Member of Russell Bedford International, a global network of independent professional service firms.

CPA | Tax Manager

On July 4, 2025, President Trump signed the One Big Beautiful Bill Act into law, bringing sweeping changes to federal tax provisions. While much attention has been focused on electric vehicle (EV) tax credits, the legislation also includes a wide range of energy-related tax incentives that could impact both individuals and businesses.

If you want to take advantage of these benefits, timing will be critical, many of these provisions have short windows before they expire. Here’s what’s changing and what you should be doing now to prepare.

The One Big Beautiful Bill Act includes several incentives designed to encourage the adoption of clean energy solutions in homes and vehicles. However, these credits are set to expire soon:

Businesses will also see notable changes to clean energy incentives, some ending soon, others phasing out gradually:

While many details are still pending clarification through regulations, here’s how you can stay ahead:

At Cray Kaiser, we’re here to help you navigate these changes and plan not just for this year, but for the years ahead. Contact us to discuss how the One Big Beautiful Bill may impact your tax situation.

MSA, MST | Assurance In-Charge

The One Big Beautiful Bill Act (OBBB) introduces significant updates to Section 174A, which governs the treatment of research and experimentation (R&E) expenses. These changes aim to boost domestic innovation in the United States by modifying how businesses can deduct and capitalize R&E costs. Whether you’re a startup investing in cutting-edge technology or an established company developing improved products or processes, the new Section 174A rules bring welcome opportunities for immediate tax savings and improved cash flow.

Historically, Section 174 of the Internal Revenue Code (IRC) permitted businesses to immediately deduct all R&E expenditures. However, the Tax Cuts and Jobs Act of 2017 (TCJA) removed this option and required taxpayers to capitalize R&E expenditures and amortize them over a five-year period for R&E performed within the United States, or a fifteen-year period for R&E performed outside the United States for tax years beginning after December 31, 2021.

New Code Section 174A restores the taxpayer’s option to immediately deduct domestic R&E expenditures incurred in connection with a trade or business for work performed in the U.S. This applies to tax years beginning after December 31, 2024. Taxpayers may still make the election to amortize R&D costs over a 5-year period or ratably over a 10-year period for certain Section 174A expenditures.

Under the OBBB, eligible small businesses, those with less than $31 million in average gross receipts over the past three tax years, receive expanded benefits:

The OBBB Act does not modify rules for foreign R&E expenditures. These costs must continue to be capitalized and amortized over a fifteen-year period.

The restoration of full expensing for domestic R&E expenditures represents a major win for U.S. businesses. Your company has the opportunity to gain greater control over cash flow, improved tax planning, and increased investment capacity. However, the decision to expense immediately or amortize isn’t one-size-fits-all. Fully capitalizing on the new law requires thoughtful evaluation of available elections and possible changes to accounting methods. Factors such as refund timing, IRS processing risks, state tax conformity, and ownership changes must all be considered. Our team at Cray Kaiser is closely monitoring IRS guidance on these changes.

If your business invests in research and development, these changes could have a major impact on your tax strategy. To learn how these provisions apply to your specific situation, contact your trusted advisors at Cray Kaiser.

International tax law is undergoing some significant changes. Under the One Big Beautiful Bill Act (O3B), new rules like the U.S. remittance tax and updated controlled foreign corporation provisions will reshape how individuals and businesses handle cross-border transactions. In this audio blog, we break down the major updates, explain their potential impact and share strategies to help you stay compliant.

Transcript:

Welcome everyone to this edition of CK Thought Leadership. My name is Eric Challenger. I’m a tax manager here at Cray Kaiser and I’m joined by Damian Contreras.

Hi everyone. As Eric said, my name is Damian Contreras. I’m a tax senior at Cray Kaiser. I’ve been here for a little over three years and started as an intern.

Today we are diving into some major updates to international tax regulations recently enacted under the One Big Beautiful Bill Act, also known as O3B. We’ll cover the new remittance tax, explain what a controlled foreign corporation is, go over the changes to guilty, and wrap up with some important foreign reporting reminders. Let’s kick things off with a new and intriguing remittance tax. Damian, can you walk us through this piece of legislation and what it means?

Absolutely, Eric. The remittance tax, while new in the U.S. effective January 1st, 2026, isn’t entirely new globally. Several other countries already have similar systems in place. Let’s focus how this will work in the U.S. Remittance tax is a 1% tax on funds sent out of the U.S. for non-commercial purposes, that is personal, not business-related transfers. The sender is responsible for the tax unless an exemption applies to them. The facilitator of the transfer, common groups are Western Union, PayPal, or money orders sent, is responsible for collecting and remitting the tax to the U.S. Treasury on a quarterly basis. If the facilitator fails to collect the tax, they’re still liable for the tax’s due. The tax applies to cash transfers and cash equivalence exceeding $15. Notably, cryptocurrency transactions and transfers are currently excluded from this tax. So what qualifies for an exemption? Transfers funded by a US-issued debit or credit card or transfers withdrawn from an account held in an institution subject to the Bank Security Act. While we’re talking about new international tax provisions, what’s happening to the old ones? I saw there were changes to guilty now renamed net CFC tested income taking effect in 2026. Can you first explain what a CFC is and then we could dive deeper into what’s changing?

Yeah, this is a big update. Let’s start with the basics. A controlled foreign corporation CFC is a foreign corporation that is more than 50% owned by U.S. shareholders which may include corporations and individuals. U.S. shareholders who own at least 10% of a CFC are required to report their share of the NCTI, previously known as Guilty, on their annual tax returns. These rules primarily impact U.S. multinational corporations and individuals with substantial foreign investments. So even if you’re not a big business, it’s something to be aware of if you’re planning to invest abroad.

Eric, now that we understand what a CFC is and what exactly guilty, you know, net CFC tested income is under the new law, what’s changing?

Great question. The guilty provisions were introduced under the 2017 Tax Cuts and Jobs Act to discourage U.S. companies from shifting profits offshore and avoiding U.S. taxation. Guilty imposed a minimum tax on profits from CFCs regardless of whether those profits were brought back to the U.S. Under O3B Act, these rules are being tightened significantly. Key changes include country-by-country calculation of Guilty, now NCTI. Previously, companies could offset low tax income with high tax income across countries. That’s no longer allowed, which increases the exposure for low-tax jurisdictions. The qualified business asset investment deduction is being phased out and eliminated. The foreign derived intangible income FD2 deduction is being reduced. Formally 50%, it’s now 37.5% which raises the effective tax rate from 10.5% to 13.125%. The high tax exception threshold is increasing from 18.9% to 21%, aligning it with the U.S. corporate tax rate. One piece of slight relief, the foreign tax credit limitation is being loosened from 80% to 90%. Originally the cut was 80%, but now it’s going to be reduced to 90%, meaning that taxpayers can now use more of their eligible foreign taxes to offset U.S. taxes. Bottom line, the overall U.S. tax burden on CFC income is going up, and affected shareholders will start to feel this on their returns beginning in 2026.

Now that’s a lot to digest. What advice do you have for multinational corporations or individuals who may be impacted by these changes?

As these changes are implemented over the next year, it’s critical that both multinational corporations and individuals work closely with their tax advisors. Strategic planning now can help minimize exposure under the new NCTI framework and ensure compliance moving forward.

Absolutely. On that note, let’s not forget the penalties. Failing to comply with foreign tax reporting rules can be very costly. Penalties start at $10,000 per violation and can add up quickly. And it’s not just Guilty that we’re talking about. These penalties apply to the F-bar, foreign bank account reporting, foreign financial asset reporting, and needed CFC disclosures. So if you even think you might have an international reporting obligation, reach out to your advisor. Don’t risk non-compliance in this fast-evolving tax environment.

Well, thanks for tuning in to the CK Audio Blog on International Tax Changes under O3B. For more information on how these updates may affect your business or personal tax situation, visit us at www.craykaiser.com or give us a call at 630-953-4900.

In this episode, Karen Snodgrass, one of our tax partners, breaks down the major business tax changes introduced by the newly passed One Big Beautiful Bill Act. From the return of 100% bonus depreciation and expanded Section 179 expensing to new R&D expensing rules and the phasing out of clean energy credits, Karen explains what these updates mean for your business in 2025 and beyond. If you’re a business owner or financial decision-maker, tune in for practical insights on planning, compliance and maximizing the bill’s benefits.

Transcript:

My name is Karen Snodgrass. I’m a tax partner with Cray Kaiser Ltd. As you know, the president signed the one big beautiful bill over the July 4th weekend. There’s a lot of change here that we’re going to unpack, and really today we’re going to focus on the business provisions. And these are going to affect your taxes in both 2025 and over the next several years.

If you’re a business owner, you’re used to the benefits of bonus depreciation, but you’re also used to the reduced benefits we’ve had over the years. Before this bill, 2025 bonus depreciation was down to 40%. A significant win for business owners is we’re now back to 100% bonus depreciation. This is only effective on purchases made after January 19th of 2025. It’s a weird cutoff date, but purchases before January 20th, they’re still required to use 40% bonus. Even better news is this 100% bonus depreciation does not sunset, meaning future administrations may change this, but for now it’s a permanent provision that won’t be reduced below that 100%.

A significant change in the law related to bonus depreciation is a new class of qualified assets. Real property being referred to as “qualified production property” is now eligible for bonus depreciation. So, what does this mean? Think of a building that is used in manufacturing or a production process. The property related to the actual production would qualify, not necessarily attached offices or other non-production space. These properties must have a construction period between January 20, 2025 and the end of 2029. Given this is an entirely new provision, we’re going to need to wait for more clarity on this. We expect regulations will be issued to address a number of questions we have. It seems a cost segregation study will be needed if a client wishes to claim this deduction. With such a study, an architect or an engineer is going to be able to look at the building and parse out exactly what will qualify for the 100% bonus depreciation.

Another pro-tax provision related to capital acquisitions is expanded section 179. Like bonus depreciation, Section 179 allows for the immediate write-off of qualified property. The 2025 limitation on Section 179 is now increased to a whopping $2 and 1/2 million in property that can be expensed. As long as certain income qualifications are met. The phaseouton eligibility applies after four million has been acquired in any given year and they’re going to keep adjusting these limitations for inflation going forward. Once again these are provisions that look to be permanent.

But let’s talk about why someone may claim Section 179 versus bonus depreciation. I mean really they’re both immediate write-offs, what’s the difference, right? It’s important to note that some states don’t follow bonus depreciation, but they do conform to federal Section 179. So depending on the state, it may be more beneficial to claim Section 179. We recommend working with your tax advisor to ensure the maximum tax benefit for your cut-backs costs.

Our top question so far is about one of the few retroactive changes in the bill. Businesses that perform a significant amount of research and development activities, or R&D, were surprised with somewhat recent legislation that curtailed the deduction of these costs. This started in tax years beginning after December 31, 2021. Taxpayers were required to capitalize and amortize R&D costs over a five-year period for domestic costs and over an even longer 15-year period for any costs that were incurred internationally. That was quite the change from the immediate expensing that we enjoyed in prior years. What we found was that the benefit of the R&D credit was not sufficient to cover the additional tax due from not being able to write off these costs. The popular argument was that this policy actually harmed American taxpayers. The new bill actually creates a whole new code section, section 174A, which partially restores expensing of R&D costs. Domestic research costs are now fully deductible, but foreign R&D costs are still being advertised over 15 years. And this applies to tax years beginning after December 2024. But here, we need to talk through two different tax treatments based on your company’s size. Let’s start with what the IRS calls small taxpayers. These businesses have average annual gross receipts of $31 million or less. The bill actually allows these businesses to retroactively apply full R&D expensing for domestic costs to tax years beginning after December 31st, 2021, by amending prior returns. Or they can elect to continue to amortize these costs in 2024 and then expense the remaining domestic costs that haven’t been written off in either 2025 or 2026.

We’ll dive deeper into that in a little bit with an example. But let’s not forget about the larger businesses. Unfortunately, they don’t get the same retroactive treatment. However, they can elect to accelerate the remaining amortization over one or two tax years beginning in 2025. But let’s go back to the small taxpayers. And here we’ve actually walked through a case study with a client of ours that was considering do they use the retroactive R&D treatment or not. So what we did was we did our own study. What we found was that in 2022 we’ll definitely be able to decrease taxable income if we choose to immediately expense R&D. Now, in order to do that, the business is going to have to amend their 2022 return and, because this is an S-Corporation, all the owners are going to have to amend their 2022 returns as well. There’s a compliance cost associated with this and that needs to be measured against the refunds to be received. Fast forward to 2023. While, again, we’re going to be able to claim all those 2023 costs immediately. We actually lost the benefit of the amortization of the 2022 costs. And in this client’s case, 2023 taxable income is actually increased by applying these rules retroactively and the same holds true for 2024. Although it’s not the tax result we wanted in 2023 and 2024, once you make the election to apply the retroactive treatment, you still need to go through the process of amending all the business and owner returns for 2022 through 2024. So we had to weigh the benefit of the 2022 refund against additional tax in 2023 and 2024. Also, you have to think about the compliance costs. What’s it going to cost to amend all of these tax returns? And finally, let’s keep in mind the IRS has cut their staff by roughly 30%. We’re all used to waiting for our refunds, and that’s not going to change. We came to the conclusion with our client, we are not going to amend the prior returns. We’re not going to use the retroactive treatment even though it meant a better result in one tax year. Instead, we’re going to utilize the remaining deductions into ‘25. What we’ll be able to do is get cash flow benefit immediately. We’re going to reduce their quarterly tax payments due in September of this year. It’s a thoughtful easy button approach in this case.

We should talk through some other changes that will affect businesses. Clean energy credits appear to be on the chopping block. The bill eliminated some of these credits, too much to get into detail and to hear. But the president has already said he’s going to revisit this and perhaps further reduce the availability of clean energy credits.

Businesses that have had limitations on their deduction of business interest got a win under this bill. The computation of allowable expense has been expanded in a pro-tax pair away. And really, these are just the highlights. What are we recommending you do now? We know there’s a lot of clarifications needed on the bill. These are going to come in the form of regulations that may not be issued for months. There’s also rumbles of corrections to this bill. But at least we can see the direction of the congressional intent. While we usually start looking at year-end tax planning in the fourth quarter, now is really the time to talk with your advisor about the impacts of the bill on your specific situation. In particular, you may be able to reduce planned payments for the remainder of 2025, given the benefits you’ll see in this bill. As always, you can contact your advisor, Cray Kaiser, and we’ll be happy to walk through the situation and how it may affect you.

Join Karen Snodgrass, one of CK’s tax partner’s, as she breaks down the One Big Beautiful Bill Act and its impact on individual taxpayers. From changes to tax rates, deductions and charitable giving to new rules around tips, overtime and auto loan interest, Karen explains what’s changing, when it takes effect and how it could affect your 2025 tax return and beyond. Whether you’re a wage earner, retiree or planning on giving to a charity, this audio blog helps you make sense of the bill and plan smarter.

Transcript:

Hi, my name is Karen Snodgrass. I’m a tax partner with Cray Kaiser Limited. As you know, the president signed the one big beautiful bill over the July 4th weekend. You’ve probably heard about some of these provisions, things like no tax on tips or no tax on overtime. But there’s a lot more change than that. Today, we’ll focus on the individual tax provisions that will affect your taxes in both 2025 and over the next several years. I also want to mention, in terms of actionable items, for most people, there’s not a lot here. However, I do think it’s important to focus on what has changed and just think about how this may or may not affect your situation.

I think the first thing to do is to look backwards. In 2017, we had the Tax Cuts and Jobs Act that changed a number of tax provisions. And mainly, these were taxpayer friendly. But due to budget constraints, a number of these provisions were due to expire in ’25 or in ’26. Without action, most of our taxes were going up. This new bill extends many of these cuts, some of them permanently. And that’s some of the difficulty of this new bill, is determining when does this rule kick in, when does this other rule get eliminated. So that’s the thing to keep in mind is some of these will kick in in ‘25, some of these not until ‘26.

But let’s start with a change that will affect everyone in 2025. Under the pre-2017 law, the highest tax rate, as you may recall, was 39.6%. However, the 2017 Act reduced the highest rate to 37%. And in ’26, we’re due to go back up to the 39.6%. Under the new law, the highest rate is now 37%, and that’s been made permanent. And if you look at the brackets in the middle, you’ll see that some tax rates are also reduced for middle-income taxpayers. Notably, they have not changed the capital gains tax rates. So what this means in 2025 is, you really won’t see a change in the tax rates that you’re used to.

But what garnered the most headlines with no tax on tips or overtime. There are limits on who can claim these benefits and how much can be deducted. Higher-income taxpayers think a married couple filing jointly with income in excess of $300,000. They’ll generally miss this advantage. We’ll wait to see the final regulations on this, but it seems the service will limit who exactly can benefit beyond income limitations. So don’t run to your employer just yet and get asked to change your comp to, hey, can you pay me in tips and overtime and that way I don’t have to pay tax? It’s only those that are usually getting tips that will get the tip exemption. Also, it’s generally going to be only exempt employees who get the overtime benefit. Believe it or not, we have to look at who is covered under the Fair Labor Standards Act to see who this applies to.

Another provision that’s going to affect everyone is the higher standard deduction, but keep in mind this is a 2026 change. You may recall before 2017 itemized deductions were generally more beneficial than claiming a standard deduction. This was during the time you could claim an unlimited state and local tax deduction, which we’ll call SALT from here on out. The 2017 Act limited the SALT deduction to $10,000, which hurt those of us in a high income tax state, and those of us who also pay real estate taxes. To balance the scale, so to speak, the standard deduction was enhanced. In 2025, the standard deduction for a married couple filing jointly is $24,000. In ’26, this was set to revert, think closer to $6,000, So basically an $18,000 reduction in the standard deduction. Under the new law, it goes the opposite way. The standard deduction for a married couple instead of $24,000 or $6,000 is now $31,500. If it weren’t for the SALT changes, it would seem most folks are still going to benefit from claiming the standard deduction. And to make things incredibly confusing, the SALT limits actually change in ‘25, not in ‘26. What used to be a $10,000 limit is now up to $40,000. Keep in mind this benefit will get phased out for higher income taxpayers, like married couples making more than $500,000.

Another change we’ve already been asked about is the new auto loan interest deduction. And this is one that kicks in during 2025. Assuming you meet the income threshold, you can take a deduction for up to $10,000 of interest expense from loans on autos that you own, as long as the final assembly occurred in the US. This only applies to vehicles weighing less than 14,000 pounds, which covers most of the cars you see on the road. If you claim this deduction, keep in mind you’ll have to certify it by showing the vehicle identification number on your tax return.

We’ve also been asked about the new charitable provisions. Starting in 2026, it’s a mixed bag of news. If you claim the standard deduction, which again is going up to the $31,500 for a married couple, you can benefit from a charitable write-off even if you don’t claim that itemized deduction. You may recall this from a few years ago, so keep track of your charitable giving even if you don’t formally itemize your deduction. For higher income folks, it’s not great news. There’s a new limitation on how much you can write off to charity in any given year based on your income. With the possible reduced benefits of charitable giving, we’ve already started to talk to clients about accelerating their planned charitable giving to 2025, instead of maybe waiting until ’26.

And finally, if you’re of a certain age group, perhaps you’ve got an email from the Social Security Administration suggesting you don’t have to pay tax on Social Security. Well, that’s not entirely true. While seniors will see a standard deduction, that’s actually higher than most, meaning if you’re over a certain age, you get an extra standard deduction. All this means is that less seniors are going to owe income tax on their social security benefits. Those benefits are still taxable.

But let’s recap. There’s still historically low tax rates. There are more deductions available to some. But how do you figure out what to do with all this information? Our suggestion is to see what provisions may apply to you and be sure to be aware of the different timing of these changes. Ask your CPA to run the numbers. Perhaps you can reduce your next quarterly estimated payment. Or is there an opportunity to accelerate a deduction in 2025 to take advantage of the additional benefits. As we’ve always done at Cray Kaiser, we’re looking at all the angles, considering not just the current year, but the effect on future tax years. There’s really not a one size fits all strategy, but being proactive with your tax advisor is the best course of action given all the changes.

CPA | CK Principal

On July 3rd, Congress passed the sweeping One Big Beautiful Bill Act (OBBBA). This bill is a landmark tax and spending package that makes key provisions from the 2017 Tax Cuts and Jobs Act (TCJA) permanent, introduces significant changes for businesses and individuals, and redefines international tax and alters clean energy incentives. The bill was signed into law by President Trump over the July 4th holiday weekend.

With so many changes packed into one bill, understanding the immediate and long-term effects is essential. We also recognize that more guidance will come in the way of Regulations that will interpret these rules. Below, we’ve outlined some of the most impactful provisions and what they could mean for you or your business.

Key updates for individuals include:

For more information about tax law changes for individuals and families, listen to this audio blog.

If you own or manage a business, several provisions in the OBBBA could immediately improve cash flow and reduce tax liabilities:

For more information about tax law changes for businesses, listen to our audio blog.

OBBBA overhauls the U.S. approach to international taxation:

If your business has a global footprint, coordinate with your CK tax advisor soon to determine how these changes affect your effective global tax rate and compliance burden.

The OBBBA substantially scales back clean energy incentives introduced by the Inflation Reduction Act (IRA):

Consider fast-tracking clean energy investments and projects to ensure eligibility before key expiration dates. Also, keep tabs on the news, as recent commentary from President Trump suggests further scaling back.

The OBBBA includes both immediate and long-term provisions. For many businesses and individuals, it could reduce estimated taxes as early as Q3 2025. But the real value comes from aligning your tax, business, and wealth strategies around these sweeping changes.

Businesses should re-evaluate capital expenditures, R&D planning, and entity structure decisions in light of these changes. Now is also the time to revisit your personal tax and wealth strategy, especially if you own a business, anticipate large charitable contributions, or are considering estate planning moves.

We recommend:

Whether you’re navigating new compliance requirements or rethinking your business strategy, the Cray Kaiser team is ready to guide you through the opportunities and implications of the One Big Beautiful Bill Act. You’ll be hearing more from us soon as we do a deeper dive into the nuances of the Act.

Are you earning money from a side hustle or creative pursuit? It’s important to understand how the IRS classifies that activity. Is it a legitimate business or just a hobby? In this video, Matt Richardson, a Senior Tax Accountant at CK, explains how the IRS makes that distinction, what factors they consider and why it matters. Whether you’re selling art, playing music or driving for a rideshare app, Matt breaks down what you need to know.

Transcript

My name is Matt Richardson. I’m a senior tax accountant at Cray Kaiser. So if you do anything that earns money on your own time, the IRS will either consider it a hobby or a trade or business. And for the IRS, a trade or business is something that you’re doing to earn a profit or to make a living. Whereas a hobby is something that you do mostly for fun. And to decide whether your activity is a hobby or a business, the IRS will look for a profit- seeking motive. So the IRS has a few different ways to look for a profit-seeking motive. But the big theme is whether you operate your activity like a for-profit business would. A major part of that is whether it is something a lot of people would do recreationally. Whether or not you made or lost money. And for example, a lot of people might play music just for fun. So the IRS might question whether your weekend rock band is a true business. But not many people do accounting just for fun. So that’s a kind of business that’s less likely to get questioned by the IRS.

Other sources of income are also part of what the IRS looks at. If it’s your only means of support, they’ll usually accept that it’s a business that you’re trying to earn a living from. But if you also receive a six-figure salary from a day job, then they’re more likely to question the business aspect of your activity.

And a few other things they look at can include your expertise in the activity, how much time and effort you put in, the amount of profit you’ve earned in past years, whether you keep detailed financial records, how actively you seek out customers, and whether you have a written business plan, including a budget and growth strategies.

So for taxes, the main difference is if you’re a business, you’re allowed to deduct your expenses. You’re only taxed on what’s left over after you take what you earned and subtract what you spent in the process of doing that. If it’s a hobby, you have to pay taxes on all the money that you earn, but you can’t deduct those expenses. So, obviously, that makes a pretty big difference in your tax liability, so the IRS can be pretty assertive in questioning things that it thinks might really be a hobby.

So, unfortunately, there’s no clear-cut dividing line between a business and a hobby. As the IRS likes to say it depends on all the facts and circumstances. So they’ll look at the activity in the context of everything that you do to decide whether it looks like a hobby or it looks like a business. They do have one general rule that will protect you in most cases, which is if you if you earn a profit in three out of the last five years then they’ll usually accept your classification as a business.

So overall the IRS is more likely to ask questions if the activity would let you claim expenses on property that you’d likely own anyhow, especially if it’s recreational. Some specific examples are horse racing has a lot of specific rules, things like auto racing, creative things like arts, crafts, and design. Writing, especially self-published books or blogs that might earn income are things they might look at. For social media, if you’re posting or live streaming and earning some money on the side that’s something that they might look at as being a hobby and not a real business. Music is another thing they’ll look at. A lot of people wish they could deduct their $60,000 Fender Stratocaster guitar, but if you’re just playing a couple of gigs a month with some friends, they’re probably not going to consider that to be a true business. Aviation is another area they look at. People might own an airplane and charge their friends a few dollars to ride around in it, hoping that they can deduct the expense as a business but chances are the IRS will will question you on that. And even rideshare driving like Uber or Lyft if you’re doing it just a few hours a week on the side that’s even something that the IRS might question you on is whether it’s a true business or not.

So a simple example of something that could go either way would be someone who paints watercolors in their spare time and decides to sell them. So you’ll probably be considered a business if you’re actively promoting your paintings and going to arts and crafts shows. If you’re keeping detailed financial records of your costs and supplies and booth rental fees. And if you’re charging a price for those paintings comparable to what most people would charge for those at similar arts and crafts shows. You’ll probably get classified as a hobby, if you’re only customers are friends, family, neighbors, people that you already know, and you don’t really advertise more widely. If you keep no records of how much you’ve spent on supplies, and make no effort to track expenses separately from personal expenses, and if you charge less for paintings than the canvas and the materials cost, chances are that will get you classified as a hobby.

So nothing can totally guarantee that the IRS won’t challenge you, they can essentially challenge you on anything. But there are four things that will help you be pretty secure. Keep detailed financial records, keep detailed records of the time you spend in the activity, maintain written business records, including a budget and a business plan, and of course talk to your tax advisor. That’s what we’re here for.

CPA | CK Principal

Please note that this blog is based on laws effective in June 2025 and may not contain later amendments. Please contact Cray Kaiser for the most recent information.

If you’ve mailed a paper check to the IRS and noticed that it hasn’t been cashed, you’re not alone. There are several different reasons that this may be happening to you. Here are some short-term reasons and long-term changes that might be affecting your situation.

If it’s been at least two weeks since you sent the payment to the IRS and your financial institution verifies that the check hasn’t cleared your account, here’s what you can do:

If you choose this option, the IRS won’t charge a dishonored check penalty and you may be reimbursed for bank charges related to stopping payment. Form 8546 will allow you to file a claim for reimbursement of bank charges.

If you’re expecting a paper refund check from the IRS and it hasn’t arrived:

If the tool shows that the IRS issued your refund, but you haven’t received it, your refund may have been lost, stolen or misplaced. You should:

Depending on the status:

In an effort to modernize and reduce fraud, President Trump signed an executive order on March 25, 2025 requiring all federal agencies, including the IRS, to end their use of paper checks and switch to electronic payments by September 30, 2025.

What does this mean for you?

The US Secretary of the Treasury has been tasked with delivering a detailed implementation plan within 180 days, along with exceptions. Exceptions may include:

There are already many payment methods available for making electronic tax payments. Some current options available are:

The executive order cited that the use of paper-based payments by the federal government imposes unnecessary costs, delays, risk of fraud, lost payments, theft and inefficiencies. By switching to electronic payments, the IRS aims to improve accuracy, speed and security for taxpayers.

As these changes happen be assured that the experts at Cray Kaiser will continue to provide guidance on your electronic options for both refunds and tax payments. If you have concerns about a check that hasn’t cleared or want help transitioning to an electronic payment method, contact us today at (630) 953-4900 or fill out this form.

Important changes to Illinois sales tax rates are coming your way. Effective July 1, 2025, several taxing jurisdictions in Illinois will impose new local sales taxes or update their existing rates on general merchandise sales.

What’s Changing?

The following local sales taxes will be affected:

These updates will be collectively referred to as “locally imposed sales taxes.”

What’s Being Taxed?

This locally imposed sales tax will apply to the same items of general merchandise reported on Line 4a of Forms ST-1 and ST-2 that are subject to State sales tax.

Locally imposed sales taxes do not apply to:

What Steps Should I Take Before July 1, 2025?

Make sure any cash registers and computer programs are updated to reflect the new tax rates beginning July 1, 2025. If a software vendor manages these processes, contact them immediately to begin implementing the changes.

Use the MyTax Illinois Tax Rate Finder here to verify your new combined sales tax rate (State and local sales taxes).

If a prior sale was subject to a sales tax rate different from the current sales tax rate, this should be reported on Line 8a of Forms ST-1 and ST-2.

What About Business District Sales Taxes?

Your business address determines whether business district sales tax applies to your sales. Remote retailers and marketplace facilitators who meet the tax remittance threshold should pay extra attention. If property is shipped or delivered to an address within a business district, the tax likely applies.

For more information, refer to the MyTax Illinois Tax Rate Finder, which provides a detailed list of business district addresses and corresponding rates.

Don’t Get Caught Off Guard

Avoid headaches and prepare now for this sales tax rate update. If you have questions or need assistance navigating these changes, Cray Kaiser is here to help. Contact your trusted advisors at (630) 953-4900 to ensure you’re ready for the July 1, 2025, rollout.

CPA | CK Principal

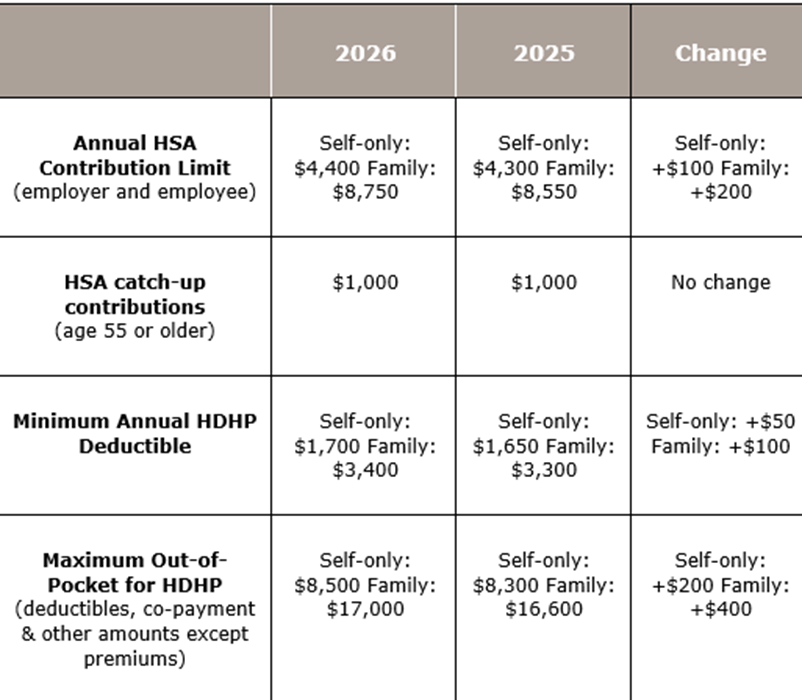

As we await possible significant changes to the 2026 tax law, the IRS has provided guidance on Health Savings Accounts (HSA). Specifically, they’ve recently released the inflation-adjusted contribution limits for 2026 related to HSAs and high-deductible health plans (HDHPs). While there are modest increases in the contribution limits, the HSA catch-up contribution amount remains unchanged.

Important Reminder: You can only contribute to an HSA account if you are enrolled in a High Deductible Health Plan (HDHP). The IRS sets specific criteria for what qualifies as an HDHP, including minimum deductibles and maximum out-of-pocket expenses.

One key tax benefit of HSAs that stands out is that contributions are tax-deductible even if you don’t itemize deductions. Additionally, these funds grow tax-free over time.

When HSA funds are used for qualified medical expenses, such as doctor visits, prescriptions, and certain medical procedures, withdrawals from an HSA are tax-free. However, if you use HSA funds for non-medical purposes, you will owe income tax plus a 20% penalty (10% after age 65).

To read more about the benefits of an HSA, click here. If you’d like to explore how an HSA could fit into your financial planning, please contact our office at 630.953.4900 or fill out this form.