Member of Russell Bedford International, a global network of independent professional service firms.

MSA | Senior of Accounting Services

As your business grows, financial decisions become more complex and more critical. Clear reporting, stronger internal controls and a plan for the future are essential. But hiring a full-time Chief Financial Officer (CFO) or Controller can be costly.

The good news? You don’t always need to add expensive executives to your payroll. Outsourced CFO and Controller services provide the expertise you need, when you need it, without the full-time expense.

Partnering with an outsourced accounting firm gives you access to executive-level financial leadership, tailored to your business’ needs. This flexible solution ensures you have the correct level of support.

With an outsourced CFO or Controller, your business can achieve:

Outsourcing doesn’t just reduce costs, it increases insight and efficiency. Businesses that leverage outsourced CFO and controller functions gain a competitive edge and the freedom to focus on what matters most: running your business.

If you want clarity, confidence and sustainable growth, outsourcing your CFO and controller functions may be the smartest financial decision you make this year.

Whether you’re a startup preparing to scale or an established business seeking better financial discipline, fractional CFO and outsourced controller services can provide the expertise you need without the full-time cost.

At CK, our mission is to help business owners move beyond the day-to-day challenges of managing their finances and step confidently toward growth. In this audio blog, Amy Langfelder and Eva Koziel discuss how our Client Accounting and Advisory Services (CAAS) provide the tools, insights and support needed to transform financial confusion into clarity.

Transcript

I am Amy Langfelder and I am one of the principals here at CK. In my role, I lead the client accounting and advisory services. We often call this CAAS. In our CAAS department, we want to help move clients from surviving to thriving. To do this, we come alongside them where they are at and provide them various services to help them along the way. Today we want to highlight some of those services. Today, I am joined by Eva Koziel, our manager of accounting and advisory services. She is going to provide some ways that she is helping our clients grow.

First things first, we start by assessing your current accounting state. Imagine you’re struggling to keep your financials organized. We conduct a thorough review of your existing systems, identifying strengths and weaknesses. For example, if you’re using outdated software or inefficient manual processes, we highlight these issues and help you understand where improvements can be made.

How can companies achieve more through outsourcing some of their accounting functions? Once we’ve assessed where you’re at, we move into providing recurring services. Whether it’s monthly or quarterly, we can prepare your day-to-day accounting or review the work your team has done. Think about it as your business having its own financial health checkup. We’re there to ensure everything looks good and even catch issues before they escalate. We can also assist with streamlining processes, particularly through AP and AR automation. Imagine you’re spending hours manually processing invoices. We can help you implement software that automates these tasks, drastically reducing the time spent and minimizing errors. For example, our clients have seen up to a 30% reduction in time spent on AP simply by switching to an automated solution.

As owners look to the future, how can CAAS come alongside them and help them on their journey to thriving? We know that many business owners find their financials confusing. Our team provides personalized explanations, breaking down your income statements, balance sheets, and cash flow statements. For example, one of our clients was unsure why their cash flow was fluctuating. We took the time to walk them through their statements, allowing them to make informed decisions for the future.

Finally, let’s focus on the future. We don’t just stop at the numbers. Our advisory services help you strategize for growth. Let’s say you’re looking to expand, whether that’s a new employee or opening a new location. We provide insightful analysis and recommendations tailored to your business goals.

Thank you for your time today. We look forward to ways we can help you on your journey to thriving. Visit our website, craykaiser.com for more information.

CPA | Tax Manager

As we highlighted in a previous blog, beginning September 30, 2025, the U.S. Treasury will stop issuing paper checks for most federal payments, including Social Security, Veterans Affairs benefits, and federal tax refunds. Instead, payments will be made electronically, usually by direct deposit into your bank account.

This change stems from Executive Order no. 14247, “Modernizing Payments to and From America’s Bank Account,” signed by President Trump in July, 2025. The government explained that the move is designed to reduce fraud, prevent lost or stolen checks, and deliver funds faster.

If you already receive payments electronically, no action is needed. However, if you still receive paper checks, you must switch to direct deposit before the deadline.

Here are 6 ways to enroll in direct deposit:

You can read the Treasury’s full announcement here.

Most taxpayers already use electronic payment methods, but if you haven’t transitioned, now is the time to act.

This change is part of a larger plan. In the future, the government will also require payments to the federal government, like income taxes, to be made electronically. For now, paper checks for payments such as the September 15, 2025, estimated tax payment are still accepted, however, expect changes in the near future.

At CK, we recommend using electronic methods whenever possible for both filings and payments. Benefits include:

If you’re not sure how to make the switch, reach out to your CK team for help with transitioning your tax payments, refunds, and estimates to secure electronic systems.

As accountants, we know that unresolved tax liabilities can lead to escalating penalties and interest but the Illinois Department of Revenue is offering a rare opportunity for a clean slate. Effective soon, the 2025 Illinois Tax Delinquency Amnesty Act provides a window for eligible taxpayers to settle outstanding state tax debts and wipe away associated penalties and interest.

Per bulletin FY 2026‑01, the Illinois Tax Delinquency Amnesty Act allows eligible taxpayers to pay overdue state tax liabilities without incurring penalties or interest, as long as they settle in full during the amnesty window.

Individuals and businesses with unpaid liabilities for state taxes administered by the Illinois Department of Revenue during the eligible period qualify for the amnesty program.

1. File any missing returns or amend incorrect filings for the eligible periods. Include any supporting documentation.

2. Pay the full tax amount due during the amnesty window (Oct. 1 – Nov. 17, 2025).

3. If your liability has already been referred to a private collection agency, you must pay through that agency, do not pay IDOR directly.

4. Use MyTax Illinois for convenient payment but if you need an account, request a Letter ID, which may take up to 10 days to receive. If your account isn’t ready by November 17, you’ll need an alternative payment method.

Tax liabilities can quietly compound. What might begin as a modest underpayment can balloon with added penalties, interest, and collection costs. This amnesty program offers relief: an opportunity to settle past issues cleanly and efficiently.

If you’re unsure whether you qualify or how to rectify your filings, now is a great time to reach out. At Cray Kaiser, we’re here to help guide you step by step. Contact us to discuss how the Illinois Announces Tax Amnesty Program may impact your tax situation.

In this video about not-for-profit organizations, Carl Thomas, a manager at Cray Kaiser, explores how federal and state funding can impact the regulatory compliance for nonprofits. He takes a close look at how uniform guidance audits can present valuable opportunities for growth and improvement.

Transcript

I’m Carl Thomas. I’m a manager at Cray Kaiser. Many not-for-profit organizations receive federal funding, even state funding, perhaps. Now, this can have certain implications for your regulatory compliance. One thing that can happen is over $750,000 of federal awards can qualify you for what we call a uniform guidance audit. This is an audit that requires the auditor to gain an understanding of the internal control over compliance with the federal grants. It also requires an actual compliance audit. So we would test the compliance with that grant. It definitely adds some time to the project. And it can also give you some insights into how you’re managing these grants and what can, you know, if there’s any room for improvement.

If there’s certain state awards as well. So when we talk about state awards, we mean state of Illinois, perhaps the Department of Commerce and Economic Opportunity, perhaps the Department of Human Services, even the State Board of Education is one that will provide state awards. And when I say state awards, I mean awards that are derived from state revenues. So a state agency may administer a federal award as a pass-through. So that’s important to understand as well. There is a distinction there. Now, when state awards are involved too, and federal awards, you may have what we call a GATA implication in the state of Illinois. Now, this is similar to a uniform guidance opinion and requires the submission of what we call a CYEFR, a consolidated year and financial report.

Now, as a result of potentially having a federal audit or certain implications of the GATA requirement in Illinois, your organization may find themselves in a position of receiving maybe an audit finding. However, it’s not really a negative thing. It’s really an opportunity for improvement, right? The auditors are looking at transactions in detail, they’re testing internal controls with grant compliance and things. And in an intensive audit, you’re bound to almost have some suggestions and value add things that come out of that. However, again, it shouldn’t be seen as a penalty. It should really be seen as an opportunity for growth. Because in the next year, it’s an opportunity to improve on that matter and take that finding away, quite frankly, with action on your part. And so there can be some value there.

Well, thank you for tuning in today. If anything we’ve talked about is resonating with you, or sounds like something you want to discuss further, please feel free to call the dedicated Cray Kaiser not-for-profit team. We’re always available. The number is listed on our website. You can ask for Carl or Amy to start, but anyone can point you in the right direction. Thank you.

MSA, MST | Assurance In-Charge

On July 4, 2025, President Trump signed the “One Big Beautiful Bill” Act into law, introducing one of the most talked-about provisions: Trump Accounts. This new type of tax deferred account aims to help children in the U.S. build long-term wealth from birth into adulthood.

A Trump Account is a federally created tax-deferred investment account designed to give children a financial head start through both government contributions and private investments.

Qualified withdrawals (Allowed starting at age 18)

Taxation & Penalties

Many details will be clarified through future regulations, including IRS interpretations. Even though year-end tax planning usually begins in Q4, now is the ideal time to talk to your tax advisor and evaluate whether a Trump Account makes sense for your family.

At Cray Kaiser, we’re here to help you navigate the One Big Beautiful Bill Act and plan not just for this year, but for the years ahead. Contact us to discuss how these new rules could impact your tax and financial future.

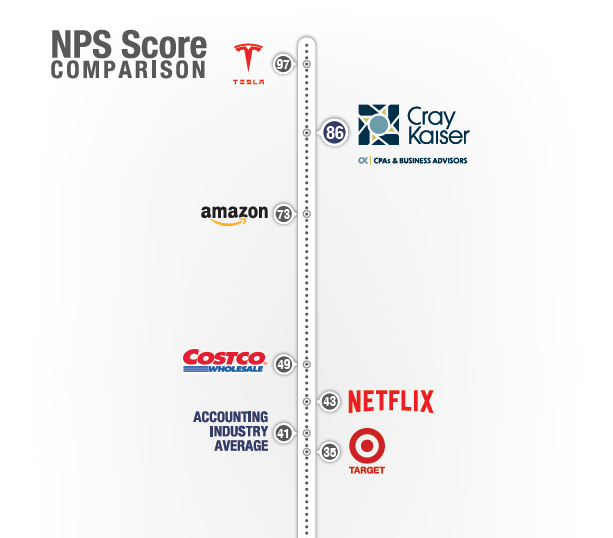

At Cray Kaiser, we believe that every number tells a story. At the heart of that story are the people whose businesses and lives those numbers represent. This year, one number in particular stood out above the rest because of what it says about the relationships we’ve built and the trust our clients place in us. That number is our Net Promoter Score. For 2025, we’re proud to share that we received a score of 86.

If you’re new to Net Promoter Score, or NPS for short, it’s a widely used benchmark across industries that measures client loyalty and satisfaction. Clients are asked how likely they are to recommend our firm to a friend or colleague on a scale of 0 to 10.

Based on client’s response, they are categorized into one of three groups:

The score is calculated by subtracting the percentage of detractors from the percentage of promoters. While a score above 0 is considered good, anything above 50 is excellent. Scores in the 80s? They’re exceptional!

The accounting industry’s average NPS hovers around 41, which makes our 86 particularly meaningful. More than just a statistic, it’s a reflection of the confidence our clients have in us and the empowerment we provide as trusted advisors.

We’re deeply grateful to our clients for their trust, loyalty, and feedback. We’re equally proud of the incredible team that makes up Cray Kaiser. The people who raise the bar every day and live out our Core Values in every interaction.

Together, we look forward to another year of building trust, reaching milestones, and celebrating success, because your success will always be ours.

CPA | Tax Manager

On July 4, 2025, President Trump signed the One Big Beautiful Bill Act into law, bringing sweeping changes to federal tax provisions. While much attention has been focused on electric vehicle (EV) tax credits, the legislation also includes a wide range of energy-related tax incentives that could impact both individuals and businesses.

If you want to take advantage of these benefits, timing will be critical, many of these provisions have short windows before they expire. Here’s what’s changing and what you should be doing now to prepare.

The One Big Beautiful Bill Act includes several incentives designed to encourage the adoption of clean energy solutions in homes and vehicles. However, these credits are set to expire soon:

Businesses will also see notable changes to clean energy incentives, some ending soon, others phasing out gradually:

While many details are still pending clarification through regulations, here’s how you can stay ahead:

At Cray Kaiser, we’re here to help you navigate these changes and plan not just for this year, but for the years ahead. Contact us to discuss how the One Big Beautiful Bill may impact your tax situation.

MSA, MST | Assurance In-Charge

The One Big Beautiful Bill Act (OBBB) introduces significant updates to Section 174A, which governs the treatment of research and experimentation (R&E) expenses. These changes aim to boost domestic innovation in the United States by modifying how businesses can deduct and capitalize R&E costs. Whether you’re a startup investing in cutting-edge technology or an established company developing improved products or processes, the new Section 174A rules bring welcome opportunities for immediate tax savings and improved cash flow.

Historically, Section 174 of the Internal Revenue Code (IRC) permitted businesses to immediately deduct all R&E expenditures. However, the Tax Cuts and Jobs Act of 2017 (TCJA) removed this option and required taxpayers to capitalize R&E expenditures and amortize them over a five-year period for R&E performed within the United States, or a fifteen-year period for R&E performed outside the United States for tax years beginning after December 31, 2021.

New Code Section 174A restores the taxpayer’s option to immediately deduct domestic R&E expenditures incurred in connection with a trade or business for work performed in the U.S. This applies to tax years beginning after December 31, 2024. Taxpayers may still make the election to amortize R&D costs over a 5-year period or ratably over a 10-year period for certain Section 174A expenditures.

Under the OBBB, eligible small businesses, those with less than $31 million in average gross receipts over the past three tax years, receive expanded benefits:

The OBBB Act does not modify rules for foreign R&E expenditures. These costs must continue to be capitalized and amortized over a fifteen-year period.

The restoration of full expensing for domestic R&E expenditures represents a major win for U.S. businesses. Your company has the opportunity to gain greater control over cash flow, improved tax planning, and increased investment capacity. However, the decision to expense immediately or amortize isn’t one-size-fits-all. Fully capitalizing on the new law requires thoughtful evaluation of available elections and possible changes to accounting methods. Factors such as refund timing, IRS processing risks, state tax conformity, and ownership changes must all be considered. Our team at Cray Kaiser is closely monitoring IRS guidance on these changes.

If your business invests in research and development, these changes could have a major impact on your tax strategy. To learn how these provisions apply to your specific situation, contact your trusted advisors at Cray Kaiser.

We are incredibly excited to share that Cray Kaiser has been ranked in USA Top 500 CPA Firms, #425, by Inside Public Accounting (IPA), a national ranking of accounting firms based on net revenue.

Each year, IPA ranks firms across the country that are growing and thriving. Earning a spot in the top 500 is a meaningful milestone for our CK team and we know we wouldn’t be here without the incredible clients who trust us with their business. Your partnership, loyalty, and confidence in our team make achievements like this possible.

From all of us at Cray Kaiser, thank you for being part of our story. We’re honored to serve as your trusted advisors and remain committed to providing the insight, integrity, and personal attention you deserve to help your business succeed.

To learn more about the IPA 500 and this year’s rankings, visit here.