Member of Russell Bedford International, a global network of independent professional service firms.

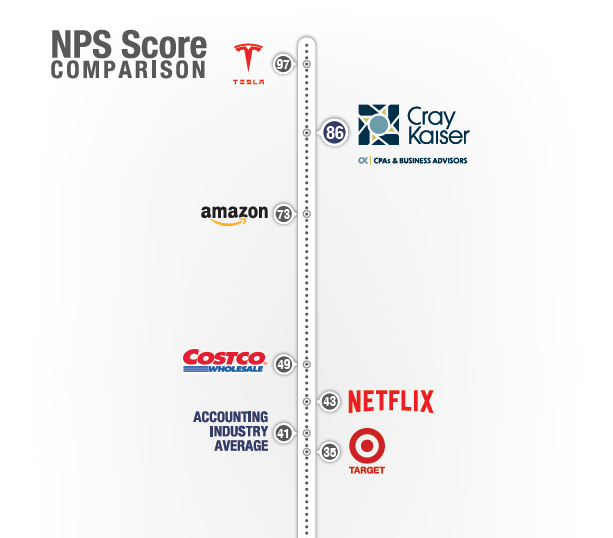

At Cray Kaiser, we believe that every number tells a story. At the heart of that story are the people whose businesses and lives those numbers represent. This year, one number in particular stood out above the rest because of what it says about the relationships we’ve built and the trust our clients place in us. That number is our Net Promoter Score. For 2025, we’re proud to share that we received a score of 86.

If you’re new to Net Promoter Score, or NPS for short, it’s a widely used benchmark across industries that measures client loyalty and satisfaction. Clients are asked how likely they are to recommend our firm to a friend or colleague on a scale of 0 to 10.

Based on client’s response, they are categorized into one of three groups:

The score is calculated by subtracting the percentage of detractors from the percentage of promoters. While a score above 0 is considered good, anything above 50 is excellent. Scores in the 80s? They’re exceptional!

The accounting industry’s average NPS hovers around 41, which makes our 86 particularly meaningful. More than just a statistic, it’s a reflection of the confidence our clients have in us and the empowerment we provide as trusted advisors.

We’re deeply grateful to our clients for their trust, loyalty, and feedback. We’re equally proud of the incredible team that makes up Cray Kaiser. The people who raise the bar every day and live out our Core Values in every interaction.

Together, we look forward to another year of building trust, reaching milestones, and celebrating success, because your success will always be ours.

We are incredibly excited to share that Cray Kaiser has been ranked in USA Top 500 CPA Firms, #425, by Inside Public Accounting (IPA), a national ranking of accounting firms based on net revenue.

Each year, IPA ranks firms across the country that are growing and thriving. Earning a spot in the top 500 is a meaningful milestone for our CK team and we know we wouldn’t be here without the incredible clients who trust us with their business. Your partnership, loyalty, and confidence in our team make achievements like this possible.

From all of us at Cray Kaiser, thank you for being part of our story. We’re honored to serve as your trusted advisors and remain committed to providing the insight, integrity, and personal attention you deserve to help your business succeed.

To learn more about the IPA 500 and this year’s rankings, visit here.

In this video, Deanna Salo, Managing Principal at Cray Kaiser, shares the story behind the firm’s relationship with Russell Bedford International, a global network of independent accounting and consulting firms. Deanna explains how Cray Kaiser’s commitment to supporting clients with international needs led them to seek out a network that offered trusted partnerships across the globe. From cross-border transactions to international tax planning, Russell Bedford has empowered Cray Kaiser to expand its reach while staying true to its values. Learn how this collaboration has deepened the firm’s bench, strengthened its global perspective, and enhanced the services offered to clients both locally and internationally.

Transcript:

My name is Deanna Salo and I’m the managing principal here at Cray Kaiser, Limited CPAs. I’m here today to talk to you about our relationship with Russell Bedford International Network and basically how we came to find this network and how it serves us in assisting us to serve our clients. So about 15 years ago, our clients were starting to grow in shape and size, dipping their toes if you will across the pond in deciding where they’re going to do business globally. Many of our clients have been doing business globally, but we’ve been able to serve them by leaning on attorneys or other affiliations. Through other networks, we were able to serve them. Our tax department has always done an exemplary job in being able to look up treaties and determine tax treatments and making sure that our clients were compliant in all the necessary pieces of their annual filing, whether they were doing business here in the States or whether they were doing business afar.

About 10 years ago, we decided to join a different group, another network, an international network that was based in the Chicago land area that we felt very aligned with. We were going to help them when they needed it, and they were going to help us when we needed it. About two years into that relationship, that organization ended up rolling up into a national firm. And it was very soon thereafter that we basically did not feel the same connection, access, and just compliance and alignment of how we wanted to serve our clients and our access to those technical things we needed when dealing with international business.

So, we received a phone call with a British accent on the other side of it asking us if we’d like to join an international network and we were surprised because of the very lovely British accent on the other line of the phone. At the same time, he said, “I’ll be in Chicago. Would you like to have a chat?” And we said, “Of course, come on by.” So, we met with the membership development person at Russell Bedford International. It was in September of that year in 2017. And they were having their annual meeting in New York City in October of that same year. And we said, “Sure, let’s go try it out. Let’s go meet and greet.” This is their global annual meeting. So people are coming from all over the world to attend this annual meeting. So I got the wonderful opportunity to hit New York City Times Square and meet what were some of the most amazing, relatable, independently owned and operated CPA firms from across the globe. And it was almost love at first sight. We had collaboration, sharing stories, sharing skills, determining how we could do business with one another without feeling a need to tit for tat and give and take, which is kind of how we felt in these other relationships we’ve had.

So since 2018, fast forward to now, we have received a number of referrals from Russell Bedford, which was not the reason why we joined. We specifically joined our intent was always to deepen our bench in our understanding of international tax law. So when I have a client who’s buying a property in Tuscany, Italy, I could pick up the phone and have somebody on the other end willing and ready to technically assist my client, language, find attorneys, find land surveyors, find whatever I needed, you know, time zones away from where I’m sitting. And so the ability to do that, the ability to serve, even though it was no increased billings for Cray Kaiser, the ability to provide resources to our clients in their moments of need, transactionally, educationally, networking-wise.

It’s been a profound impact not only to our ability to serve our clients but also even with our staff. When we’re recruiting for employees and to be able to say you’re working in our size of our firm in Chicago at an international CPA firm and you will be doing some international work is a really interesting thing for many people. They like to savor international tax law, or just the opportunity to be talking with people, networking with people from not just your area, but literally from across the globe. So our reason to join was really to deepen our bench. Certainly from a recruiting perspective, it was a fantastic roadmap to getting new staff here. And we also had the opportunity to have exchange students, some college graduates from Spain that were coming to the United States and wanted to intern with us. We’ve had those opportunities to exchange some personnel and again fast forward to 2019, I was asked to be on the board of Russell Bedford International and so since then I’ve had the opportunity to sit amongst some extremely brilliant individuals. My perspective of how we do business here in the United States has been enhanced globally by really understanding boots on the ground, what’s happening in the world, in business, as these other practitioners are trying to serve their clients amidst economic downturn, war, social responsibility, global warming, all the various impacts that other parts of the world are far more sensitive to than what we might be here in the United States. So, the perspective gained by this relationship has profoundly impacted how I’m able to serve our clients here at Cray Kaiser.

Some of the statistics that I just want to share a few of just to understand the size of Russell Bedford International because here in the United States it’s not as well-known as some of the other global alliances which are typically supported by the big four CPA firms. They rank in the top 20 global networks around the world. This past year, we ranked 17th among the top 20. I have 110 countries that I can call upon literally picking up the phone or dropping an email and having what is otherwise real-time or next-day responses if those folks can help my clients. There are 375 offices around the world and almost 10,000 people at these other firms globally that are ready and waiting to assist us. Conversely, one of the new things that we’ve been able to do, not really new, but it’s been a wonderful enhancement to our relationship, is we’re getting called upon to assist their clients here in the United States. There’s a lot of business that wants to be done here in the United States, so we have clients that are now ours from Ireland. We have clients that are now ours from Spain, from the UK. And while those other CPA firms host the relationship, we’re used to assist in getting those companies set up here in the United States to do business here in the United States. And so we not only have the referral from that other firm in those other countries, but we now get the opportunity to work alongside them to help secure their relationship as well. Because on both sides we want to keep our clients happy and well served as well with the resources that they need to keep their businesses going. So it’s a win-win across the board.

One of the other things that I think felt very in well-alignment with our firm was really their vision and their mission and their vision is why we exist, to be the global network of choice for independent professional service firms committed to sharing core values and to enable their clients to do better business globally. And that’s really what we’re all trying to do, is do better business globally. Not every one of Cray Kaiser’s clients needs a global representative, but at some point in time, they might and we’ll be ready by being able to leverage our relationship with Russell Bedford.

Their mission is also to take clients further to a better future and that again, similar to Cray Kaiser, we want a better future for our clients and we want to see them to and through their transactions. So Russell Bedford for Cray Kaiser has been a fantastic alignment, very resourceful, growing our business, growing our people, and certainly growing relationships abroad.

Russell Bedford has empowered Cray Kaiser to serve our clients domestically and globally in an enhanced position than we’ve ever had before. And as I said earlier, it’s because of the commitment to serving each other, whether it’s a tax question, a transactional question, I need somebody, do you have the resources, and trusting that the person on the other end of that email or phone call is going to deliver. It’s no different than how we make referrals here in the states, but having an international alliance network to deepen our bench, to enhance our employees’ experiences in doing the work that they do here, enhance our education, our perspectives, our awareness of what’s happening globally and locally is really why Russell Bedford has been such an amazing colleague and companion to Cray Kaiser over the past handful of years. In summary, if you want more information about how we can help you with your international or local accounting or tax or advisory services, you can check us out at www.craykaiser.com and Russell Bedford and Cray Kaiser’s team would be welcome to have you give us a call.

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on Helen Kubitschek.

At Cray Kaiser, no two days are the same for Helen, our Tax Administrator. She plays a vital role in keeping tax administration running smoothly, ensuring every process is seamless and efficient. As the tax season approaches, Helen diligently oversees the distribution and collection of engagement letters for our 2,000+ clients. Once tax season is in full swing, she takes charge of e-filing tax returns, managing critical deadlines, and providing support to her team on a variety of administrative tasks. Helen’s dedication keeps everything on track, ensuring our clients receive the exceptional service they deserve.

As one of the newest members of the Cray Kaiser team, Helen was immediately drawn to CK’s welcoming culture. The close-knit, collaborative atmosphere stood out, offering the perfect balance of teamwork and growth. For Helen, seeing how seamlessly the team works together—and how that dynamic fosters genuine, lasting relationships with clients—was truly inspiring. She was especially impressed by how comfortable and confident clients feel when partnering with the CK team, a testament to the trust and strong connections they’ve built.

So, it’s no surprise that when asked which of CK’s core values resonates with her the most, Helen answered without hesitation: “People”.

When asked, “What piece of advice would you give to someone new in the industry?” Helen emphasized the importance of keeping an open mind. “The accounting industry has so many different aspects to explore. My advice is to seek guidance, talk to seasoned professionals, and get a taste of everything. Focusing on one area too soon isn’t ideal, you don’t know what you’re going to love until you try it.” For Helen, curiosity and a willingness to learn are key. “The more you learn, the more valuable you become.”

Now, let’s shift gears with some lighter questions to get to know Helen a little better—straight from her own words!

How do you like to spend your weekends?

In my free time, I love being with family and friends, often enjoying a bit of cooking or hanging out with my Goldendoodle, Phoebe. I’m also a big fan of exploring new restaurants and catching musicals and plays. Recently, I had the chance to see Frozen—and it was absolutely incredible!

What motto do you live by?

“Mind over matter” is something my dad told me as a young child. So, when things get hard, that’s what sticks in my head. I say it out loud to get me through whatever I’m facing.

What was your favorite vacation?

Years ago, my friends and I took a girls’ trip to Clearwater Beach, Florida—right around the time Hulk Hogan’s reality TV show was being filmed there. As a fan of both Hulk Hogan and the show, I was thrilled at the possibility of spotting him in person. Our driver for the weekend happened to know where he lived, so naturally, we cruised by his house, hoping for a glimpse of the celebrity. Unfortunately, no luck.

Fast forward to our last night in town, we decided to visit one of Hulk Hogan’s favorite local spots. As we were sitting and chatting, my friend suddenly grabbed my arm, her face frozen in shock—Hulk Hogan had just walked in! We couldn’t believe it, and I knew I couldn’t let the moment pass without saying hello.

With a mix of excitement and nerves, I walked over and introduced myself. To my surprise, he was incredibly kind and personable. We chatted for a few minutes, and he even took a picture with me and hugged me before I rejoined my friends. It was such an unbelievable moment and made the trip one I’ll never forget!

And last, what’s on your music playlist?

I love a variety of music! 80’s, 90’s, classic rock, country… it depends on whatever I’m in the mood for!

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on Emily Zeko

As a Senior Tax Accountant, Emily is a key player on the CK tax team. She spends her days preparing and reviewing tax returns, assisting with tax planning, and responding to federal and state tax notices. As a generalist, Emily has experience with a wide range of tax returns, from individuals to passthrough entities and corporations. While she’s well-versed in many areas, she has a growing passion for international tax and hopes to make it her area of expertise as she continues to gain experience.

Emily joined Cray Kaiser in October 2024, eager to grow her skills and strengthen her expertise across diverse clients. But what truly set CK apart for her was the welcoming, friendly atmosphere she experienced during her interview. “Everyone I met was incredibly kind, and the environment was so positive; it made me excited to be part of this team.”

When asked which of CK’s core values resonates with her most, Emily immediately chose Integrity. “In the tax profession, there are moments when we might feel pressure to make morally gray decisions to satisfy clients. I believe that maintaining a strong ethical code is essential in everything we do.”

For Emily, the most meaningful moments in her career come when she gets to meet clients face to face. “In tax preparation, it’s easy to get caught up in the numbers and forget that there are real people behind them. Meeting clients in person, hearing about their businesses, or even seeing their operations firsthand is always a powerful reminder of why our work matters.”

For anyone just starting in the accounting field, Emily offers this advice: Be kind to yourself when it comes to the CPA exam. “It’s completely normal to struggle with studying after a full day of work. I had to take time off to pass my exams, and that’s okay. Everyone’s journey is different. What matters is finding what works for you.”

Now, let’s get to know the lighter side of Emily – straight from her own words!

Do you have a special talent or hobby?

I love to sing! I was in choir up until college, and I miss it dearly. My forte (no pun intended) was blending and harmonizing.

What’s your favorite vacation spot?

Disney World in Florida. I’m very in touch with my inner child, and nothing beats the magical feeling of being there!

What’s on your music playlist?

I’m a diehard Swiftie! Taylor Swift’s music has a song for every mood. I also love current pop music, especially anything with influences from ’70s funk.

What’s the last book you read?

I’m currently reading Les Misérables. I love the musical and wanted to dive deeper into the original story. It’s been refreshing to read something older and so rich in history.

As we celebrate International Women’s Day, we take this opportunity to honor the incredible women of Cray Kaiser. Their dedication, expertise, and leadership drive our firm’s success and make a lasting impact on the accounting profession.

International Women’s Day has been observed since the early 1900s. It’s a day to recognize the social, economic, cultural, and political achievements of women worldwide and to advocate for gender equality.

We’re proud that women make up 54% of our team with 67% of the Firm being women-owned. Their contributions across accounting, tax, and advisory services bring diverse perspectives and innovative solutions to our clients every day.

International Women’s Day is a powerful reminder of the importance of gender equality and the need to continue fostering an environment where women can thrive and lead. At CK, we are committed to empowering women by providing opportunities for growth, mentorship, and leadership at every level.

Today, and every day, we celebrate the achievements and resilience of women around the world. Join us in recognizing the remarkable women who shape our industry and inspire future generations.

Tax season is upon us, and at Cray Kaiser, that means two things: extra efforts and the fiercest office rivalry this side of the accounting world. While our team spends their weekdays crunching numbers, lunchtime on Saturdays is reserved for a different kind of competition. Welcome to Season 3 of CK Nation – a high-stakes battle between Team Assurance and Team Tax, where spreadsheets take a backseat to sportsmanship (and sometimes sheer luck).

CK Nation isn’t just about bragging rights. Oh, no, it’s more than that. It’s about survival. When the calculators are put down and the coffee pots are refilled, our accountants, auditors, and tax professionals engage in epic lunchtime showdowns. Every Saturday, these two powerhouse teams face off in challenges designed to test their skill, precision, and ability to function on a diet of takeout and caffeine. Game on!

Will Team Assurance audit their past performances and give themselves a glowing review? Or will Team Tax claim the ultimate deduction, writing off their opponents’ chances entirely? No one knows for sure but with fierce competition, nonstop puns, and the ever-watchful eyes of our dynamic ref duo (one tall, one questionable, both equally ruthless), there’s no room for funny business. Every match is a battle for bragging rights!

Every year brings a fresh season of wild, heart-pounding challenges, but past competitions have included some true greats. There’s Cards, where players master the high-stakes art of flicking playing cards into a distant trash can. Top Gun takes paper airplane precision to legendary heights – so intense that even Maverick and Goose might think twice. And then there’s Field Goal, where the delicate craft of finger football meets tiny uprights and big bragging rights. Of course, we also honor the classics like Hot Potato, Chopsticks, and Bowling because some games never go out of style.

But here’s the twist: teams never know what game they’ll face next. Each challenge is kept top secret, adding to the suspense and strategy. Every Saturday brings a spectacular surprise, turning players into quick-thinking competitors ready to conquer whatever comes their way!

At stake? The illustrious, highly sought-after CK Cup. Forget championship rings or gold medals – this trophy represents the pinnacle of tax-season athleticism. Only one team will claim the honor of hoisting the CK Cup at season’s end. Will it be a meticulous strategist of Assurance or a tax-savvy tactician from Team Tax? The battle rages on.

One thing’s for sure: when April rolls around, there will be one winner and one office full of high fives and celebration, knowing we thrived through another tax season – not just with spreadsheets, but with a bit of fun along the way.

Stay tuned for more updates, and may the best team win!

In Cray Kaiser’s Employee Spotlight series, we highlight a member of the CK team. We couldn’t be prouder of the team we’ve grown and we’re excited for you to get to know them. This month we’re shining our spotlight on Raimonda Kesler. Raimonda is returning to Cray Kaiser after spending some time working for another CPA firm. Listen to her audio blog and learn more about why she came back to the CK team.

Transcript:

My name is Raimonda Kesler and I am an Assurance Senior here at Cray Kaiser. As an Assurance Senior, I manage audits and reviews for non-public companies, which definitely keeps me on my toes and engaged with a variety of clients. I also havethe responsibility of supervising and mentoring our staff, which is very fulfilling to help them grow and develop their skills. There’s more to my role. I am part of a dedicated team here at Cray Kaiser that’s focused on evaluating and improving our processes. We are always looking for ways to improve our efficiency and prioritize the tasks that truly offer more value to our clients.

As I am settling back into my role at Cray Kaiser, I’m reminded of what makes this place so special. The culture here is all about teamwork and support. It’s very refreshing to work in an environment where everyone genuinely cares about each other’s success. I miss the brainstorming sessions here at Cray Kaiser, being able to bounce off ideas of my colleagues and learn from their experiences, something I’ve really missed. I’m also excited about all the new initiatives Cray Kaiser is rolling out. It’s very inspiring to be a part of a company that values innovation and is constantly looking for ways to improve. I can’t wait to dive in into some of these projects and contribute my own ideas.

The five core values that guide us here at Cray Kaiser are education, integrity, people, care, and trust. A couple of years ago, I felt that integrity was the most important core value. It really resonated with me because integrity forms the foundation of everything we do. However, as I’ve grown and evolved in my role, I come to realize that care is now the value that’s sent out the most. While integrity is still incredibly important, I believe that care encompasses so much more. Caring for each other and our clients allows us to fulfill our other values like trust and integrity in a much deeper way. When we genuinely care, we create a culture where everyone feels valued and motivated to do their best work.

My journey in public accounting has been a bit unconventional. I earned my accounting degree and my CPA license while juggling the responsibilities of being a mom to two little girls. It was truly a family effort. Everyone played a role in making this happen. I couldn’t have done it without my husband, Jack. He supported and encouraged me all the way. I’ve worked in public accounting for the last seven years, taking various roles along the way. I started my CPA career here at Cray Kaiser, where I spent five years learning and growing within the firm. After that, I spent two years at a large CPA firm where I gained new experiences and insights. However, at the end, I realized that my heart belongs here at Cray Kaiser, and I’m thrilled to be back.

If you are starting your journey in public accounting, my top piece of advice is to never stop learning. This field is always evolving, so staying updated on industry trends and regulations is essential. Don’t ever hesitate to reach out for mentorship from more experienced colleagues, whether it’s through email, a quick phone call or just stopping by the office. We’ve all been there. We’ve all been beginners and someone helped us along the way. Remember, we wouldn’t be where we are today without that support.

So my life motto is if you’re not falling, you’re not learning. This wise advice comes from my father-in-law who used to share it with his five kids when they were learning how to water ski. I have embraced this motto in my own life and it really resonates with me. For me, it’s a reminder that you have to step out of your comfort zone to truly learn something new. Sometimes that means you might stumble along the way, so it’s important to learn how to fall softly.

My family absolutely loves water sports. We really believe in working hard and playing hard and our vacation reflects that. Almost every trip that we take involves some kind of water sport, water activity. One of our absolute favorites is spending time at the lake house. There, it’s all about skiing, eating delicious food, catching up, and always, and of course, getting some sleep. It’s basically a fun cycle of ski, eat, sleep, and repeat. There’s just something special about being on the water. It’s these moments that create unforgettable memories for our family.

So last summer my family, my husband, and my daughters and I watched Inside Out 2 together. My daughters were very young when we watched the first, the original movie about nine years ago. So it was fun to revisit the story with them now. As parents, we could really appreciate how the sequel beautifully explored the complexity of growing up and the emotional challenges that come with it.

I’m a total bookworm, and I have to say that the story of Edgar Sautel by David Roblesque is definitely one of my favorite this year. I absolutely love this story. The way it explores the bond between Edgar and his dogs is incredibly moving and really pulls at your heartstrings. The writing is beautiful too. The vivid descriptions made me feel like I was right there in the world of Sautel. Plus the dynamics of family relationships along the themes of loyalty and betrayal kept me completely hooked. Overall, it’s just a fantastic book.

Cray Kaiser is proud to announce that Deanna Salo, Managing Principal at Cray Kaiser, has been named a 2025 Chicago Titan 100 honoree. This marks her second year receiving this prestigious recognition. The Titan 100 program celebrates the region’s most accomplished business leaders based on their exceptional leadership, vision, and passion. The 2025 Titan 100 honorees collectively represent companies employing over 439,000 individuals and generating more than $70 billion in annual revenues.

Earning a Titan 100 recognition for two consecutive years is no small feat. The process requires reapplying and undergoing a fierce evaluation by an independent selection committee, raising the bar even higher for the competition. If selected, second-year honorees have the opportunity to further relationships within the Titan 100 community, deepening their connections and amplifying their impact.

Reflecting on her second-year recognition, Deanna shared, “Being recognized as a second-year Titan 100 honoree is an incredible honor. It’s a testament to the value of persistence, collaboration, and the power of building meaningful connections. This recognition inspires me to continue pushing boundaries, supporting others, and contributing to the growth of our business community in even greater ways.”

Our Cray Kaiser team congratulates Deanna on this outstanding achievement and for continuing to exemplify the core values that make Cray Kaiser a trusted leader throughout the Chicago business community. We look forward to seeing how her contributions continue to inspire and shape the future.

In Cray Kaiser’s Employee Spotlight series, we highlight a member of our CK team. We’re proud of the team we’ve grown and excited for you to get to know them. This month, we’re shining our spotlight on Ryan Maloney.

GETTING TO KNOW RYAN

Ryan plays an integral role as a Staff Accountant on the assurance team at Cray Kaiser. In his day-to-day work, Ryan performs various audit tests and corresponds with clients, ensuring that all processes are thorough and accurate. During tax season, he also steps in to assist with tax return preparations, showcasing his adaptability across different areas of accounting. Ryan is eager to learn and make the most of the opportunities provided at CK to develop his skills further.

Before joining CK, Ryan earned his bachelor’s degree in accounting from Goshen College, where he graduated Summa Cum Laude. His previous role as an accounting tutor allowed him to impact fellow students’ journeys, sparking his passion for helping others.

WHY CK?

Ryan joined the CK team in July of this past year. He was drawn to the firm by the warm and welcoming team members he met during his interview process and by the opportunity to grow in an environment that values learning. At CK, he appreciates being able to work across different facets of accounting, building a foundation for a successful career.

For Ryan, CK’s core value of education resonates deeply. He views every day as a learning opportunity and is grateful for the support and mentorship he receives from experienced colleagues. Ryan credits his rapid growth to the guidance of the CK team, who genuinely care about his development as a young accountant.

Ryan advises newcomers to the accounting field to take note of feedback from managers. He emphasizes the importance of reflecting on review comments and implementing them in future tasks, as this has been a key learning method for him.

MORE ABOUT RYAN

What’s your hidden talent?

My hidden talent is that I am very good at solving Rubik’s Cubes. I have a collection of them, with the largest being 8×8 sides. My fastest time with a 3×3 (normal-sized) is 11 seconds.

What’s on your vacation bucket list?

My #1 vacation spot would be Ireland. I have never been, but my grandparents immigrated from Ireland, and the pictures I have seen are amazing.

Favorite TV Show?

My favorite TV show is Peaky Blinders on Netflix. The movie is coming out soon, so maybe this will be my favorite movie, too!

What’s on your music playlist?

My music playlist is basically all country music. I have many favorite artists, but number one is Darius Rucker.