Member of Russell Bedford International, a global network of independent professional service firms.

Cray Kaiser is proud to announce that Deanna Salo, Managing Principal at Cray Kaiser, has been named a 2025 Chicago Titan 100 honoree. This marks her second year receiving this prestigious recognition. The Titan 100 program celebrates the region’s most accomplished business leaders based on their exceptional leadership, vision, and passion. The 2025 Titan 100 honorees collectively represent companies employing over 439,000 individuals and generating more than $70 billion in annual revenues.

Earning a Titan 100 recognition for two consecutive years is no small feat. The process requires reapplying and undergoing a fierce evaluation by an independent selection committee, raising the bar even higher for the competition. If selected, second-year honorees have the opportunity to further relationships within the Titan 100 community, deepening their connections and amplifying their impact.

Reflecting on her second-year recognition, Deanna shared, “Being recognized as a second-year Titan 100 honoree is an incredible honor. It’s a testament to the value of persistence, collaboration, and the power of building meaningful connections. This recognition inspires me to continue pushing boundaries, supporting others, and contributing to the growth of our business community in even greater ways.”

Our Cray Kaiser team congratulates Deanna on this outstanding achievement and for continuing to exemplify the core values that make Cray Kaiser a trusted leader throughout the Chicago business community. We look forward to seeing how her contributions continue to inspire and shape the future.

Starting January 1, 2024, a significant number of businesses were required to comply with the Corporate Transparency Act (“CTA”). The CTA was enacted into law as part of the National Defense Act for Fiscal Year 2021. It is anticipated that 32.6 million businesses will be required to comply with this reporting requirement. The BOI reporting requirement intends to help U.S. law enforcement combat money laundering, the financing of terrorism and other illicit activity. To learn more about the CTA, listen to this audio blog by Matt Richardson, a senior tax accountant at CK.

Transcript:

My name is Matt Richardson. I’m a senior tax accountant at Cray Kaiser.

So the Corporate Transparency Act is a piece of legislation that went into effect in 2024. And it requires certain companies to report their beneficial ownership information, also known as BOI. And this is a report that goes not to the IRS, but to the FinCEN, which is the Financial Crimes Enforcement network, which is the law enforcement arm of the US Treasury Department. Information that needs to be reported for the business includes the full legal name and any DBA names ortrade names, a business address and the state or jurisdiction of formation, and an IRS taxpayer ID number. Additionally, information has to be reported for each beneficial owner, including a name, address, and an ID number from a valid ID like a passport or a driver’s license. With a few exceptions, the filing is required for any domestic corporations, limited liability companies, or other entities that are formed by a filing with a secretary of state or a similar office to do business under a state or a tribal jurisdiction. Foreign-incorporated entities are also required to file if they’re registered with a state or tribal jurisdiction to do business, and domestic entities that are not created by filing with a secretary of state, like an unincorporated sole proprietorship, are not required to file this reporting.

So a beneficial owner under the CTA is any individual who has substantial control over the company, either directly or indirectly. It can also include anyone who controls at least 25% of ownership. And this is important to note because it’s not only ownership, but it’s also control. So a non-owner officer who has decision-making power can also be considered a beneficial owner under the legislation. The purpose of the BOI is to aid law enforcement and enforcement of financial crimes like fraud, money laundering, sanctions evasion, and the financing of other crimes like terrorism or drug trafficking. And this disclosure of corporate ownership is intended to make it harder for criminals to use shell companies to cover up the financial aspects of their criminal activities. So the BOI reporting requirement has exceptions for certain categories of companies, as well as what it calls large operating entities. The specific categories of companies are highly regulated areas like banking and publicly traded companies and non-profit entities. A large operating entity is defined as any company that has 20 or more employees, five million dollars in gross sales or more, and a physical presence in the United States.

Many are confused about why large companies are exempt from reporting rather than small companies. Since so many government reporting requirements do exempt small companies. But this is because in general these larger companies are going to be visible to law enforcement and regulators through other types of tax and payroll banking reports. Whereas the purpose of the legislation is to make these smaller companies more visible, I mean, easier to track ownership for law enforcement.

So there are different filing requirements for the BOI report depending on when the entity was formed. New entities created in 2024 have 90 days after their creation to file the report. New entities created starting January 1st, 2025 have 30 days to file the report and existing entities created before January 1st, 2024 have until January 1st, 2025 to file the report. And then any companies that have a change in their ownership information or have a correction of an error to report have 30 days from the discovery of the error or from the change in information to file an updated report.

Penalties for willful non-compliance are steep, so the risk involved in shirking the requirements are serious. Consequences can include civil penalties of over $500 per day that the report has filed late, and those can escalate to up to $10,000 in criminal fines or up to two years in jail time. These requirements are generally covered by the Treasury Department’s criminal enforcement arm, which is different than the tax law and IRS matters that CPAs are generally authorized to address. And there are some legal complexities in determining who is a beneficial owner and who is subject to the requirement that need the expertise of a lawyer.

CPA | CK Principal

As the accounting industry evolves, businesses increasingly rely on advisory services to navigate the complexities of their financial landscapes. CAS (Client Accounting Services) and CAAS (Client Accounting Advisory Services) are two such services often discussed. Although these acronyms may sound similar, they represent distinct offerings tailored to different needs. At Cray Kaiser, we aim to empower our clients with the knowledge they need to confidently make informed decisions. By understanding the differences between CAS and CAAS, you can understand which service best aligns with your business’s unique requirements.

Client Accounting Services (CAS) refers to the traditional accounting services that businesses rely on to manage their financial records and transactions. These services are essential for maintaining accurate financial data and ensuring compliance with relevant regulations. CAS focuses on the day-to-day accounting functions that keep a business running smoothly.

Services typically included in CAS:

Bookkeeping: Managing daily financial transactions, including recording sales, expenses, and other activities.

Payroll Services: Processing employee payroll or working with a payroll provider, managing deductions, and ensuring compliance with tax laws.

Financial Reporting: Preparing financial statements and reports that provide insights into the business’s financial health.

Tax Preparation and Compliance: Ensuring businesses meet their tax obligations and prepare necessary tax filings.

Client Accounting Advisory Services (CAAS) takes CAS further by combining traditional accounting services with high-level strategic advice and guidance. It is designed to handle routine accounting functions and provide insights that help businesses make informed decisions and achieve their goals. By integrating advisory services with accounting functions, CAAS offers a more comprehensive approach.

Services typically included in CAAS:

All CAS Services: Including bookkeeping, payroll, financial reporting, and tax compliance.

Strategic Planning: Assisting businesses in developing long-term strategies for growth and success.

Financial Forecasting and Budgeting: Providing insights into future financial performance and helping businesses plan accordingly.

Business Process Improvement: Identifying inefficiencies in business processes and recommending improvements.

Risk Management: Helping businesses identify potential risks and develop mitigation strategies.

The primary difference between CAS and CAAS lies in the level of advisory support provided. While CAS focuses on the essential accounting functions necessary to keep a business operational, CAAS offers strategic advice and guidance beyond that. CAAS is ideal for businesses that need both reliable accounting services and the added benefit of high-level advisory support to drive growth and efficiency.

At Cray Kaiser, we recognize that no two engagements are alike, which is why our proactive strategies are customized to meet each client’s unique needs. Whether you’re looking for dependable accounting support, strategic guidance, or a combination of both, we’re here to help you navigate the complexities of your financial landscape—all under one roof.

If you’re ready to learn more about the CK team and how CAAS can benefit your business, call (630) 953-4900 or click here.

In Cray Kaiser’s Employee Spotlight series, we highlight a member of our CK team. We’re proud of the team we’ve grown and excited for you to get to know them. This month, we’re shining our spotlight on Ryan Maloney.

GETTING TO KNOW RYAN

Ryan plays an integral role as a Staff Accountant on the assurance team at Cray Kaiser. In his day-to-day work, Ryan performs various audit tests and corresponds with clients, ensuring that all processes are thorough and accurate. During tax season, he also steps in to assist with tax return preparations, showcasing his adaptability across different areas of accounting. Ryan is eager to learn and make the most of the opportunities provided at CK to develop his skills further.

Before joining CK, Ryan earned his bachelor’s degree in accounting from Goshen College, where he graduated Summa Cum Laude. His previous role as an accounting tutor allowed him to impact fellow students’ journeys, sparking his passion for helping others.

WHY CK?

Ryan joined the CK team in July of this past year. He was drawn to the firm by the warm and welcoming team members he met during his interview process and by the opportunity to grow in an environment that values learning. At CK, he appreciates being able to work across different facets of accounting, building a foundation for a successful career.

For Ryan, CK’s core value of education resonates deeply. He views every day as a learning opportunity and is grateful for the support and mentorship he receives from experienced colleagues. Ryan credits his rapid growth to the guidance of the CK team, who genuinely care about his development as a young accountant.

Ryan advises newcomers to the accounting field to take note of feedback from managers. He emphasizes the importance of reflecting on review comments and implementing them in future tasks, as this has been a key learning method for him.

MORE ABOUT RYAN

What’s your hidden talent?

My hidden talent is that I am very good at solving Rubik’s Cubes. I have a collection of them, with the largest being 8×8 sides. My fastest time with a 3×3 (normal-sized) is 11 seconds.

What’s on your vacation bucket list?

My #1 vacation spot would be Ireland. I have never been, but my grandparents immigrated from Ireland, and the pictures I have seen are amazing.

Favorite TV Show?

My favorite TV show is Peaky Blinders on Netflix. The movie is coming out soon, so maybe this will be my favorite movie, too!

What’s on your music playlist?

My music playlist is basically all country music. I have many favorite artists, but number one is Darius Rucker.

Although you can’t avoid taxes, you can take steps to minimize them. This requires proactive tax planning – estimating your tax liability, looking for ways to reduce it and taking timely action. To help you identify strategies that might work for you, we’re pleased to present the 2024 – 2025 Tax Planning Guide.

CPA, CVA | CK Principal

Whether expected or unforeseen, the need for a business valuation can happen in a number of scenarios, each unique to your business. Perhaps you’re preparing to exit and pass the torch to the next generation, or maybe you’re seeking financing for your next big venture. A valuation may be needed for gifting or estate planning purposes, or to evaluate a potential buyout offer. Whatever the reason, Cray Kaiser is here to provide the precise valuation you need to make informed decisions.

Gathering and preparing key information and documentation is crucial to ensuring a smooth and efficient valuation process. While every situation is different and may require additional details, we have provided some of the basics that may be requested by Cray Kaiser to complete a business valuation.

Financial Statements

The backbone of any business valuation is the business’s financial health, which is primarily assessed through detailed financial reporting. This includes:

If you need what we call an “accounting catch-up,” we offer a one-time onboarding service to ensure you have up-to-date, accurate financial data.

Tax Returns

Obtaining your business tax returns for the past three to five years helps us further understand your tax obligations and adjustments that may need to be made for the valuation.

Organizational Documents

Key organizational documents provide context and structure for your business operations, as well as spelling out the rights and restrictions applicable to the ownership interest being valued . These may include:

Industry Information

Understanding the broader context in which your business operates is essential. You may be asked to provide any relevant industry reports, trade publications or trade association resources, market analyses, and competitive benchmarking data.

Legal Documents and Contracts

Any legal documents that could affect your business’s value will be requested, including:

Historical Data and Anecdotal Information

Historical context and anecdotal insights can provide valuable background for your valuation. In developing a conclusion of the value of your business, we gain an understanding of the history of your company, notable events, growth milestones, or challenges that have shaped your business. We will also work closely with you to assess the company’s strengths, competitive advantages, and position in the marketplace, as well as any threats and risks affecting the company.

Educating and Empowering You Through the Process

The documents listed above are just the starting point for a business valuation. Because your business is unique, additional documentation will likely be needed to capture its full value. At Cray Kaiser, every business valuation begins with a thorough discussion to understand your specific reasons and goals. From there, we’ll provide a tailored list of all required documentation to ensure an accurate and comprehensive valuation.

We recognize that each situation comes with its own complexities, and we’re here to guide you through the process. If you’re ready to take the next step, contact Cray Kaiser today to begin your business valuation journey.

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on Sohaiba Khan.

GETTING TO KNOW SOHAIBA

Sohaiba is an Accounting Services Specialist at Cray Kaiser, where she plays a crucial role in maintaining financial accuracy. Her day-to-day responsibilities include reconciling accounts, managing the AF roll forward, handling bookkeeping, and preparing returns. With such a diverse range of tasks, no two days are ever the same for Sohaiba as she navigates various accounting and tax-related challenges with expertise.

Looking ahead, Sohaiba aspires to deepen her expertise in tax regulations and accounting technologies, recognizing these areas as pivotal to the industry’s future. She is committed to embracing new challenges and continuously expanding her skill set to make an even more significant impact in her role.

Before joining Cray Kaiser, Sohaiba gained valuable experience working with various firms and companies, which enriched her skills and allowed her to thrive in diverse cultural and professional environments. She holds a Bachelor of Science in Accounting from Governors State University, where she built a strong foundation. This background has equipped her with the knowledge and expertise to excel at Cray Kaiser.

WHY CK?

Sohaiba joined the Cray Kaiser team in July 2024, eager to dive into a role offering comprehensive exposure to tax and accounting services. The dynamic work environment and the promise of continuous learning and growth immediately attracted her, allowing her to make meaningful contributions from day one.

The core values that resonate most with Sohaiba are education, integrity, and care. She believes fostering a culture of continuous learning, upholding ethical standards, and genuinely caring for clients and colleagues is essential for personal and professional growth.

When it comes to her favorite CK outing, Sohaiba enjoyed this year’s “Spa Day and Golf Card.” It provided a delightful opportunity to unwind and bond with colleagues, allowing her to relax and recharge while enjoying some well-deserved downtime.

MORE ABOUT SOHAIBA

If you could be an expert at anything, what would it be and why?

Cooking has always been a passion of mine; I started cooking when I was just 11 years old. I truly believe that food has the power to bring people and cultures together and create moments of joy and connection.

How do you like to spend your weekends/time off? Bonus question: what do you want to do most when tax season is over?

During my weekends and time off, I love to spend quality time with my family, immerse myself in good books, and take the opportunity to rest and recharge. After the busy tax season, I look forward to relaxing and possibly exploring new recipes in the kitchen.

What motto do you live by?

My motto is, “When you do good, God does you good.” This belief encourages me to lead a life of kindness and integrity, knowing that my actions can positively impact others.

What’s your favorite movie or tv show?

“Catch Me If You Can” on Netflix!

The IRS has recently launched the Second Employee Retention Credit Voluntary Disclosure Program (ERC-VDP), which presents a critical opportunity for businesses that may have inadvertently filed erroneous ERC claims for the 2021 tax period. This program, effective from August 15, 2024 to November 22, 2024, offers a path for businesses to correct these errors and avoid potentially severe penalties as the IRS ramps up its enforcement efforts against improper ERC claims.

Understanding the Second ERC-VDP

The Second ERC-VDP is different from the initial program, which closed in March 2024, offering a slightly different set of terms for repayment and eligibility. Under this new program, eligible businesses can repay 85% of the ERC amount they received. This is a more favorable rate compared to the first ERC-VDP, making it a viable option for those who missed the initial window.

It’s important to note that this program exclusively covers ERC claims for the 2021 tax periods. Businesses that need to rectify claims from 2020 are not eligible under this program and should seek alternative compliance options.

Key Eligibility Criteria

To qualify for the Second ERC-VDP, businesses must meet several stringent criteria:

Application Process

For those eligible and interested in applying, the process is straightforward but requires attention to detail. Businesses must complete Form 15434, the Application for Employee Retention Credit Voluntary Disclosure Program, and submit it via the IRS Document Upload Tool.

In cases where businesses cannot repay the required 85% upfront, they may apply for an installment agreement by submitting Form 433-B, Collection Information Statement for Businesses, alongside their application package. It’s also essential to include Form 2750, Waiver Extending Statutory Period for Assessment of Trust Fund Recovery Penalty, if applicable.

What Happens After Application Approval?

Once the IRS approves the application, businesses will receive a closing agreement. They are then required to repay 85% of the ERC received, which can be done online or via phone using the Electronic Federal Tax Payment System (EFTPS). Penalties and interest will apply under the standard terms for those opting for an installment agreement.

Deadline and Resources

All application packages for the Second ERC-VDP must be submitted by 11:59 p.m. local time on November 22, 2024. The IRS has provided a comprehensive set of FAQs on their website, detailing the nuances of the program, including eligibility, application steps, and the consequences of non-compliance.

At Cray Kaiser, we understand that navigating these programs can be complex and daunting. Our team is here to help you assess your situation, determine eligibility, and ensure that your application is accurate and timely. Don’t let an improper ERC claim result in unnecessary penalties—reach out to the experts at CK today to explore your options under the Second ERC-VDP.

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on David Dang.

GETTING TO KNOW DAVID

David plays a crucial role in the assurance department at Cray Kaiser. As an in-charge assurance accountant, he is deeply involved in the audit process, whether it’s for-profit, non-profit, or employee benefit plan (EBP) audits. David’s day-to-day responsibilities include performing audit tests and conducting analytical procedures to ensure that financial statements are accurate and comply with relevant regulations.

Before joining Cray Kaiser, David earned a Bachelor of Accountancy and Finance from DePaul University. He then spent two years working at Baker Tilly, where he gained valuable experience that has shaped his approach to accounting. David’s background has equipped him with a strong foundation in both theory and practice, which he now applies to his work at CK.

WHY CK?

David was drawn to Cray Kaiser by the firm’s commitment to “lifelong learning.” This motto resonates with David, who is passionate about continually expanding his knowledge in both assurance and tax. The opportunity to grow and learn in a supportive environment was a major factor in his decision to join the CK team in July of 2024. Since coming on board, David has embraced the firm’s culture of education and is eager to develop his skills further.

For David, the core values of “education” and “people” hold special significance. He values the chance to learn from new experiences and the mentorship provided by his colleagues. The supportive environment at CK, where everyone embodies these values, has been instrumental in David’s professional development. He aspires to follow in the footsteps of his mentors and contribute to the growth of others in the firm.

David’s advice for those just starting out in the accounting industry is simple but profound: be open to new experiences and ask a lot of questions. He believes that there is no such thing as a dumb question, especially when you are new to the field. For David, the key to success is a willingness to learn and the courage to seek out knowledge whenever possible.

MORE ABOUT DAVID

How do you like to spend your weekends/time off?

I like to cook and try new recipes; I am currently on the hunt for the best chocolate chip cookie recipe!

What motto do you live by?

Failure builds confidence. You learn so much from your mistakes so you should be open to trying new things and know you won’t be perfect.

Do you have a special/hidden talent or hobby?

I can solve a Rubik’s cube in less than 30 seconds. I hope to improve my time and learn how to solve it blindfolded!

What’s your favorite movie or TV show?

Oceans 11 is my favorite heist movie, and it has a star-studded cast! Community is my favorite TV show (6 seasons and a movie)!

What’s the last book you read?

Atomic Habits and Dessert Person. My favorite self-improvement book and my current baking obsession.

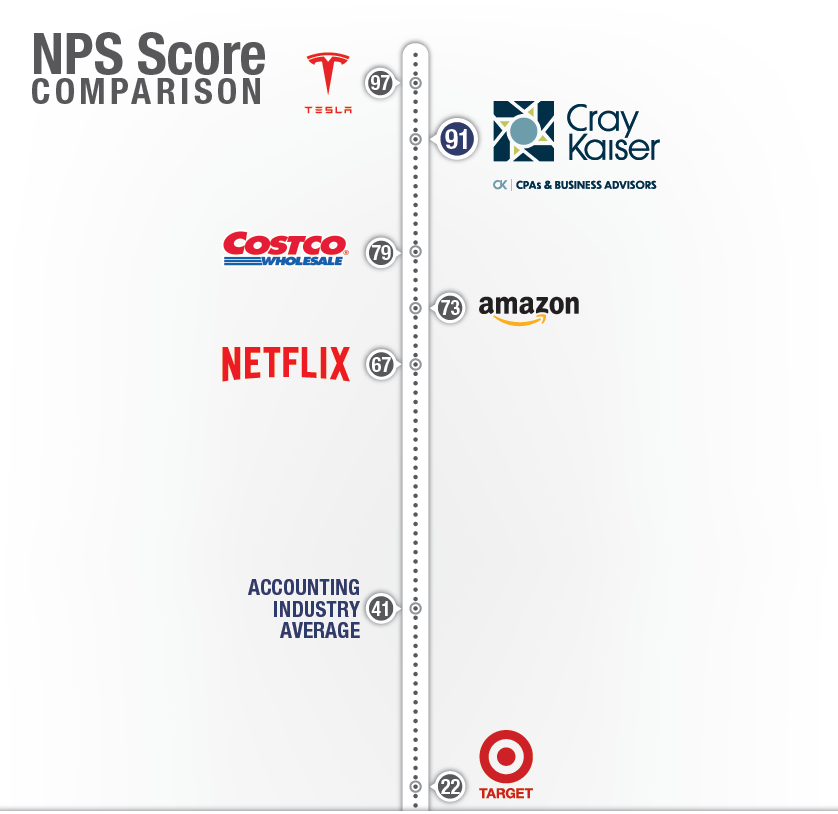

At Cray Kaiser, trust is more than a core value—it’s the foundation of every client relationship. We believe trust is earned through consistent dedication, transparency, and a deep understanding of our clients’ needs. This commitment to building trust is reflected in our work, and as our 2024 NPS score reveals, it continues to resonate with those we serve. Our clients’ trust in us is an honor and a driving force behind the high levels of satisfaction and loyalty we’re proud to see year after year.

NPS Demystified

For anyone unfamiliar with it, Net Promoter Score, or NPS, is a standardized metric used across industries to gauge customer loyalty and satisfaction. How does it work? Customers are asked one straightforward question: “On a scale from 1 to 10, how likely are you to recommend our business to a friend or colleague?”

From the responses, customers fall into one of three groups:

The formula to derive the NPS is as straightforward as the question itself—subtract the percentage of detractors from the percentage of promoters.

To give some context: A score above zero is already good, surpassing 50 is deemed excellent, and anything beyond 80 is simply incredible.

Cray Kaiser: Continuing to Set New Industry Standards in 2024

Just as your numbers tell the story of your business, ours tell the story of our commitment to excellence. This year, we’re proud to have achieved an NPS score of 91, far surpassing the accounting industry’s average of 41. But our success doesn’t stop there—our score also outpaces market leaders like Costco, Amazon, and Netflix.

For us, it’s more than just a number—it’s a powerful affirmation that our clients trust and genuinely value the service we provide.

Your Trusted Advisors

At Cray Kaiser, our success hinges on your success. In 2024 and beyond, our commitment remains steadfast: prioritizing your needs, delivering impeccable accuracy in our numbers, and providing unmatched people skills. We’re here to support your growth, navigate challenges, and celebrate every milestone with you. We look forward to another year of achieving success together!