Member of Russell Bedford International, a global network of independent professional service firms.

Major life changes are an exciting and emotional time. But with the positive changes, there can sometimes be challenges too. If you’re facing a change in your life in the near future, have you thought about what the tax implications might be? Below are four examples of life changes that can have complicated effects on taxes that come with them:

Whether it’s a new, exciting opportunity or the result of being laid off, a job change is going to affect your tax obligation. The termination of your previous job likely adds additional taxable income in the form of accrued vacation or a severance package. Review how your former employer handles tax withholdings, especially for big payouts. Your new job also brings new tax implications with a new salary, new benefits and possibly different taxing jurisdictions if you also move to a new location.

The extra money you earn when adding a second job or business also brings extra taxes. How much additional tax this second income creates depends on your specific situation. Employment status, type of business, and how it relates to your other tax activities need to be considered. The extra income alone can send you into a higher tax bracket.

Your retirement plans and timing of retirement plan distributions play a big role in how much tax you will pay on your retirement earnings. For example, with traditional IRAs, there are early withdrawal penalties before you reach age 59½ and required minimum distributions after reaching age 70½ years old. For Social Security, collecting benefits early means less in monthly benefits and potentially a higher tax obligation if you have additional earnings. Each source of retirement income has its own set of taxation rules which can create a very complicated tax environment.

When selling a house or other residential property, the first thing to determine is whether it’s your primary residence. If so, the IRS provides an exemption from tax for up to $250,000 ($500,000 for joint couples) of the gain realized from the sale of your home as long as you lived in it for at least two of the previous five years. Any gain above the exemption is subject to capital gains tax. If the property you are selling is not your primary residence, capital gains tax applies, and you also have to deal with other more complicated tax code issues.

We hope this helps you become more aware of how your tax situation might change in the future based on any decisions you make in your personal or professional life. Always remember to carefully weigh your options and speak with your accountant if you’re unsure about how a future decision will impact your taxes. Contact Cray Kaiser if you have any questions.

There are so many wonderful things about spring. Flowers are starting to bloom, the grass is green, and (hopefully) Chicago is done with snow! But as accountants, we sometimes look at spring with unease. We’ve worked hard all fall and winter to help our clients prepare for April 15th, but how will our collective efforts pan out? While the work of tax season is fresh in our minds, we wanted to share our insights into the lessons learned during the 2018 tax season (Cray Kaiser’s 47th tax season).

Last January, the IRS adjusted the federal tax withholding tables to reflect the reduced tax rates that would apply during the 2018 tax season. As a result, many employees enjoyed higher paychecks, at the sake of reduced federal tax withholding. The problem was that the tables were too generous in reducing federal tax withholding. The tables didn’t take into account other changes in the law, including the loss of tax deductions by higher income individuals. As a result, many taxpayers faced significant, unexpected tax bills.

If you fell into the camp of being disappointed with the tax results, let us know. We can plan beyond the basic tax table to advise not only the appropriate federal tax withholding rate, but also other tax minimization ideas.

The 20% deduction for Qualified Business Income (QBI) was one of the most discussed topics this year. It was not until the summer of 2018 that we received more clarity on “specified service” businesses. There are still uncertainties in the law, which we hope will be ironed out via additional guidance. That said, many of our clients took advantage of the new deduction and the advance planning surrounding maximizing the QBI was effective.

On the flip side, we saw a significant delay in tax reporting from partnerships and S corporations that hold businesses that may generate QBI. Hedge funds in particular will face extremely challenging reporting requirements for the QBI. We expect that some K1’s will arrive even later in the summer of 2019.

Effective for the 2018 tax season, the standard deduction was increased ($12,000 single and $24,000 married filing jointly). Given the $10,000 limit on the income and real estate deduction, as well as the elimination of miscellaneous itemized deductions, many taxpayers’ standard deduction was higher than allowable itemized deductions. Taxpayers that found themselves in this situation would likely anticipate that the standard deduction will probably be more beneficial in the near term. Those taxpayers should consider steps to better plan controllable tax deductions in order to maximize the benefit of the deduction.

At the time of this writing, a mere week after April 15th, our clients have already started receiving tax notices from both the IRS, and more so from the Illinois Department of Revenue. Our advice: Don’t panic! Most of these notices are showing disallowed deductions or credits, but that doesn’t mean the notice is correct. The revenue agencies are simply asking for more information. If you receive any such notice, forward it to your tax advisor. They will be able to provide the information necessary to rectify an apparent underpayment with the information supporting the tax position.

Sadly, there continues to be an uptick in fraud and scams, and tax returns are no exception. As an added protection, the IRS has in recent years provided an Identity Protection (IP) PIN to affected taxpayers. The PIN is a six-digit number assigned to eligible taxpayers that helps prevent the misuse of their Social Security Number on fraudulent federal income tax returns. Taxpayers with a PIN must use the PIN on their tax returns in order for the IRS to accept the tax filing.

Recently, the program opened up to taxpayers here in Illinois. We believe that requesting an IP PIN is yet another tool to help you protect your identity. Please contact us if you’d like to learn more.

While it’s easy to bask in the glow of another tax season behind us, we believe it’s important to continually learn. When a rainy spring day arrives and you want to look ahead to 2019 taxes, give us a call at 630-953-4900. We are happy to walk through the nuances of your tax return in order to plan effectively for next year.

The benefits package that your company offers is extremely important to your employees. How important? A survey performed by the Society of Human Resource Management (SHRM) found that benefits are directly tied to overall job satisfaction for 92% of employees. More importantly, 29% of employees cited the overall benefits package at their current employer as the top reason to look for new employment in the next 12 months.

So, what can you do to keep your employees satisfied when it comes to their benefits package? Here are a few tax-free ways that you can help bolster your benefits package and retain your staff:

According to SHRM, health insurance still remains one of the most important employee benefits. Health insurance benefits come in all shapes and sizes, so you will need to constantly evaluate plans and costs. From a tax standpoint, employers can deduct this expense, and your employees do not report health insurance premiums or employer contributions to health savings accounts (HSAs) as additional income. This includes premiums paid for the employee and qualified family members. Even better, the employee portion of premiums can still be paid in pre-tax dollars.

Employers are able to provide employees with up to $5,000 per year in tax-free dependent care assistance under a qualified plan. There are a few ways to provide this benefit, but a common method is to set up a flexible spending account (FSA) that both the employer and employee can use to make contributions. The employer portion is tax-free, and the employee portion reduces taxable income as long as the total benefit is $5,000 or less.

By offering tuition reimbursement, you can add another quality benefit to your package while investing in your employee’s career. Up to $5,250 of tuition expenses can be reimbursed tax-free to your employee each year.

This is a good benefit for outside sales or other employees that travel frequently. If you have a corporate credit card program, consider passing the points on to the employee. If you reimburse employee expenses under an accountable plan, estimate the value of points your employee earns on reimbursed business purchases and include it in your annual benefits presentation. Generally, the IRS considers credit card points as rebates and not taxable income.

You can generally exclude the cost of up to $50,000 of group term life insurance from your employee’s wages.

Some examples of other nontaxable fringe benefits are employee wellness programs, onsite fitness gyms, adoption assistance, retirement planning services and employee discounts.

The IRS calls these “de minimis” benefits. Small-valued benefits are not included in income and can include things like the use of the company copy machine, occasional meals, small gifts and tickets to a sporting event.

With historically low unemployment levels, employees have more options than normal to look around if they aren’t satisfied in their current position. The benefits package you offer is an important tool to help you retain your valued employees. While each is an additional expense to the employer, the perceived benefit by employees may far outweigh these costs. If you have any questions, please contact Cray Kaiser today.

Every business, no matter its size, needs to have enough cash to pay the bills. Focusing solely on sales and profits could create issues when invoices arrive and you find that there aren’t enough funds available to pay them. Below are five ways you can be proactive and improve cash management for your business:

1. Create a cash flow statement and analyze it monthly. The primary objective of a cash flow statement is to help you budget for future periods and identify potential financial problems before they get out of hand. This doesn’t have to be a complicated procedure. Simply prepare a schedule that shows the cash balance at the beginning of the month and add cash you receive (from things like cash sales, collections on receivables, and asset dispositions). Then, subtract cash you spend to calculate the ending cash balance. If your cash balance is decreasing month to month, you have negative cash flow and you may need to make adjustments to your operations. If it’s climbing, your cash flow is positive.

Note that once you have a cash flow statement that works for you, you can automate the report in your accounting software. Or, you can create a more traditional cash flow statement that begins with your net income, then make adjustments for non-cash items and changes in your balance sheet accounts.

2. Create a history of your cash flow. Build a cash flow history by using historical financial records over the course of the past few of years. This will help you discover if there is a particular time of year which needs more attention.

3. Forecast your cash flow needs. Use your historic cash flow and project the next 12 to 24 months. This process will help identify how much excess cash is required in the good months to cover payroll costs and other expenses during the low-cash months. To smooth out cash flow, you might consider establishing a line of credit that can be paid back as cash becomes available.

4. Implement ideas to improve cash flow. Now that you know your cash needs, consider ideas to help improve your cash position. For example:

5. Manage your growth. Be cautious when expanding into new markets, developing new product lines, hiring employees, or ramping up your marketing budget. All of these activities require cash and you don’t want to travel too far down that road before generating accurate cash forecasts.

Understanding cash flow needs is one of the key success factors in any business. If you are in need of tighter cash management practices, contact Cray Kaiser and we’d be happy to help you.

As a business owner, your day is primarily focused on fulfilling your overall mission, meeting customer needs and keeping up with day-to-day obligations. While less of your time is likely to be focused on the accounting policies that your company is using, we’re here to remind you just how important those policies are.

The accounting policies you adopt create the internal reporting standard that’s reflected in the financial statements of your business – all of which impact how you benchmark and communicate success. What story are you communicating to the outside world? How can you report the story in a way that is easy to understand but still communicates who you are, what you do and how you are achieving success?

First, when selecting accounting policies to use, your first goal should be reporting operational activity and not necessarily based upon ease of recordkeeping. For example, cash basis reporting is easy as we record transactions on the flow of cash in and out of the organization. But it doesn’t account for the significant operational activity that takes place between the use of cash funds and the collection of such funds. Operational activities, such as the conversion of raw materials to finished goods, are central to our operations but are omitted in this process. In this case, using an accrual basis reporting, which tends to be more complex, would tell your story with more clarity.

Another missed opportunity is not prioritizing book reporting objectives over tax objectives. Your operational story becomes diluted when you select accounting policies based solely upon your tax strategies. While minimizing tax obligations is important, reduced profitability is not a story you want the outside world to know. You want your story to be one of steady growth and investment. This occurs when you choose accounting policies based upon operational objectives rather than tax objectives.

As you review your internal financial statements, take a moment to reflect on the story they are telling the outside world about your business. Is it a story of steady growth and investment? Or is it sending a mixed message? We recommend revisiting your accounting policies to ensure that they convey your operational story in a positive, more accurate light. Should you need any assistance, please don’t hesitate to contact Cray Kaiser. You can also click here to learn about our Accounting Services.

As a business owner, your day is primarily focused on fulfilling your overall mission, meeting customer needs and keeping up with day-to-day obligations. While less of your time is likely to be focused on the accounting policies that your company is using, we’re here to remind you just how important those policies are.

The accounting policies you adopt create the internal reporting standard that’s reflected in the financial statements of your business – all of which impact how you benchmark and communicate success. What story are you communicating to the outside world? How can you report the story in a way that is easy to understand but still communicates who you are, what you do and how you are achieving success?

First, when selecting accounting policies to use, your first goal should be reporting operational activity and not necessarily based upon ease of recordkeeping. For example, cash basis reporting is easy as we record transactions on the flow of cash in and out of the organization. But it doesn’t account for the significant operational activity that takes place between the use of cash funds and the collection of such funds. Operational activities, such as the conversion of raw materials to finished goods, are central to our operations but are omitted in this process. In this case, using an accrual basis reporting, which tends to be more complex, would tell your story with more clarity.

Another missed opportunity is not prioritizing book reporting objectives over tax objectives. Your operational story becomes diluted when you select accounting policies based solely upon your tax strategies. While minimizing tax obligations is important, reduced profitability is not a story you want the outside world to know. You want your story to be one of steady growth and investment. This occurs when you choose accounting policies based upon operational objectives rather than tax objectives.

As you review your internal financial statements, take a moment to reflect on the story they are telling the outside world about your business. Is it a story of steady growth and investment? Or is it sending a mixed message? We recommend revisiting your accounting policies to ensure that they convey your operational story in a positive, more accurate light. Should you need any assistance, please don’t hesitate to contact Cray Kaiser. You can also click here to learn about our Accounting Services.

If you have children (or grandchildren) you have an opportunity to give them a jump-start on their journey to becoming financially responsible adults. While teaching your child about money and finances is easier when you start early, it’s never too late to impart your wisdom. Below are some age-relevant suggestions to help develop a financially savvy young adult:

Knowing about money – how to earn it, use it, invest it and share it – is a valuable life skill. Simply talking with your children about its importance is often not enough. Find simple, age-specific ways to build their financial IQ because a financially savvy child will hopefully lead to a financially wise adult. If you have any questions about raising a financially savvy child, please contact your trusted advisor at Cray Kaiser.

Identity theft is a real threat, but it is often downplayed because not everyone has witnessed or experienced it firsthand. Having a false sense of security can leave you exposed, especially during tax season. Here are some tips to keep your identity safe from tax scams and scammers:

1. Be naturally suspicious. Understand that there are people out there trying to get your information, and others willing to pay for it. With that in mind, be suspicious of anyone asking for personal information – especially your Social Security number (SSN). Even when a known vendor asks for your SSN, ask what they will be using it for and refuse most requests unless you deem it necessary.

2. File your tax return as soon as possible. A popular tax scam is to file a fake tax return and deposit the refund into the thief’s account, all before you get the chance to file your own return. You close the door on scammers once your tax return is filed with the IRS so consider completing your return sooner rather than later.

3. Shred your documents. Get in the habit of shredding all paperwork before it’s thrown out to keep personal information from falling into the wrong hands. If you don’t own a shredder, contact your bank or other local community services as they often offer free shredding services on specific days.

4. Keep your Social Security card safe. Only carry your Social Security card with you when it’s needed for a specific purpose. Your wallet or purse is not a good permanent spot for your card. Any criminal would have a treasure trove of personal data if it were to get lost or stolen along with your driver’s license and credit cards.

5. Periodically check your credit reports. The three major collection agencies (Experian, Equifax and TransUnion) are legally required to provide you with a free credit report each year. Take advantage of this service and review the reports. Correct any errors and use this report to monitor your accounts for any potential identity theft.

The bottom line: be smart when handling your personal information. Don’t get caught off guard by identity theft, especially by being careless. If you think you are a victim of a tax scam, alert the IRS right away and go to identitytheft.gov for more information. If you have any additional questions about tax scams, please contact us.

Small business owners are constantly looking for ways to save money and streamline processes in order to stay competitive. Using a cloud-based accounting software, such as QuickBooks Online, is one way to save time and money. Cloud-based platforms require little capital outlay for equipment while offering access to massive data storage and computing power. And because the software handles calculations, you can spend time growing your business instead of crunching numbers. Whether you are a small or mid-size business, moving to the cloud is one way to become more efficient and boost profitability. Here are the top five benefits of moving to the cloud:

Manual data entry is not only inefficient, but it is also prone to errors and compliance risks. With cloud-based accounting, automation of manual processes is possible and allows for automatic synchronization and reconciliation without the need for countless hours of work. Cloud accounting software will check for data entry errors, multiple entries, or other common accounting mistakes, which improves your data’s reliability.

Typical accounting software only allows access to a single user. With the cloud, multiple authorized users, including your accountant, can access the software simultaneously from anywhere with an internet connection. Business owners can now login in real time with their accountants and view the same screen to discuss specific transactions. This makes it easy for your team to collaborate and can help streamline internal controls and reduce error. In addition, teams can stay connected to their data and their accountants.

Maintaining a traditional accounting software can be costly. The cloud spares companies the expense and disruption of needing to update installed software company-wide and cuts the cost of maintaining secure servers in an inhouse data room. With the cloud, everything is done online, which means regular upgrades push automatically and inhouse storage isn’t needed. This helps streamline software maintenance and reduces administrative costs, as they are managed by the cloud service provider.

The cloud provides a secure way to store information. Unlike a hard drive, it can’t be lost, stolen or wiped out. Cloud technology provides backup functionality to prevent the possibility of data loss. You can also control the privacy access of your confidential data with login details. This provides the user with the flexibility to log in using any computer or mobile device, which is great for those on the move.

Most cloud accounting software can integrate with other cloud-based software which allows you to automatically transfer data into your accounting system – or vice versa. Third party applications provide users with options to customize their software and processes – doing away with the “one-size-fits-all” notion. These add-ons can help business owners with specific needs like payroll services, job management and a more robust inventory system to name a few

Businesses in any industry will find a myriad of benefits when moving their accounting processes to the cloud. Cloud-based software isn’t limited to any particular industry, but here are a few examples of how certain industries benefit from cloud-based software such as QuickBooks Online (QBO):

The world of accounting will continue to change and be impacted by advancements in technology. It is vital for businesses of any size to keep up with these changes in order to grow and stay healthy. If you are interested in learning more about moving to the cloud, contact Cray Kaiser today.

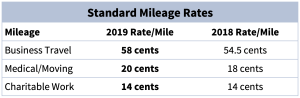

The updated mileage rates for travel for 2019 have been confirmed by the IRS. The standard business mileage rate is increasing by 3.5 cents to 58 cents per mile. The medical and moving mileage rates are also increasing by 2 cents to 20 cents per mile. Charitable mileage rates remain unchanged at 14 cents per mile. Please see the chart below for quick reference:

It is important to properly document your mileage in order to receive full credit for your miles driven. As always, should you have any questions or concerns please contact Cray Kaiser at 630-953-4900.