Member of Russell Bedford International, a global network of independent professional service firms.

CPA | CK Principal

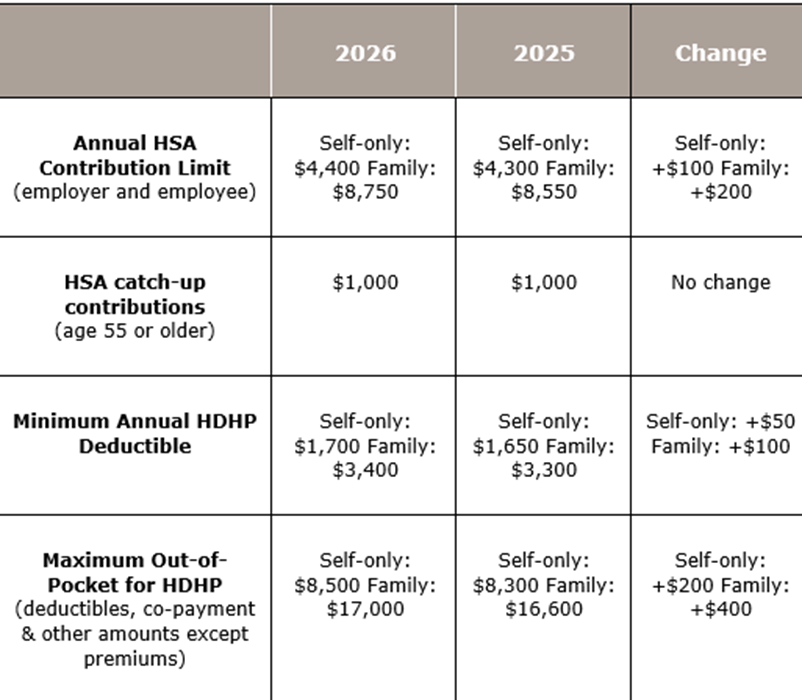

As we await possible significant changes to the 2026 tax law, the IRS has provided guidance on Health Savings Accounts (HSA). Specifically, they’ve recently released the inflation-adjusted contribution limits for 2026 related to HSAs and high-deductible health plans (HDHPs). While there are modest increases in the contribution limits, the HSA catch-up contribution amount remains unchanged.

Important Reminder: You can only contribute to an HSA account if you are enrolled in a High Deductible Health Plan (HDHP). The IRS sets specific criteria for what qualifies as an HDHP, including minimum deductibles and maximum out-of-pocket expenses.

One key tax benefit of HSAs that stands out is that contributions are tax-deductible even if you don’t itemize deductions. Additionally, these funds grow tax-free over time.

When HSA funds are used for qualified medical expenses, such as doctor visits, prescriptions, and certain medical procedures, withdrawals from an HSA are tax-free. However, if you use HSA funds for non-medical purposes, you will owe income tax plus a 20% penalty (10% after age 65).

To read more about the benefits of an HSA, click here. If you’d like to explore how an HSA could fit into your financial planning, please contact our office at 630.953.4900 or fill out this form.

CPA | CK Principal

In a world where resources are stretched thin and regulatory compliance is more demanding than ever, many organizations are asking the same question: How can we effectively plan for and manage our external financial statement audits?

The answer for many is to leverage outsourced support, particularly through Client Accounting Advisory Services (CAAS). If you’re skeptical about how an external team can integrate with your team’s processes, you’re not alone. But with the right support, you can significantly reduce the workload on your team, meet deadlines and stay in compliance, without sacrificing accuracy or transparency. Here’s how CAAS can help you simplify and strengthen your external audit process.

Many firms have dedicated teams specializing in client accounting and advisory services (CAAS or CAS). These teams are experts in audits, financial reporting and compliance. When you engage a CAAS team, you gain access to seasoned professionals who can assist your in-house accounting functions in planning for the year-end financial statement audit without disrupting your day-to-day operations. Here are several key areas where CAAS support can make a real difference:

Planning for your next external audit doesn’t have to be stressful or overwhelming. If you consider the topics discussed above and look to outsource some of these tasks to professionals who can guide you through the process, you will be able to save time and resources for your internal team.

Let CK’s CAAS team help. We offer tailored solutions to support your audit readiness and financial transparency. Reach out today to learn how our experts can help your organization move through the audit process with ease.

CPA | CK Principal

Illinois taxpayers looking to give back while receiving a tax benefit now have a new opportunity with the Illinois Gives Tax Credit Act. Effective January 1, 2025, the act allows donors to receive a 25% state tax credit for qualified charitable contributions made to permanent endowments at approved community foundations.

However, the State has capped the program at $5 million in total tax credits per calendar year through 2029. Additionally, the credits are distributed based on the order in which the donations are received. Because of these limitations, we recommend that you act early if interested in the credit.

Only permanent endowment funds held by Qualified Community Foundations are eligible to receive donations that generate the credit.

Donations can support or establish funds that:

Qualified Community Foundations are specifically designated as such by the State. Additionally, each Qualified Community Foundation can issue up to $750,000 in credits per year (15% of the $5 million available in total annual credits).

Be sure to inquire on eligibility before starting the contribution process.

The Illinois Gives Tax Credit offers a limited amount of State tax credits no matter if donors itemize or take the standard federal deduction.

The credit can only offset your state income tax liability each year. Any excess credit is carried forward and applied to your tax liability in the subsequent five taxable years.

Donors should apply online at MyTax.Illinois.gov and request a Contribution Authorization Certificate (CAC). Once the CAC is received, you have 10 business days to make your gift to a Qualified Community Foundation.

If you have questions about the Illinois Gives Tax Credit or are ready to take advantage of the new credit but need assistance, contact Cray Kaiser at 630-935-4900 or visit here.

Deanna Salo, Managing Principal at Cray Kaiser, shares valuable insights for business owners navigating the complex process of selling their company. She discusses the various payment structures sellers might encounter and the tax implications of each. Deanna also highlights common pitfalls that can be encountered throughout a merger or acquisition. Whether you’re beginning to explore a sale or already deep into negotiations, this video offers practical guidance to help you make informed decisions.

Transcript:

My name is Deanna Salo and I’m the Managing Principal here at Cray Kaiser, Limited CPAs and Advisors.

When a seller receives a letter of intent and is trying to understand how much money am I going to get and when am I going to get it, you know, in the current market we’ve seen a lot of private equity firms coming in and they’ve got a lot of cash to spend on new investments. And so they’ll come in and provide a full cash deal at closing. The seller looks at that and says, “Wow, that’s fantastic.” That also might indicate a lower value for your company because they’re willing to absorb that risk of what might happen after they purchase your company. We do see sometimes that in private equity deals while I might get all my cash up front, what happens if my company grows exponentially because I’m still here with maybe an employment agreement, maybe I’m helping them around the corner of maybe some existing big deals that I’ve had already in the hopper when I sold them my company. In that situation, I may want some additional cash on the on the prospect of me getting additional profits in the company and I might even want an earn out what might be some future compensation to me as the seller for me doing really great work while I’m still hanging around. So the benefit of getting all the money at closing is that the seller can turn around and reinvest that and kind of look to retirement. Some sellers want to stick around for a little longer. Some buyers need the sellers to stick around a little longer. So in that case, you’ll want to make sure that you, as the seller, have some uptick, up game, on the back end of maybe some of these deals. When private equity, excuse me, when a privately held company comes in to buy another privately held company, oftentimes we see that they don’t maybe have as much liquid cash. They may be financing it with a bank and maybe they need the seller to finance a little bit more of that. In that situation, the seller has a little bit more risk. What if I don’t get all my money at closing? I then, as the seller, am bearing the risk of maybe not getting paid the rest of my money over the set amount of time that I was told that I was going to be able to receive my money. So, in either situation, cash at close, cash at close plus earn up, or maybe the seller has to take financing on the proceeds of the sale of their company. Each one of them have different tax effects to the seller. Each one of them may adjust the value of the company because there’s a risk and reward element of timeliness of getting all my money up front versus timeliness of getting my money a little bit over time versus me having to wait as the seller for five to seven years before I get my money. We often see our sellers, our clients not wanting to wait very long for their full cash outlay of their sale of their company. But again that might also indicate a risk of the buyer that they have to come up with all the money at closing and it might affect the value of the of the company and might reduce it a little bit more too. So there’s a lot of numbers that play into a fact of do I get my money all at closing? Do I get my money at closing with some additional uptick on an earn out? And lastly, will I get some money at closing and maybe get the rest of my money over a period of time?

A common mistake I see is going too fast. This is a process and with due care and listening to your advisors in each of the phases of a transaction is really important. If a buyer is really eager and wants to go really fast through the transaction, you as the seller might be really excited and want to go as fast with them, But we really need to be thoughtful in each phase of a transaction because it affects the future of your company, the future of your people, as well as the future of your customers and vendors that you’ve been serving for the many years you’ve been in business. So I think sometimes, you know, people want to get the deals done, they want to get the deals done quickly. There is a point of it’s taking too long versus it’s going too fast and somewhere in between is probably the right speed by which these transactions are best processed.

I think the red flags that companies need to look at is if you’re looking at a buyer, I would suggest that you’re looking at more than one buyer before you sign a letter of intent. If you have multiple buyers that are courting you to sell your business to them, I think that is a good position for the seller to be. If you really only have one buyer in the market for yourself, it may not be the right time to sell your company. Again, sellers get really excited because they may be done. They may be mentally, physically ready to be out of their business and they may want to go too fast, as I mentioned before, going too fast through the process. Jumping into the wrong conclusion is one of the red flags I see and that’s even on the buyer and the seller side.

So, in terms of the communication and what role we play in the very large group of advisors as we talked about, the buyer is going to have its group of advisors and the seller is going to have its group of advisors and you don’t want to be tripping on one another. So, having a clear line of roles and responsibilities in the process of selling your company is really important. Somebody needs to take the lead. Sometimes Cray Kaiser is called upon to set up the data room, which is an electronic space for all the information that’s going to be shared. There’s folders set up in there so it really identifies the attorney’s lane, the accountant’s lane, maybe payroll and HR lane. And so being very organized in this process and making sure that people are communicating. At the very front of all of this, the owners are going to be overwhelmed. The sellers, our clients, are usually very overwhelmed. So we typically have weekly calls with them just to make sure that we’re on pace, information is being shared. Both the buyer and the sellers use a lot of checklists to make sure all the work is getting completed and we can have a timeline for which the transaction is supposed to transpire. So making sure you’re organized to get set up. The attorneys, they’ll talk to one another. The accountants typically are the ones talking to one another. We, Cray Kaiser, get involved. Sometimes talking to the attorneys, we’ll get drafts of the agreements as they’re getting drafted by the buyer to just make sure that it makes numerical sense. But clearly the attorneys are used to make sure that the companies are protected from any of the things that we need to be protected on in the seller’s position. So if everybody does what they’re supposed to do and communicates at a high level, stays in their lane to the extent that they are hired to do a specific task. But certainly raising their hand during the course of these conversations as well as, you know, having some memorial timeline points that we each have to come and connect on to make sure we’re moving through the transaction as efficiently as possible. So being organized, a timeline of communication, setting forth the roles and responsibilities of your advisors, the data room is super helpful. It’s an electronic place to keep everybody organized to what they’re looking at, and, again, keeping the owners involved as much as they need to be. But also they’re relying on us as professionals to get the work done and get to the goal line.

All of this process, there’s lots of phases to this process, and at Cray Kaiser, you know, we’re here to help our clients, again, to and through their transactions at whatever point in their life cycle they’re at. And if you need any further assistance on that, please feel free to give us a call. Cray Kaiser is here for you during any part of this transaction.

CPA | Manager

Financial statement audits don’t have to be a stressful time for nonprofit organizations. With some proactive planning and preparation, nonprofits can successfully prepare themselves to have a successful and smooth audit process. Below are some key tips to help your team get ready before the auditors arrive:

1. Get Organized

Make sure that important documents are easy to find and well-organized. This includes:

Having these readily available will help to streamline the audit process.

2. Update Your Books

Ensure your accounting records are current. You should:

Up-to-date books are essential for a smooth audit.

3. Review and Analyze Financial Results

Before the audit:

If something looks off, investigate further. It might require adjusting a journal entry.

4. Know Your Compliance Requirements

Nonprofits face unique compliance obligations. Be aware of the following:

Know your state and federal requirements ahead of time.

5. Coordinate with Your Audit Firm

Proactive communication with your auditor can prevent delays and confusion. Consider the following:

At Cray Kaiser, we understand that preparing for an audit can feel overwhelming. Our experts are here to support you every step of the way, from organizing your records to navigating compliance requirements and coordinating with your auditors. If you need guidance with preparing for your upcoming audit, don’t hesitate to contact us at 630.953.4900 or fill out this form.

In this video, Deanna Salo, Managing Principal at Cray Kaiser, shares the story behind the firm’s relationship with Russell Bedford International, a global network of independent accounting and consulting firms. Deanna explains how Cray Kaiser’s commitment to supporting clients with international needs led them to seek out a network that offered trusted partnerships across the globe. From cross-border transactions to international tax planning, Russell Bedford has empowered Cray Kaiser to expand its reach while staying true to its values. Learn how this collaboration has deepened the firm’s bench, strengthened its global perspective, and enhanced the services offered to clients both locally and internationally.

Transcript:

My name is Deanna Salo and I’m the managing principal here at Cray Kaiser, Limited CPAs. I’m here today to talk to you about our relationship with Russell Bedford International Network and basically how we came to find this network and how it serves us in assisting us to serve our clients. So about 15 years ago, our clients were starting to grow in shape and size, dipping their toes if you will across the pond in deciding where they’re going to do business globally. Many of our clients have been doing business globally, but we’ve been able to serve them by leaning on attorneys or other affiliations. Through other networks, we were able to serve them. Our tax department has always done an exemplary job in being able to look up treaties and determine tax treatments and making sure that our clients were compliant in all the necessary pieces of their annual filing, whether they were doing business here in the States or whether they were doing business afar.

About 10 years ago, we decided to join a different group, another network, an international network that was based in the Chicago land area that we felt very aligned with. We were going to help them when they needed it, and they were going to help us when we needed it. About two years into that relationship, that organization ended up rolling up into a national firm. And it was very soon thereafter that we basically did not feel the same connection, access, and just compliance and alignment of how we wanted to serve our clients and our access to those technical things we needed when dealing with international business.

So, we received a phone call with a British accent on the other side of it asking us if we’d like to join an international network and we were surprised because of the very lovely British accent on the other line of the phone. At the same time, he said, “I’ll be in Chicago. Would you like to have a chat?” And we said, “Of course, come on by.” So, we met with the membership development person at Russell Bedford International. It was in September of that year in 2017. And they were having their annual meeting in New York City in October of that same year. And we said, “Sure, let’s go try it out. Let’s go meet and greet.” This is their global annual meeting. So people are coming from all over the world to attend this annual meeting. So I got the wonderful opportunity to hit New York City Times Square and meet what were some of the most amazing, relatable, independently owned and operated CPA firms from across the globe. And it was almost love at first sight. We had collaboration, sharing stories, sharing skills, determining how we could do business with one another without feeling a need to tit for tat and give and take, which is kind of how we felt in these other relationships we’ve had.

So since 2018, fast forward to now, we have received a number of referrals from Russell Bedford, which was not the reason why we joined. We specifically joined our intent was always to deepen our bench in our understanding of international tax law. So when I have a client who’s buying a property in Tuscany, Italy, I could pick up the phone and have somebody on the other end willing and ready to technically assist my client, language, find attorneys, find land surveyors, find whatever I needed, you know, time zones away from where I’m sitting. And so the ability to do that, the ability to serve, even though it was no increased billings for Cray Kaiser, the ability to provide resources to our clients in their moments of need, transactionally, educationally, networking-wise.

It’s been a profound impact not only to our ability to serve our clients but also even with our staff. When we’re recruiting for employees and to be able to say you’re working in our size of our firm in Chicago at an international CPA firm and you will be doing some international work is a really interesting thing for many people. They like to savor international tax law, or just the opportunity to be talking with people, networking with people from not just your area, but literally from across the globe. So our reason to join was really to deepen our bench. Certainly from a recruiting perspective, it was a fantastic roadmap to getting new staff here. And we also had the opportunity to have exchange students, some college graduates from Spain that were coming to the United States and wanted to intern with us. We’ve had those opportunities to exchange some personnel and again fast forward to 2019, I was asked to be on the board of Russell Bedford International and so since then I’ve had the opportunity to sit amongst some extremely brilliant individuals. My perspective of how we do business here in the United States has been enhanced globally by really understanding boots on the ground, what’s happening in the world, in business, as these other practitioners are trying to serve their clients amidst economic downturn, war, social responsibility, global warming, all the various impacts that other parts of the world are far more sensitive to than what we might be here in the United States. So, the perspective gained by this relationship has profoundly impacted how I’m able to serve our clients here at Cray Kaiser.

Some of the statistics that I just want to share a few of just to understand the size of Russell Bedford International because here in the United States it’s not as well-known as some of the other global alliances which are typically supported by the big four CPA firms. They rank in the top 20 global networks around the world. This past year, we ranked 17th among the top 20. I have 110 countries that I can call upon literally picking up the phone or dropping an email and having what is otherwise real-time or next-day responses if those folks can help my clients. There are 375 offices around the world and almost 10,000 people at these other firms globally that are ready and waiting to assist us. Conversely, one of the new things that we’ve been able to do, not really new, but it’s been a wonderful enhancement to our relationship, is we’re getting called upon to assist their clients here in the United States. There’s a lot of business that wants to be done here in the United States, so we have clients that are now ours from Ireland. We have clients that are now ours from Spain, from the UK. And while those other CPA firms host the relationship, we’re used to assist in getting those companies set up here in the United States to do business here in the United States. And so we not only have the referral from that other firm in those other countries, but we now get the opportunity to work alongside them to help secure their relationship as well. Because on both sides we want to keep our clients happy and well served as well with the resources that they need to keep their businesses going. So it’s a win-win across the board.

One of the other things that I think felt very in well-alignment with our firm was really their vision and their mission and their vision is why we exist, to be the global network of choice for independent professional service firms committed to sharing core values and to enable their clients to do better business globally. And that’s really what we’re all trying to do, is do better business globally. Not every one of Cray Kaiser’s clients needs a global representative, but at some point in time, they might and we’ll be ready by being able to leverage our relationship with Russell Bedford.

Their mission is also to take clients further to a better future and that again, similar to Cray Kaiser, we want a better future for our clients and we want to see them to and through their transactions. So Russell Bedford for Cray Kaiser has been a fantastic alignment, very resourceful, growing our business, growing our people, and certainly growing relationships abroad.

Russell Bedford has empowered Cray Kaiser to serve our clients domestically and globally in an enhanced position than we’ve ever had before. And as I said earlier, it’s because of the commitment to serving each other, whether it’s a tax question, a transactional question, I need somebody, do you have the resources, and trusting that the person on the other end of that email or phone call is going to deliver. It’s no different than how we make referrals here in the states, but having an international alliance network to deepen our bench, to enhance our employees’ experiences in doing the work that they do here, enhance our education, our perspectives, our awareness of what’s happening globally and locally is really why Russell Bedford has been such an amazing colleague and companion to Cray Kaiser over the past handful of years. In summary, if you want more information about how we can help you with your international or local accounting or tax or advisory services, you can check us out at www.craykaiser.com and Russell Bedford and Cray Kaiser’s team would be welcome to have you give us a call.

When hiring a new insurance agent, it’s essential to evaluate more than just their skills and cultural fit — you must also consider the financial impact. A new hire can significantly affect your agency’s cash flow, both in the short term and long term. Here are key financial considerations to keep in mind when making this important decision:

1. Salary and Compensation Structure

The most immediate and ongoing cost of hiring a new agent is their compensation. Your agency must decide whether to offer a base salary, commission-based pay, or a combination of both. Each structure impacts your agency’s cash flow differently:

Projecting how these salary and commission structures will fit within your overall budget and monthly cash flow is critical to making an informed decision.

2. Onboarding and Training Costs

Training and onboarding investments are necessary for a new agent’s success, but they also come with costs. You must consider:

Tracking these expenses and their potential ROI is essential. A well-trained agent can generate income sooner, but upfront expenses must be carefully managed.

3. Employee Benefits and Related Costs

Beyond salary, employee benefits add to overall hiring costs. Benefits may include:

Calculating the total cost of employee benefits and their impact on your agency’s cash flow — both immediately and over time — is crucial for financial planning.

4. Technology and Tools

Equipping a new agent with the necessary tools ensures productivity but also adds to operational costs. Consider expenses for:

While investing in the right tools can enhance efficiency, initial costs should be factored into your cash flow projections.

5. Revenue Generation Potential

A key factor in justifying hiring costs is assessing the new agent’s potential to generate revenue — both in the immediate and long-term. Consider:

By comparing projected revenue generation against hiring costs, you can better determine the financial feasibility of your decision.

6. Ramp-Up Time and Cash Flow Impact

New agents often require time to establish their client base. Calculate the projected ramp-up time, which can vary depending on the market and the agent’s experience. During this period, be prepared for slower cash flow:

Proper forecasting helps manage expectations and ensures financial stability during the transition period.

7. Long-Term Financial Considerations

Beyond immediate costs, hiring decisions should align with your agency’s long-term financial goals. Consider:

Conclusion

Careful financial planning is crucial when hiring a new insurance agent. While hiring costs can be substantial, the right agent can provide significant returns on investment, making the expense worthwhile. By incorporating these financial considerations into your decision-making process, you can strengthen your team’s capabilities while maintaining a healthy cash flow for your agency’s growth.

How Cray Kaiser Can Help

If you’re considering hiring a new insurance agent, the experts at Cray Kaiser can provide financial insights and strategic planning to help you make a well-informed decision. Our team specializes in financial analysis and business consulting to help your agency maintain a strong financial position while expanding your team. Contact us at 630.953.4900 or visit www.craykaiser.com to learn more about how we can assist you with your hiring strategy.

If you’re a business owner considering a sale or acquisition, understanding the key differences between mergers and acquisitions is crucial. In this third installment of our series about mergers and acquisitions, Deanna Salo, Managing Principal at Cray Kaiser, breaks down these concepts in simple terms and shares essential advice for navigating the transition. Deanna offers insights that can help make your transaction smoother. She also highlights the critical role an accountant plays in guiding business owners through financial readiness, due diligence, and post-sale planning.

Transcript:

My name is Deanna Salo, and I’m the Managing Principal here at Cray Kaiser, Limited CPAs and Advisors.

There’s probably thousands of definitions on mergers and acquisitions if you Google it, and I think the best way that I like to quantify it is with a math problem. A merger is A plus B equals C. That’s where two joining companies come together and they decide to create something brand new. So C is the new company. An acquisition is a little bit different math problem. It’s A plus B equals A or B. And this is where somebody’s relayed the buyer and somebody’s the seller of the company. And whoever survives the acquisition is who absorbs the target. So, you know, I think in today’s environment, we really don’t see very many mergers going on anymore. They’re pretty much acquisitions where somebody at the end is absorbing the target or the selling company and they become part of the existing or the buyer’s company.

I think the best piece of advice I have actually given to most of my clients who have gone through the process of thinking about selling their business is keep your eyes on your business. This effort to sell your business, while it might only be 45 to 60 to 90 days, it may take much longer than that. Certainly the readiness of getting ready to sell your company is a long and can be a longer process, if you take your eyes off of the business, you may fall upon economic hardship. You may not be pressing all the different strategies that you have within the company. So keeping your eyes on the business to keep it running successfully while you’re taking a lot of energy and time to this acquisition sale process is really the best piece of advice. It’s easy to get rolled up in the acquisition process because it’s an exciting time. A lot of people ask in your questions about a lot of things but keeping your eyes on the business is probably the single best piece of advice that I have actually given clients and they look at me and they say oh yes we definitely need to keep our eyes on the business during this process.

In sharing the news with your organization, I would suggest a best practice is you start with your C-suite in terms of understanding what this process is going to be because many of the executive team will need to be a participant in the due diligence. So start small. What happens sometimes is the deals don’t go through. We actually had a client who went all the way up until a week or two. I think it was 10 days before the actual closing was to happen and the seller decided not to sell their business and they were wise to only really include the ownership team and some executive team members within the journey that got them even there. They did not tell the entire company. What happens oftentimes is there’s going to be little, mini tornadoes in your company of information being shared and so you could lose employees, you could lose customers, you could lose vendors if there would be a word on the street that you could be sold. So keeping the information, which is super hard to do because most owners are very excited with this new opportunity and they want to share it with everybody, that keeping the information to the tight group until such time as it’s appropriate to tell the rest of the organization about the great new news is a best practice. I think in smaller organizations where everybody knows everybody’s birth dates and anniversaries and they know when they’re feeling well and they know when they’re not feeling well it’s much more difficult to hold back the news when there’s an opportunity to acquire another business. I think as owners and businesses we have to let our employees know that we’re constantly looking to improve our organizations and we may be looking at acquiring another firm, another practice, another group of professionals. I think that’s a growth mindset and so if that’s part of the tenor of the company to tell the team that you’re looking to acquire other businesses, other practices, other specialists. I think when it does in fact happen, it’s an easier conversation because it’s already part of the strategic plan that’s been shared within your existing small organization that we’re constantly looking to buy and acquire other companies, other specialties. And then when it does happen, It’s not really new news, it’s just, oh, we have these new team members that are going to be coming to join us. And I think that’s really, if it can be set the course in your strategic plan, which you’re sharing with your existing smaller company, I think it becomes less of a hurdle once the target is identified and once the target is acquired and you’ve got new people joining the firm or your organization, it’s just an easier transition because everybody was already in the know that you are already out seeking this opportunity.

As the seller, when that needs to be announced to your team, when it is really time to tell your team, it’s a very delicate matter. And I think if ownership has been clear with their team that they are selling, that we are looking to connect ourselves with other resources so that we can deploy our services and goods at a much more efficient pace and have a lot more resources. And yes, I’m here to ensure that the transition is going to take place between where we’re at now and when we join the new company, giving them some conversations around it, meeting individually. Sometimes it takes meeting individually with people to let them have a surety that you will be with them throughout this next process is an important part of that conversation.

I think for a company who’s looking to sell, again, there’s a lot of what I call head and heart. Head knows that it’s time to sell, I’m ready, but the heart is my people, my clients, my customers, my vendors, all the people that got me to here, I need to make sure that they’re well taken care of. And if you start those conversations a little bit earlier on, meaning you’re not going to tell them you’re going to be getting that you’re going to be sold, but you’re letting them know that we need to be, we can be better and bigger and greater by aligning ourselves with another organization and start that in your own strategic plan that we may be acquired, we may merge into another company because I want all of us to have the benefit of being able to do bigger, better, bolder work going forward. I think that that’s an important message to give to your existing employees so that they know that they want to stay with you for that next great opportunity and put some really positive energy around it is an important part of transitioning your company from who you are to the next owner.

The role Cray Kaiser plays in a merger or acquisition process is really one of a consultant first. We really want to make sure that the client is ready for the transaction, that they’ve gotten their checks and balances with their financial warehouse, that they understand that the value is not going to be how much the seller needs to retire. It’s really providing them the consultancy piece, the reality check of what this next process is going to be. It’s kind of phase one. Phase two is really when we become the financial advisors and help them review the letter of intent before they sign it and sure it’s got all the right pieces that we believe are important. Certainly, we are not attorneys and we let legal counsel take care of the legalese of these letters of intent. And then we participate in the third phase, which is really the due diligence phase, supporting their internal accountants, controllers, CFOs and helping them provide the buyer with whatever information they need, making sure that the information is scrubbed in a great format so that the buyer has an ease of looking through it efficiently and with accuracy. And then lastly, we assist with the after-tax cash flow. We, you know, sometimes we start that at the beginning. Clients say, “Well, if I sell my company for X dollars, how much money am I actually going to be able to keep?” And we’ll help our clients provide those proformas, those projections of if I sell my company for $10 million, how much will I receive after tax? And what’s my actual cash flow? Which also helps the investment advisors understand how much money is that owner actually going to receive out of that 10 million when everything comes to close. So we are there from the beginning to help get them, get their mind and their mindset around the sale of their business. And we also help them through each of the phases as much or as little as they need us. And certainly in the life thereafter, many of our clients who have in fact sold their companies, we’re helping them in their next level of enterprise. Some of them become real estate enthusiasts and we help them with their accounting and tax on the real estate side. So we’re here to help clients throughout the entire cycle, life cycle of their existing business, and even in the life cycle after their business. All of this process, there’s lots of phases to this process, and at Cray Kaiser, you know, we’re here to help our clients, again, to and through their transactions at whatever point in their life cycle they’re at. And if you need any further assistance on that, please feel free to give us a call. Cray Kaiser is here for you during any part of this transaction.

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on Helen Kubitschek.

At Cray Kaiser, no two days are the same for Helen, our Tax Administrator. She plays a vital role in keeping tax administration running smoothly, ensuring every process is seamless and efficient. As the tax season approaches, Helen diligently oversees the distribution and collection of engagement letters for our 2,000+ clients. Once tax season is in full swing, she takes charge of e-filing tax returns, managing critical deadlines, and providing support to her team on a variety of administrative tasks. Helen’s dedication keeps everything on track, ensuring our clients receive the exceptional service they deserve.

As one of the newest members of the Cray Kaiser team, Helen was immediately drawn to CK’s welcoming culture. The close-knit, collaborative atmosphere stood out, offering the perfect balance of teamwork and growth. For Helen, seeing how seamlessly the team works together—and how that dynamic fosters genuine, lasting relationships with clients—was truly inspiring. She was especially impressed by how comfortable and confident clients feel when partnering with the CK team, a testament to the trust and strong connections they’ve built.

So, it’s no surprise that when asked which of CK’s core values resonates with her the most, Helen answered without hesitation: “People”.

When asked, “What piece of advice would you give to someone new in the industry?” Helen emphasized the importance of keeping an open mind. “The accounting industry has so many different aspects to explore. My advice is to seek guidance, talk to seasoned professionals, and get a taste of everything. Focusing on one area too soon isn’t ideal, you don’t know what you’re going to love until you try it.” For Helen, curiosity and a willingness to learn are key. “The more you learn, the more valuable you become.”

Now, let’s shift gears with some lighter questions to get to know Helen a little better—straight from her own words!

How do you like to spend your weekends?

In my free time, I love being with family and friends, often enjoying a bit of cooking or hanging out with my Goldendoodle, Phoebe. I’m also a big fan of exploring new restaurants and catching musicals and plays. Recently, I had the chance to see Frozen—and it was absolutely incredible!

What motto do you live by?

“Mind over matter” is something my dad told me as a young child. So, when things get hard, that’s what sticks in my head. I say it out loud to get me through whatever I’m facing.

What was your favorite vacation?

Years ago, my friends and I took a girls’ trip to Clearwater Beach, Florida—right around the time Hulk Hogan’s reality TV show was being filmed there. As a fan of both Hulk Hogan and the show, I was thrilled at the possibility of spotting him in person. Our driver for the weekend happened to know where he lived, so naturally, we cruised by his house, hoping for a glimpse of the celebrity. Unfortunately, no luck.

Fast forward to our last night in town, we decided to visit one of Hulk Hogan’s favorite local spots. As we were sitting and chatting, my friend suddenly grabbed my arm, her face frozen in shock—Hulk Hogan had just walked in! We couldn’t believe it, and I knew I couldn’t let the moment pass without saying hello.

With a mix of excitement and nerves, I walked over and introduced myself. To my surprise, he was incredibly kind and personable. We chatted for a few minutes, and he even took a picture with me and hugged me before I rejoined my friends. It was such an unbelievable moment and made the trip one I’ll never forget!

And last, what’s on your music playlist?

I love a variety of music! 80’s, 90’s, classic rock, country… it depends on whatever I’m in the mood for!

MSA | Senior of Accounting Services

Technology is advancing at an exponential rate. To put this into perspective, it took 2.4 million years for our ancestors to discover and control fire for basic needs, yet only 66 years passed between the first airplane flight and having humans landing on the moon. Knowing this, if your accounting software looks and feels like it was designed in the early 2000s, it’s probably time for an upgrade. Here’s why:

These are just a few of the ways outdated accounting software can hold your business back from achieving growth and success. As you begin researching your next upgrade, you’ll likely discover even more areas for improvement. Now, let’s explore why modern accounting solutions are so effective.:

Upgrading to modern accounting software isn’t just about keeping up with the times. It’s about making your life easier, saving money, and setting your business up for long-term success.

Client Accounting Advisory Services (CAAS) at Cray Kaiser can help you modernize your accounting systems. We take the time to understand the story behind those numbers. Our goal isn’t to only provide data but to empower you with the knowledge and understanding needed to make confident, strategic decisions. With CK’s CAAS, you’ll have a trusted partner helping you navigate the transition to modern accounting software. You can learn more about our services by visiting our CAAS page.