Member of Russell Bedford International, a global network of independent professional service firms.

CPA | CK Principal

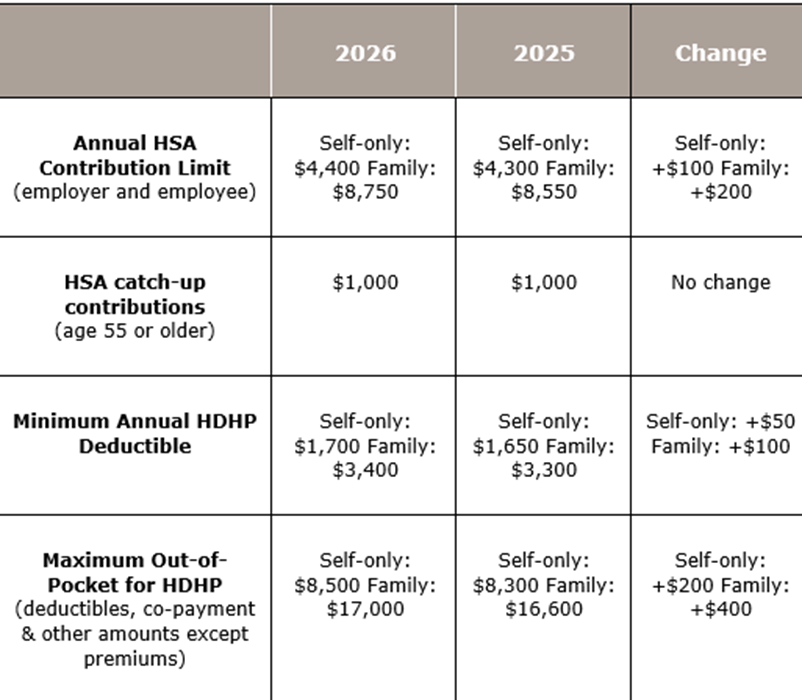

As we await possible significant changes to the 2026 tax law, the IRS has provided guidance on Health Savings Accounts (HSA). Specifically, they’ve recently released the inflation-adjusted contribution limits for 2026 related to HSAs and high-deductible health plans (HDHPs). While there are modest increases in the contribution limits, the HSA catch-up contribution amount remains unchanged.

Important Reminder: You can only contribute to an HSA account if you are enrolled in a High Deductible Health Plan (HDHP). The IRS sets specific criteria for what qualifies as an HDHP, including minimum deductibles and maximum out-of-pocket expenses.

One key tax benefit of HSAs that stands out is that contributions are tax-deductible even if you don’t itemize deductions. Additionally, these funds grow tax-free over time.

When HSA funds are used for qualified medical expenses, such as doctor visits, prescriptions, and certain medical procedures, withdrawals from an HSA are tax-free. However, if you use HSA funds for non-medical purposes, you will owe income tax plus a 20% penalty (10% after age 65).

To read more about the benefits of an HSA, click here. If you’d like to explore how an HSA could fit into your financial planning, please contact our office at 630.953.4900 or fill out this form.