Member of Russell Bedford International, a global network of independent professional service firms.

We all know we are supposed to have an annual check-up with our doctor to prevent health problems and catch issues early. Of course, whether we do it is another topic. An annual check-up can do the same thing for the financial health of your business and can be simple and straightforward when you know what to do. Evaluate these areas of your business to start your year off right.

A big-picture evaluation can start with a fresh strategic plan for the next several years.

Are your accounting records supplying the data necessary for making sound decisions?

When you own a business, your personal finances can be affected by your company’s activities.

Conduct an audit of your company website.

As you sit down with your New Year’s resolutions and schedule your annual physical with your doctor, remember to conduct an annual check-up for the financial health of your business as well. If you have any questions or would like some help, please contact Cray Kaiser.

John’s skills and talent have resulted in a great deal of success for the company. His sales job involves quite a bit of driving throughout the Midwest. You’ve decided you want to reward his efforts and success with a company car. Before you tell John, you have a decision to make. Will his car be leased? Or will the company buy it outright? What kind of impact does leasing versus owning have on the company’s tax situation? Several factors impact this decision, including how long the car will be kept and how consistently the car will be driven.

How long will the company keep the car?

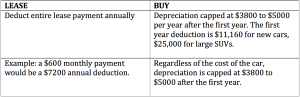

If the company plans for John to keep the car longer than a leasing period, it likely makes sense to buy the car outright. If the company plans to reward John with new cars fairly frequently, a lease may make more sense. Weigh the annual lease payments against the annual deductions.

Will the use of the car be consistent year-to-year?

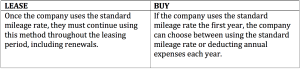

Regardless of whether you lease or buy John’s car, the company has a choice to make. They can either deduct all expenses, including gas, service, repairs, depreciation/lease expenses and insurance, or use the standard mileage rate (54¢ per mile in 2016). Tolls and parking can be expensed in addition to the standard mileage rate.

Only mileage associated with business use can be deducted, and a log must be kept to separate business mileage from personal use. In order for the expenses/mileage to be fully deductible to the company, the employee using the car must have the personal portion of the auto use recorded on their W2 as a fringe benefit. The pretax benefit to the employee far outweighs the small amount of additional income associated with the fringe benefit.

Different rules apply to switching between deduction methods for leasing versus buying.

If John’s use of the company car will vary from year to year, buying the car will offer more flexibility. In addition, inconsistent use can also create costly leasing expenses. Leases include an annual mileage allowance with per mile surcharges for overages.

Choosing the best option between leasing and buying John’s new car means considering tax implications and predicting the use of the car. Careful planning including consideration of when John’s car will be replaced and how consistent his travel will be will help you reach the best decision for your company.

If you are facing a similar decision and want to talk through the tax implications, we would be happy to help. Contact us today.

2016 W2 Forms must be filed with the Social Security Administration (SSA) by January 31, a month earlier than in past years. The deadline to mail W2s to employees remains January 31. The date was accelerated as an attempt to reduce fraud.

Follow these tips to avoid errors:

Meeting the new deadline can be stress-free if you take the time to prepare in advance. Throughout the next year, create a set process for collecting taxable benefit data. For example, require any employees who use a company car to maintain and submit an auto log and collect the log on a monthly or annual basis.

We are happy to help calculate the value of your employees’ taxable benefits for your W2s. For help or to learn more about W2 preparation and filing, contact us today.

You get an oil change every three months to protect your car. You get a check-up every year to protect your health. You file your taxes every year to prevent issues with the IRS. But what are you doing to protect your family and your business when you will not be around to protect them yourself?

In the event of an unexpected death or tragedy, what can you do to make this time easier for those you leave behind? Create a crash card. The crash card contains and communicates all the information your family and business successors need in order to move forward with your estate and business. It lists the contact information for your trusted advisors, locations of important papers and login information for your accounts.

None of us want to think about preparing for the end of our own lives. It is sad, complicated and scary. However, if we avoid taking the time to properly prepare for this eventuality, we leave our family members and business successors in a difficult position at a stage when they are feeling emotional. Recently we helped a family manage the estate of a loved one who passed away. They almost missed out on a significant amount of insurance proceeds because none of the family members were aware of the policy and no documents were found with the other financial paperwork. Fortunately, when going through the client’s checkbook, it was discovered that the client had been making quarterly payments to a life insurance company. The family received the benefits, but they easily could have missed this asset.

In a family business situation, we recommend annual family meetings, a sort of a state of the union address that includes all family members, even those not involved with the business. During this meeting, the location of the crash card should be communicated to the family along with a high level understanding of the succession plan.

All family members should have a personal crash card that includes all the information listed above as well as any additional personal accounts, including mortgage papers, credit cards and auto titles.

More than one person should know the location of your crash card. Many clients choose to store a copy in a safety deposit box or an in-house safe and have a trusted advisor hold onto the originals. Typically an attorney would hold this document along with the corporate record book, will, trust and other estate documents.

The crash card is not a one-and-done deal. It is a living, breathing document. It should be reviewed and revised once a year or at least every two years. We live in an accelerated, changing world in which your vendors, their contact information and your account access information changes frequently. An outdated crash card does not provide your survivors with the assistance and comfort that is intended.

Thinking about an event that leaves your family and business successors to manage your estate is likely not at the top of your list of things to do for the day. We have a story that may help you prioritize.

We were sad to learn that a well-loved client passed away unexpectedly. He had a number of companies where many people were involved, which could have easily increased the difficulty of this situation for his survivors. However, because he had a succession plan with all the relevant succession documents: wills, trusts, shareholder agreements and operating agreements in place, his survivors could focus on dealing with losing him and on managing damage control for the business. While the ripple effect of losing this entrepreneurial and generous man will be felt forever, the enterprise he left is well-managed and well-executed. And it is all because he communicated with his survivors about the location of the information they would need to move forward in the event of his absence.

Let us help you stay on a path that ensures your survivors are also in as positive of a position as possible someday. Contact us today to start the process of developing your crash cards and succession planning documents.

Remember when you first started working and the idea of traveling for business sounded exotic and adventurous? Then you discovered that business travel means seeing too many hotels and convention centers and not leaving much time for exploring new cities. You also discovered the limitations of your employer’s travel and expense policies. For most business travelers, images of fine dining and staying in 5-star hotels are quickly replaced by the reality of keeping travel costs down to keep profitability up.

Travel and expense policies may take away some of the mystique of travel, but they benefit both employers and employees. Having a travel and expense policy protects employers from fraud and employee error. It also prevents conflict and confusion for employees, providing boundaries and clarity that helps them do their jobs better.

While business travel can quickly lose its allure, good travel and expense policies will stand the test of time. By clearly communicating the policies, travelers and employers will be on the same page, avoiding tax issues, preventing conflict and reducing expensive fraudulent submissions and inadvertent errors. Contact Cray Kaiser today for help creating your travel and expense policies, developing an internal control system or reviewing your policies to identify opportunities for improvement.

Every month you or your accountant creates a profit and loss statement (P&L) for your business and reviews any pertinent information. If you are like most business owners, you look at the net income and maybe a few other numbers and file it away. But if that is all you do, you are missing many of the important stories your P&L tells.

The language and format of a profit and loss statement may be unfamiliar to you if you are not an accounting professional. Once you understand how to interpret a P&L, it reads like a storybook that tells the tale of your business’ financial progress over the past time period, be it a month or a year. When you dive into some of those stories, you learn a lot about your business that you may not have discovered anywhere else. These stories are important because they can help you identify mistakes and fraud, profitability of jobs and opportunities for growth, such as new, more profitable product mixes.

The buzz around the office is about the big client the sales team just closed and how, that, combined with the decline in prices of raw materials, is going to make a great year. Sitting down to review the P&L, you anticipate seeing a nice big number next to net income, but it is much lower than you expected. The P&L is telling you the story of your business, but it is not matching up with your expectations. How could that be? The P&L offers clues to help you discover the problem. Looking at the P&L, you may see that it shows that raw material costs are going up, not down, which does not match with what you had been told by your operating crew. It may be due to a bookkeeping entry error or perhaps while some raw materials prices are decreasing, others are rising. This could also be a sign that some kind of fraud or theft is occurring, requiring you to review your internal controls.

The P&L may offer another explanation for lower than expected net income numbers: issues with job profitability. Even with a great year in the sales department and reduced prices on your raw materials, the jobs or products may simply not be profitable. The P&L can help you identify why. For example, did you hire more staff to manage the additional sales? Maybe those salaries are higher than what you can handle to still be profitable. Maybe additional staff was not yet hired and the quality of the work of the current staff is suffering, creating more warranty claims and returns, which you will also discover by reviewing and investigating these variances on your P&L.

Your P&L does not just identify potential problems; it also shines a spotlight on opportunities. The ratios on the P&L can be compared year-to-year, showing you which jobs or products are becoming more profitable over time and which are declining. This information can help you identify product mixes or job types that could increase the company’s financial performance. You may decide that the sales team for the area that is improving can share their techniques with the other departments.

Next time you sit down with your accountant to review your P&L, ask about the story it tells. If the story does not flow with the tales you have heard from your team, explore the reasons why. You may not find yourself sitting around the campfire reading your P&L to your grandchildren or anxiously waiting for it to come out as a movie, but it is still a story you do not want to miss.

If you’d like help with your P&L, please contact Cray Kaiser today.

Your toga-partying, test-cramming days were years ago. So why should you care about tax credits for education? Because if you’re doling out some dollars for keeping up your skills (or your employees’), there are likely tax benefits to you or your company.

How Employers Benefit

Encouraging your employees to boost their skills with continued education impacts your bottom line in more ways than one. Employees who receive assistance covering educational costs are more motivated and loyal. They do not have to pick up the costs as income. They apply their new skills to help you improve your business. And the costs are tax deductible to boot. It’s a win-win.

It’s simple:

How Individuals Benefit

If your employer does not provide an educational expense reimbursement plan, you can still receive a tax benefit in the form of the Lifetime Learning Credit. Whether you are pursuing a degree in your field or simply taking a class to help you improve your skills, you can take a credit for up to 20% of up to $10,000 in tuition costs and related expenses, for a maximum credit of $2,000.

Limitations depend on income level. In 2023, for example, a married couple’s credit limitation starts at an adjusted gross income level of $160,000, and the benefit phases out completely at adjusted gross income of $180,000 or higher. As the rules for a single taxpayer are different, and the phaseout amounts are adjusted annually, call Cray Kaiser to see which limitations apply to you.

How the Self-Employed Benefit

When you’re self-employed and dealing with a tax rate as high as 37%, investing in your education can benefit your bottom-line not only by improving your skills but also with some welcome tax deductions. As a self-employed taxpayer, business-related educational costs can be deducted directly against your business income. How does that impact your tax situation? Let’s look at an example of an attorney who is in the highest tax bracket. An attorney pays $1,000 for a seminar put on by a local law firm accredited for law coursework. By deducting the $1,000 in course fees, he saves at least $370 in federal taxes. That’s a tax deduction with some impact!

While a Rodney Dangerfield-style deep dive back into your college days may not be in your future, hopefully you or your employees will take some classes along the way. You’re no doubt aware of the many benefits of updating and improving your skills and those of your team members. Be sure to consult with your accountant to understand how to take advantage of the tax benefits of continued education as well.

You are not considering selling your business soon. Fortunately, you are not going through a divorce, and no one has died. So why would you need to pay to find out the value of your business? Some of the many reasons business owners choose to investigate the true value of their business extend far beyond the reasons listed above.

Exploring the financial worth of your company can help your company respond to other parties’ interests, it can help your leadership team make important decisions about the growth of the firm, and it can provide context for succession planning and establishing bonus and compensation structures for key employees and managers.

In some cases, the valuation results can be expressed in the form of a formal report. In others, support and calculations can be provided in abbreviated formats resulting in a less costly alternative.

Reasons most professionals expect business valuations to be conducted typically revolve around communicating the value of the business to an outside party.

Transactions.

Owners often look to the valuation to confirm the value of the Company in a proposed sale or transfer. Often the report is intended to clarify their own opinion of value and sometimes to convince a buyer of the value. These objectives often include:

Litigation.

Financing.

Other common reasons for valuing a business include:

In evaluation of the need for a valuation, it is important to consider the valuation process and not just the resulting conclusion. Valuation is an art as opposed to a science. The conclusion is an estimate of value with merit only to the extent that one understands the process and assumptions upon which it was derived.

Understanding the process unlocks the ability to understand the business model in place and to adjust the characteristics in a way to provide the necessary insights to maximize opportunity and to limit potential risks in the application of a company’s resources.

A business valuation can present you with a perspective on your business that takes strategic planning to a new level:

To learn more about how a business valuation can help your business reach the next level, contact Cray Kaiser today. Click here to read more blogs from our Business Valuation 101 series.

Suppose you’re a partner in a partnership where the agreement requires you to work some of the time for the business. Can you ever be treated as an employee of the partnership for tax purposes instead of as a partner? The lines may become blurry, but the IRS has maintained, at least up until this point, that partners aren’t employees.

New regulations concerning disregarded entities shed some light on this issue. Traditionally, the IRS has said that if you’re a partner who provides services to the partnership, you aren’t treated as an employee of the partnership. The regulations clarify that this result can’t be avoided if you become an employee, based on state law, of a single-member limited liability company owned by the partnership.

What is the tax significance? Unlike corporations, partnerships pass through items of income and loss to partners. You report the appropriate share on your personal tax return. Instead of receiving Forms W-2 as employees do, the partnership issues a Schedule K-1, Partner’s Share of Income, Deductions, Credits, etc., to partners. In addition, you must pay income tax on guaranteed payments made during the year even though you don’t receive a taxable salary. Guaranteed payments are amounts paid to partners no matter the partnership’s income.

Similarly, although employment taxes aren’t deducted from wages, you pay equivalent self-employment taxes. The tax rate is double the usual rate for employees, but half of the amount is deductible on your return.

This tax structure can be problematic if fringe benefits are provided to workers. Because you, as a partner, aren’t treated as an employee, you generally aren’t eligible for the tax exclusion for certain statutory fringe benefits. That means the fringe benefit payments can represent taxable income to you.

Do you have questions about how your business ventures affect your tax return? Contact us for help.

Partnership Tax Terms and What They Mean:

Puzzled by tax-related partnership lingo? Here’s the definition of key terms in partnership tax rules.

It’s awkward. And complicated. And emotional. But dealing with what happens to your estate after your death is an unavoidable and essential task. Like many people, you may have consulted an estate attorney to create a trust and will, ensuring that assets pass along to selected family, friends or institutions. However, like many people, you may not realize there is another step to take. A step that, if missed, could mean your wishes are not followed or your beneficiaries pay more taxes or wait longer to have access to their inheritance.

That is, regardless of who is named on your will and trust, those wishes have no bearing on accounts that have a different beneficiary designated.

As an example, imagine that your uncle goes through a terrible divorce but then meets the woman of his dreams and gets remarried. Being a responsible person, Uncle Charles revises his will and trust naming his new wife as his beneficiary. However, he neglects to update his beneficiary designation on his life insurance policy and his IRAs. When he passes away unexpectedly, his insurance and IRA benefits are paid out to his ex-wife while his new wife receives nothing, even though she’s listed in the will and trust.

As another example, let’s say that you and your spouse created a will and trust that equally distributes your $5 million insurance policy among your four children. However, unfortunately, you had not updated the policy beneficiary designations between the births of your second and third children, listing only the older two by name. Since the beneficiary designation on the account takes precedence over the will and trust, only your oldest two children would receive any inheritance from the policy. The younger two children would receive nothing, which would likely create conflict and drama at an already emotional time.

What if there is no beneficiary listed on an account?

If there is no beneficiary designation on an account, the will or trust will be consulted. However, if there is no beneficiary designation and no will or trust, a court determines your beneficiaries for you.

Even if you have a will or trust to turn to in the case that an account has no beneficiary designated, there can be tax implications for the heir. For example, some accounts must be paid out within five years of death, like annuities, qualified plans and IRAs. A named beneficiary can rollover to a qualified plan or stretch out their withdrawals from the IRA over the rest of their lives, deferring their income taxes. If the beneficiary is named by the will or trust or determined by a court, the funds must be drawn out during a five-year period or possibly even taken out as a lump sum distribution, both of which would be taxed at a much higher tax rate than funds rolled into a qualified plan.

What should you do next?

First, review your estate plan and ownership of your assets. Consider whether your trust should be the beneficiary rather than specific people’s names. Listing your trust has two main benefits:

For example, let’s say you have a $2 million qualified plan that you are leaving to your son. To be fair, you leave the rest of your estate, also worth two million dollars, to your daughter. You feel that you’ve balanced the inheritance perfectly and that both your children will receive equal shares. However, because your son is named, he can take the assets out of the account throughout his life, paying a much lower tax rate. While your daughter, unfortunately, may be required to pay the entire inheritance tax, which is at a much higher rate. While you intended to be fair, tax implications of the various kinds of inheritance leave your son with a much larger amount than your daughter. Naming your trust as the beneficiary and then designating inheritance within the trust will allow you to achieve the balance you desire.

Second, check the following list of accounts to be sure your designated beneficiaries are up to date:

When should you update your beneficiaries?

Some experts suggest checking your beneficiaries annually; others suggest every three to five years. One easy way to remember which accounts to check is to gather the 1099 tax forms from the financial institutions holding your assets, which you should receive in February of each year.

You should also update your beneficiaries any time there is a major change in your life, including:

How do you check who is listed as your beneficiaries?

Simply call your financial institution or see if you can access the information through your online account. Typically, the only information you need to provide about your beneficiary is their name and address, although sometimes a social security number is also required.

While thinking about what happens to your assets after your death can feel overwhelming, awkward and emotional, taking the time to update your beneficiaries prevents animosity and expense for your beneficiaries after your death. If you have any questions about trusts, wills or beneficiary designations, contact us today.