constantly looking to buy and acquire other companies, other specialties. And then when it does happen, It’s not really new news, it’s just, oh, we have these new team members that are going to be coming to join us. And I think that’s really, if it can be set the course in your strategic plan, which you’re sharing with your existing smaller company, I think it becomes less of a hurdle once the target is identified and once the target is acquired and you’ve got new people joining the firm or your organization, it’s just an easier transition because everybody was already in the know that you are already out seeking this opportunity.

As the seller, when that needs to be announced to your team, when it is really time to tell your team, it’s a very delicate matter. And I think if ownership has been clear with their team that they are selling, that we are looking to connect ourselves with other resources so that we can deploy our services and goods at a much more efficient pace and have a lot more resources. And yes, I’m here to ensure that the transition is going to take place between where we’re at now and when we join the new company, giving them some conversations around it, meeting individually. Sometimes it takes meeting individually with people to let them have a surety that you will be with them throughout this next process is an important part of that conversation.

I think for a company who’s looking to sell, again, there’s a lot of what I call head and heart. Head knows that it’s time to sell, I’m ready, but the heart is my people, my clients, my customers, my vendors, all the people that got me to here, I need to make sure that they’re well taken care of. And if you start those conversations a little bit earlier on, meaning you’re not going to tell them you’re going to be getting that you’re going to be sold, but you’re letting them know that we need to be, we can be better and bigger and greater by aligning ourselves with another organization and start that in your own strategic plan that we may be acquired, we may merge into another company because I want all of us to have the benefit of being able to do bigger, better, bolder work going forward. I think that that’s an important message to give to your existing employees so that they know that they want to stay with you for that next great opportunity and put some really positive energy around it is an important part of transitioning your company from who you are to the next owner.

The role Cray Kaiser plays in a merger or acquisition process is really one of a consultant first. We really want to make sure that the client is ready for the transaction, that they’ve gotten their checks and balances with their financial warehouse, that they understand that the value is not going to be how much the seller needs to retire. It’s really providing them the consultancy piece, the reality check of what this next process is going to be. It’s kind of phase one. Phase two is really when we become the financial advisors and help them review the letter of intent before they sign it and sure it’s got all the right pieces that we believe are important. Certainly, we are not attorneys and we let legal counsel take care of the legalese of these letters of intent. And then we participate in the third phase, which is really the due diligence phase, supporting their internal accountants, controllers, CFOs and helping them provide the buyer with whatever information they need, making sure that the information is scrubbed in a great format so that the buyer has an ease of looking through it efficiently and with accuracy. And then lastly, we assist with the after-tax cash flow. We, you know, sometimes we start that at the beginning. Clients say, “Well, if I sell my company for X dollars, how much money am I actually going to be able to keep?” And we’ll help our clients provide those proformas, those projections of if I sell my company for $10 million, how much will I receive after tax? And what’s my actual cash flow? Which also helps the investment advisors understand how much money is that owner actually going to receive out of that 10 million when everything comes to close. So we are there from the beginning to help get them, get their mind and their mindset around the sale of their business. And we also help them through each of the phases as much or as little as they need us. And certainly in the life thereafter, many of our clients who have in fact sold their companies, we’re helping them in their next level of enterprise. Some of them become real estate enthusiasts and we help them with their accounting and tax on the real estate side. So we’re here to help clients throughout the entire cycle, life cycle of their existing business, and even in the life cycle after their business. All of this process, there’s lots of phases to this process, and at Cray Kaiser, you know, we’re here to help our clients, again, to and through their transactions at whatever point in their life cycle they’re at. And if you need any further assistance on that, please feel free to give us a call. Cray Kaiser is here for you during any part of this transaction.