Member of Russell Bedford International, a global network of independent professional service firms.

A lot of change has come with the 2017 Tax Reform. As we adjust to the new provisions, we’re constantly learning about ways that we can shift tax planning strategies in the future to benefit and lessen tax burdens. One way to potentially minimize your taxes is with a strategy called “bunching”.

What is “Bunching”?

The near doubling of the standard deduction amount to $12,000 for single filers and $24,000 for joint filers produced the bunching strategy. With tax bunching, you move two or three years of deductible expenses into the one year you intend to itemize. For the other years, in lieu of itemizing deductions, you can claim the new higher standard deduction.

Assess Your Bunching Option

Using the bunching strategy requires some planning. First, you need to know how close you are to the standard deduction limit by reviewing your 2017 tax return. Because of the many new limits on qualified itemized deductions, you will need to estimate how close you are to the new standard deduction thresholds. Remember to limit your state and local tax deduction to $10,000 and eliminate any miscellaneous itemized deductions.

The closer your total itemized deduction total gets to the standard deduction amount for your filing status, the more the bunching strategy makes sense.

For example, John and Mary’s new itemized deduction total is about $22,000, which includes $10,000 of state taxes paid and $12,000 of charitable deductions every year. Since their itemized deductions are less than the new $24,000 standard deduction, they are losing the benefit of their itemized deductions.

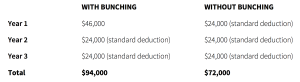

Instead, John and Mary can choose to “bunch” three years of charitable contributions into one year. Using this strategy, the couple have itemized deductions of $46,000 in year one ($10,000 of state taxes and $36,000 of charitable contributions). In years two and three, John and Mary would claim the standard deduction. Here are the deduction results:

By bunching, John and Mary are able to shift their itemized deductions to maximize the tax benefit.

If you determine that bunching is the best strategy for you, here are a few ways you can bunch your itemized deductions:

1. Review your medical and dental expenses. This is a potential bunching expense group if you project these expenses will surpass 7.5% of your income. Schedule non-emergency expenses, such as medical exams and dental cleanings, in the year you plan to clear the deduction threshold. Plan other procedures such as crowns and braces in one year instead of over many years. You can even move up health insurance premium payments.

2. Consider charitable donations as bunching options. This is the largest potential bunching area. Make all your gifts in the year you plan to surpass the standard deduction threshold. But keep an eye on the 60% of adjusted gross income (AGI) annual limit.

Alternatively, consider postponing contributions to January of the following year if you aren’t going to itemize.

3. Use mortgage interest as another bunching tool. The deduction for interest paid on new acquisition debt of up to $750,000 (or $1,000,000 if the loan was made prior to Dec. 15, 2017) is still available. Consider pre-paying the next month’s mortgage payment at the end of the year to increase the deductible interest in the year you wish to itemize.

We recommend speaking with your accountant to determine if the bunching option is best for you. Please don’t hesitate to contact Cray Kaiser with any questions.